CFPB report focuses on ‘discount points,’ but paints an incomplete picture

Housing Wire

APRIL 8, 2024

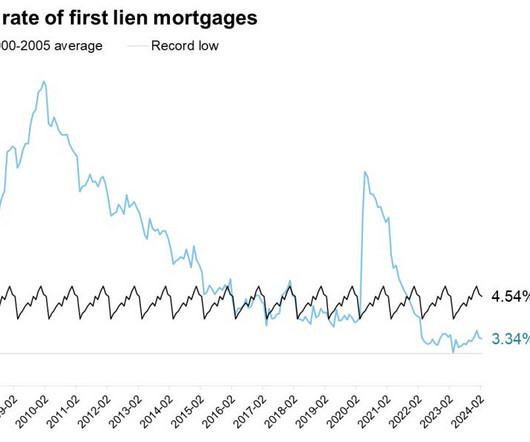

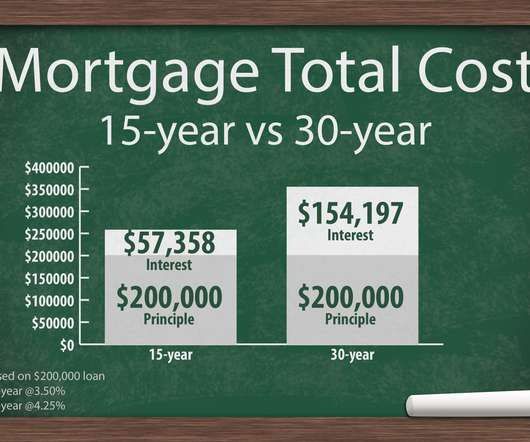

Marty Green, principal at mortgage law firm Polunsky Beitel Green , suggested that the CFPB report is missing some important details, including the availability of loans without discount points in the market. The percentage of homebuyers paying discount points roughly doubled from 2021 to 2023,” the report said. “The

Let's personalize your content