23 Common First-Time Homebuyer Questions: Your Questions Answered

Redfin

JULY 30, 2025

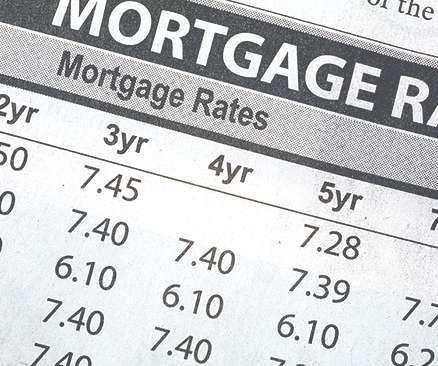

A shorter mortgage term will result in a higher monthly payment since you’ll be paying off the principal balance faster. With a longer mortgage term, you’ll have a lower monthly payment because the principal is stretched over more years. Should I get pre-qualified or pre-approved for a mortgage?

Let's personalize your content