Buying a Home This Spring? Hire Your Agent Before the Rush Begins

Lighter Side of Real Estate

MARCH 11, 2025

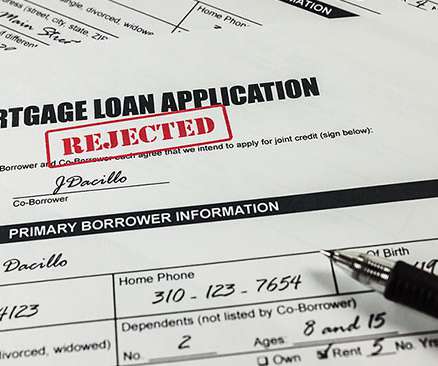

Heres what you should do before you even start looking at homes: Get Pre-Approved for a Mortgage: Knowing how much you can afford is critical. A mortgage pre-approval gives you a clear budget and shows sellers youre a serious buyer. Check Your Credit: Your credit impacts your loan approval and interest rates.

Let's personalize your content