How to Buy a Foreclosed Home: The Ultimate Step-by-Step Guide

Redfin

MARCH 4, 2025

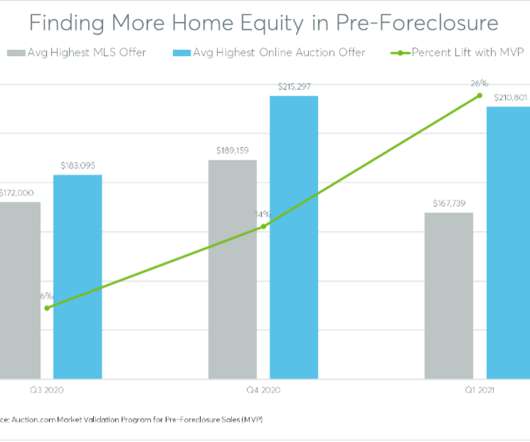

There are several types of foreclosure sales – auctions, bank-owned properties, government-owned properties, preforeclosures, and short sales. These properties are often priced below market value, making them attractive to buyers looking for a good deal or hoping to build equity quickly.

Let's personalize your content