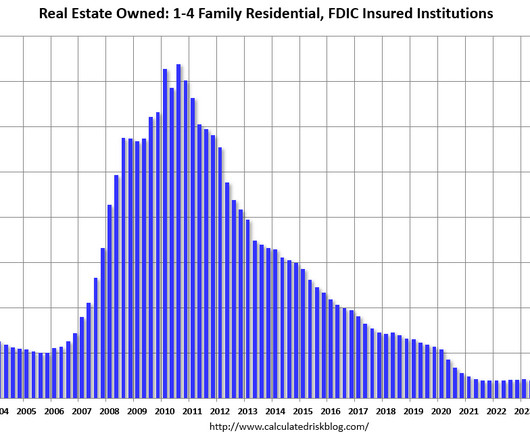

Q4 Update: Delinquencies, Foreclosures and REO

Calculated Risk Real Estate

MARCH 14, 2025

This entire housing cycle I’ve argued that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes. This is still historically extremely low.

Let's personalize your content