What Is an Assumable Mortgage and How Does It Work?

Point2Homes

DECEMBER 15, 2021

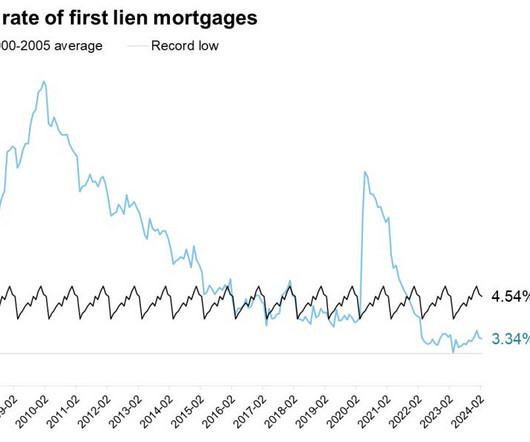

An assumable mortgage is a financial agreement in which a homebuyer takes over, or assumes, the seller’s outstanding mortgage balance and its terms when buying a home , rather than taking out their own loan. Or you can assume your partner’s mortgage in case of a divorce if your name is listed on the house title but not on the initial loan.

Let's personalize your content