Builders rediscover a tool from the 1980s that keeps new home prices from falling

Housing Wire

DECEMBER 12, 2023

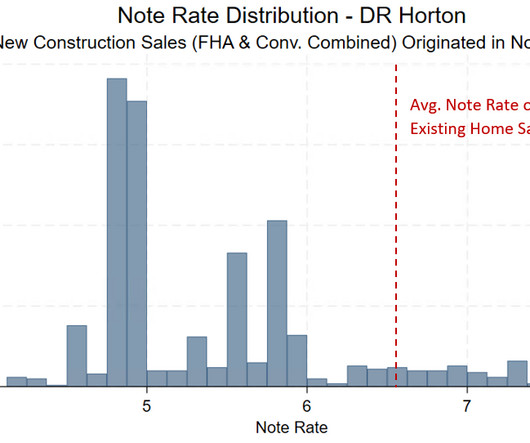

Assuming a 30-year fixed rate mortgage of 7% with 20% down payment, the monthly payment would be roughly $2,100. In this case, the total debt-to-income ratio (DTI) would be 51% and would exceed the Fannie Mae or Freddie Mac DTI limit of 50%. of sales price) Source: AEI Housing Center, www.AEI.org/housing.

Let's personalize your content