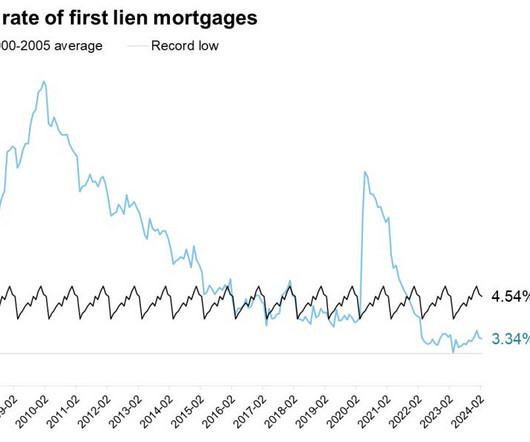

When rates skyrocketed, mortgage servicing reset the board. The next battle is about to begin

Housing Wire

AUGUST 26, 2024

When interest rates began skyrocketing more than two years ago, mortgage companies faced a pivotal decision regarding a crucial part of their business: the servicing portfolio. trillion unpaid principal balance (UPB). Mr. Cooper estimates it will hold about $132 billion in mortgages at 6% or higher once the acquisition is finalized.

Let's personalize your content