Mortgage demand is up 5.4% as interest rates ramp down

Housing Wire

DECEMBER 11, 2024

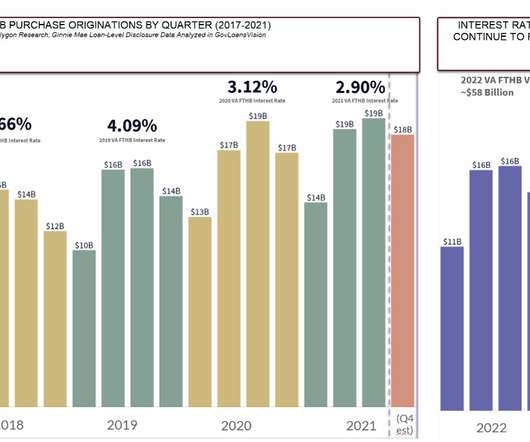

Government loan activity saw a slight jump. Department of Veterans Affairs (VA) loans followed suit, jumping 270 bps to 16.3% Department of Agriculture (USDA) loans were flat at 0.4%. MBA’s report also examined the average contract interest rates for several loan types. Mortgage applications increased 5.4%

Let's personalize your content