ICE: Student debt, negative equity fuel pockets of mortgage risk

Housing Wire

JULY 7, 2025

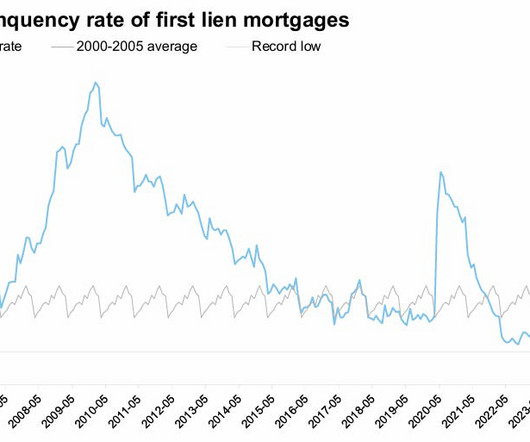

A rise in negative equity and exposure to student debt are creating “pockets of vulnerability” for U.S. The resumption of student loan payments and collection efforts on defaulted federal student loans in May, following a five-year pause, could increase financial pressure on some homeowners, according to ICE.

Let's personalize your content