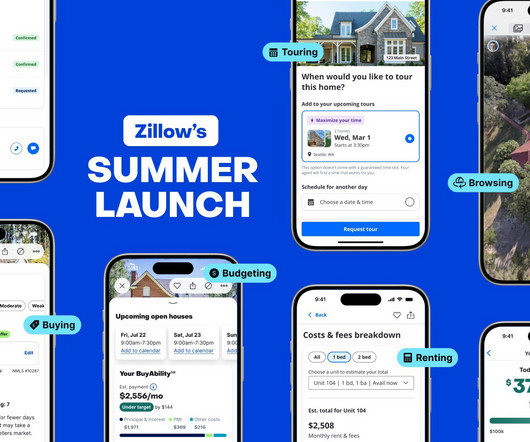

From Drones to Data: Breaking Down Zillow’s 5 New Features

BAM Media

JULY 16, 2025

In a July 15 announcement , Zillow unveiled five new consumer-facing features designed to simplify everything from affordability calculations to home tour scheduling. New this summer: Users can now compare two critical figures: 1) target price based on their desired monthly payment, and 2) maximum home price based on loan qualification.

Let's personalize your content