A simple guideline change could boost home sales and help homebuyers

Housing Wire

JULY 11, 2025

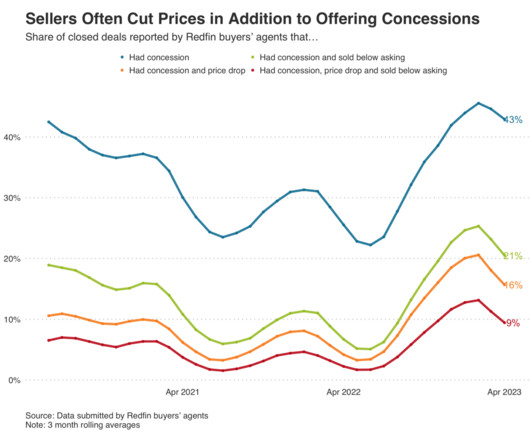

The seller sold the house, and the buyer became a homeowner, entering homeownership with less consumer debt. Conventional guidelines do not allow the buyer to use seller concessions towards debt. It is a win-win situation. So why isn’t everyone doing that? Simple, you can only do it with VA loans.

Let's personalize your content