9 Smart Tips for Making an Offer on a House That Stands Out

Redfin

JULY 30, 2025

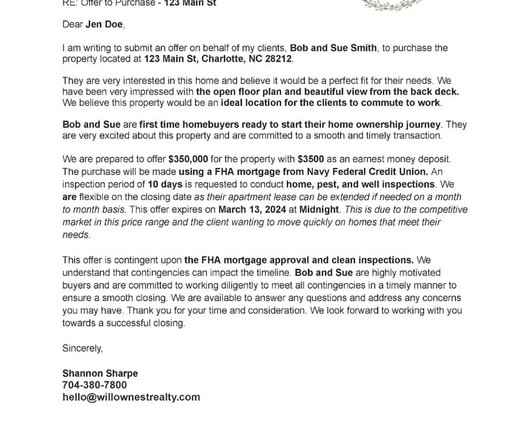

Knowing your true budget means going beyond just what a lender will approve you for. Get pre-approved for a mortgage and have cash ready One of the biggest signals to sellers that you’re serious is a mortgage pre-approval letter. Why pre-approval matters: It gives sellers confidence in your ability to close.

Let's personalize your content