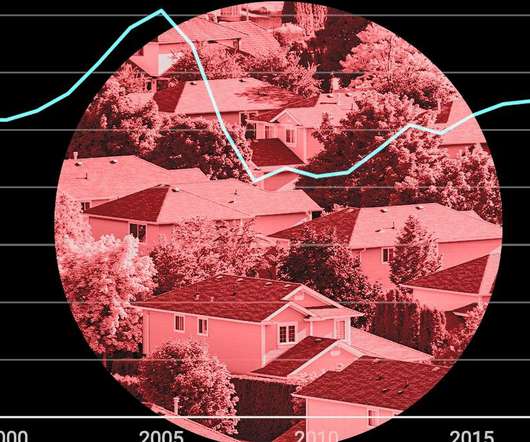

6 Simple Graphs Proving This Is Nothing Like Last Time

Keeping Current Matters

MARCH 10, 2021

A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. New construction isn’t making up the difference in inventory needed. Some may think new construction is filling the void. This is nothing like the last time.

Let's personalize your content