Commission fees have become a testy topic in the industry, so here’s how to determine a rate that’s right for you

By Michelle Huffman

“Can you offer a discounted rate?” “Is that the best you can do?” “Another agent would do it for 1% less.”

Around the country, this is what agents are hearing from sellers when they discuss commission. While many say it’s nothing new, data suggests real estate commission rates have been dropping for years.

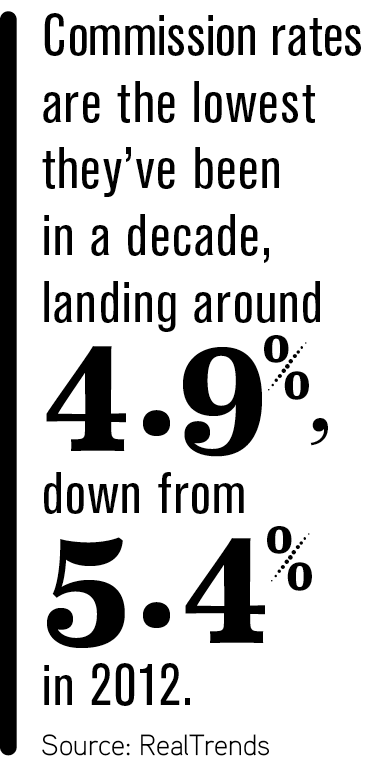

According to RealTrends, commission rates are the lowest they’ve been in a decade, landing around 4.9%, down from 5.4% in 2012.

This makes agents like Monica Neubauer, CRS, with Benchmark Realty LLC in Franklin, Tennessee, think the time is right to crack open a discussion on agent rates. “I would rather talk about our situation with intention than be upset with it changing around me,” she says.

This makes agents like Monica Neubauer, CRS, with Benchmark Realty LLC in Franklin, Tennessee, think the time is right to crack open a discussion on agent rates. “I would rather talk about our situation with intention than be upset with it changing around me,” she says.

Think about this: “Why are brand-new agents charging and getting the same fee that experienced, well-trained agents are getting? And for that matter, why is the public paying the same?” asks Neubauer, who is also an RRC Certified Instructor. “You pay more for an experienced, skilled hairstylist; why wouldn’t you pay more for a more skilled agent? These experienced agents need to and can clearly lay out what they do and do well.”

Neubauer believes there’s plenty of room for different agents to make different rates depending on their level of service and experience—she says there’s room for a lower-cost “Walmart model,” a mid-tier “Kohl’s model” and a high-end “Nordstrom’s model”—but it’s ultimately up to the agent to discover and clearly explain what they’re worth.

Why commission rates are dropping

There’s several reasons commissions have been on the decline. Here’s what CRSs are seeing:

A sellers’ market makes it look easy. “When the market is very hot, some sellers think that anything sells and it doesn’t matter who is selling it,” says Melinda Estridge, CRS, with Long & Foster Real Estate in Bethesda, Maryland.

The problem with that? It’s really hard to see money left on the table.

She cites a specific example where she lost a listing because, as she carefully explained to the sellers, she couldn’t do the job correctly at the reduced rate they requested. That house sold for $1 million. Across the street, she took a listing for a smaller property, prepared and staged it for the market—and sold it for more than $1.2 million.

“A seller thinks they’re saving money by paying less commission, but working with a seasoned professional nets them more in the end,” Estridge says.

In a hot market, some agents are willing to work for less. With homes moving so quickly, new and inexperienced agents come into the market looking to make easy money. But with limited inventory, listings are hard to come by, so agents are willing to be more flexible with their fees. At the end of the day, because home prices are constantly rising, this may not translate to lost dollars, Neubauer says.

Under pressure, some listing agents are cutting buyer agent rates. Because buyers don’t often pay their own agents, the pay structure can be hazy, even invisible, depending on how the buyers’ agent wants to approach it. So when a listing agent cuts their commission to win the listing, that may mean cutting the buyers’ agent’s portion, as well.

How to combat lower commission rates

While commission rates overall are trending lower, that doesn’t mean agents have to lower their rates accordingly. Here’s some ways that CRS agents have found to navigate the downward trend.

Refuse to settle for less. Many CRSs say they simply won’t take less than their desired rate.

“My belief is that good agents who know their value, are trained and have business knowledge and experience should have no trouble earning a good commission without dropping their rate,” says Susan Richter, CRS, with Berkshire Hathaway Home Services in Durham, North Carolina.

Be willing to negotiate. You can also take the exact opposite tact. Neubauer says she is always willing to negotiate her rate—and she knows this makes her a little unusual.

“I will negotiate my commission, but I’m not randomly reducing what I get,” she says.

This is a calculated approach that takes some advanced effort. Neubauer looks at how quickly she thinks the house will sell, how willing the sellers are to participate in the sale, the condition of the house, whether it’s going to be vacant or occupied and how much marketing it will require.

Get creative with how you charge. Some buyers’ agents are asking buyers to make up the difference when a listing agent is offering a less-than-standard commission on a listing. While it can be a tough ask, it’s worth defending your minimum rate, Richter says.

Jeff Kreinbring, CRS, with Keller Williams in Vancouver, Washington, takes it a step further: After one buyer pointed out that Kreinbring makes more if the buyer pays more, Kreinbring asked the buyer if he’d be willing to pay a dime for each dollar Kreinbring saved him. “He shook hands with me so fast I thought I had really miscalculated, but it worked,” Kreinbring says.

That led to his formula, which he is happy to share. He uses a written buyer broker contract where the buyer agrees to pay X% of the final sale price plus 10% of what Kreinbring saves them. If the buyer pays more than list price, the commission is figured on the list price instead of the higher sale price. Anything Kreinbring receives from the listing brokerage is credited toward what the buyer owes. If there is more than what the buyer owes, the excess goes toward the buyer’s closing costs.

Many agents say that there’s room for new ideas in the way people pay agents.

“There’s only one other industry that bills this way and it’s medicine—and nobody likes that model,” Kreinbring says.

Commission in Court

While there have been several lawsuits targeting real estate agent compensation, March 2019 lawsuits filed in Illinois and Missouri against the National Association of REALTORS® and four corporate defendants have everyone’s attention.

The suits allege that home sellers have been damaged because the listing broker compensates the buyer’s broker.

They claim “various NAR rules and members’ adherence to those rules have led to artificially fixed and inflated commissions being paid to real estate professionals.”

In April, the lawsuits were granted class-action status, a decision NAR says was “extremely disappointing.”

The association holds that the free market organically establishes commission within local markets based on “service, consumer preference and what the market can bear.” NAR has established a website, competition.realtor, which has talking points you can refer to when discussing the lawsuit.

As of the time of publishing, NAR Is appealing the class-action decision.

For more on selling your value as an agent and other business tips, check out “The Bottom Line” newsletter for members on CRS.com/resources/rrc-bottom-line.

Photo: iStock.com/Loungepark