Trapped by design: Why America’s housing market is stuck — and what the rest of the world can teach us

Housing Wire

APRIL 10, 2025

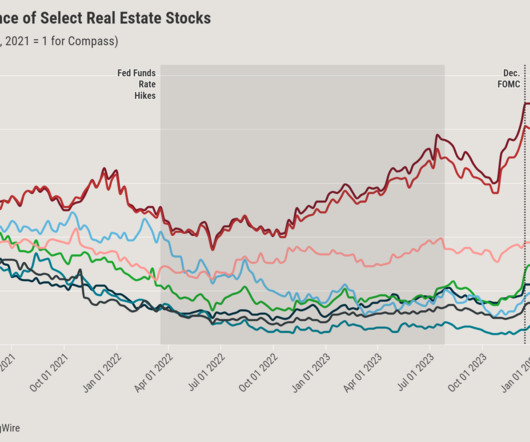

Existing home sales have hit multi-decade lows. Banks and credit unionsmany of which depend on mortgage activity to fuel lending, gather deposits, and generate fee incomeare facing an extended drought. The 30-year fixed-rate mortgage is a cornerstone of American housing finance, but it wasnt built for flexibility.

Let's personalize your content