Builders rediscover a tool from the 1980s that keeps new home prices from falling

Housing Wire

DECEMBER 12, 2023

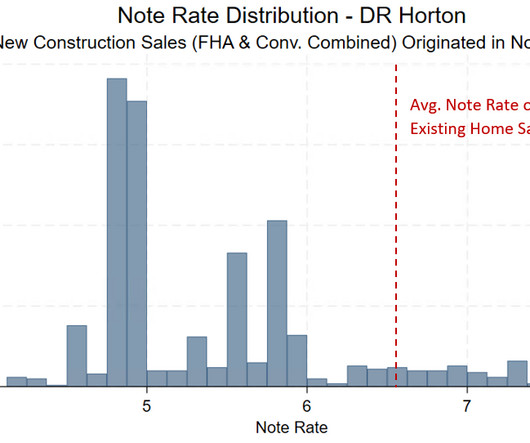

The gap peaked in November 2022, when the average note rate for new construction sales was one percentage point lower than the rate for existing home sales. Limited to loans with CLTV 76-80 and FICO 720-770 to control for the effect of loan level pricing adjustments. As of July 2023, the gap had slightly narrowed to 0.8

Let's personalize your content