USDA’s rural manufactured housing rule has gone into effect

Housing Wire

MAY 7, 2025

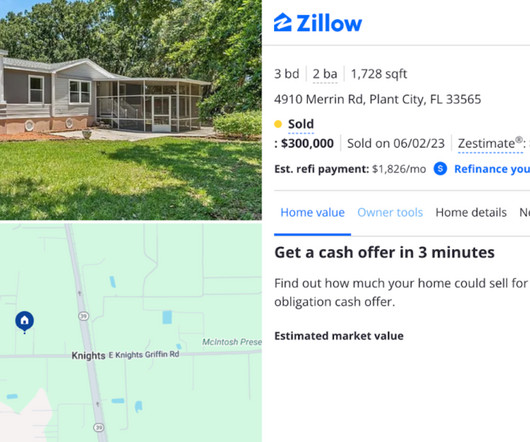

Department of Agriculture (USDA)s Rural Housing Service (RHS) has implemented a final rule that allows for the financing of manufactured homes through the RHS Single Family Housing (SFH) Direct Loan Program and the SFH Guaranteed Loan Program. The rule went into effect on Monday, May 5. increased by 58.34% between 2018 and 2023.

Let's personalize your content