Are Mortgage Rates Back to “Normal”?

Lighter Side of Real Estate

FEBRUARY 2, 2023

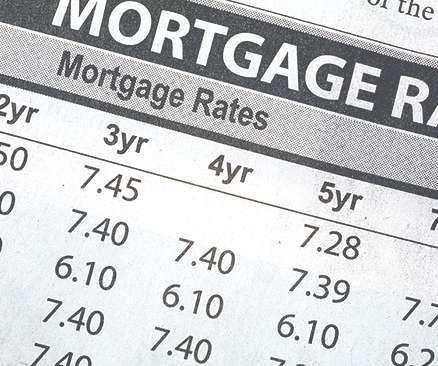

If you think mortgage rates are at an all-time high, you wouldn’t be alone. The thing is, mortgage rates aren’t actually the highest they’ve ever been; not by a long shot. The thing is, mortgage rates aren’t actually the highest they’ve ever been; not by a long shot. And who knows, the rates could be lower by then anyway.

Let's personalize your content