Builders rediscover a tool from the 1980s that keeps new home prices from falling

Housing Wire

DECEMBER 12, 2023

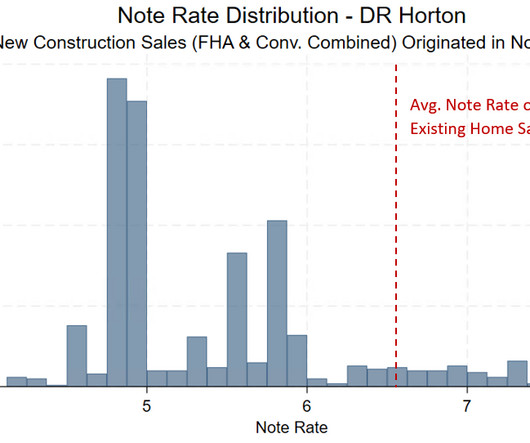

While sellers of existing homes have struggled with rising rates and softening demand, homebuilders have not only survived, but thrived in this market thanks to the use of mortgage rate buydowns , a tool more widely used by builders since their business is selling homes and clearing inventory.

Let's personalize your content