What Granular Building Data Reveals Since Reopening Began

Summary

There are understandable concerns about higher operating costs due to coronavirus mitigation, specifically with HVAC costs

At the same time, the data reveals that shutdowns gave operators a chance to implement efficiencies that have so far offset these costs

The trick will be maintaining these efficiencies as reopening continues

While daily COVID-19 cases sets new records nationally, the story in New York City, the original epicenter in the United States, is much different. In fact, this past Saturday, New York City reported 0 coronavirus deaths for the first time since the first one was reported on March 11.

The immediate rise, slow decline and no reopening setbacks makes New York a clean dataset to work with when trying to understand the effects of stay-at-home orders and new protocols on operating expenses.

Of course, many people started working from home before the stay-at-home order was enacted. Likewise, many people have not returned to the office even when the governor initiated Phase II. But from a building operations standpoint, it doesn’t really matter. If tenants can be in the building, you essentially must operate it as if it’s fully occupied.

In addition, following ASHRAE and CDC guidelines means increasing the amount of outdoor air brought into the building and using higher-grade filters. These measures are known to increase operating costs, but by how much? That’s what this analysis intends to answer, by looking at granular data in office and multifamily buildings in New York City while accounting for outside factors such as increasing summer temperatures.

Silver Lining in Offices

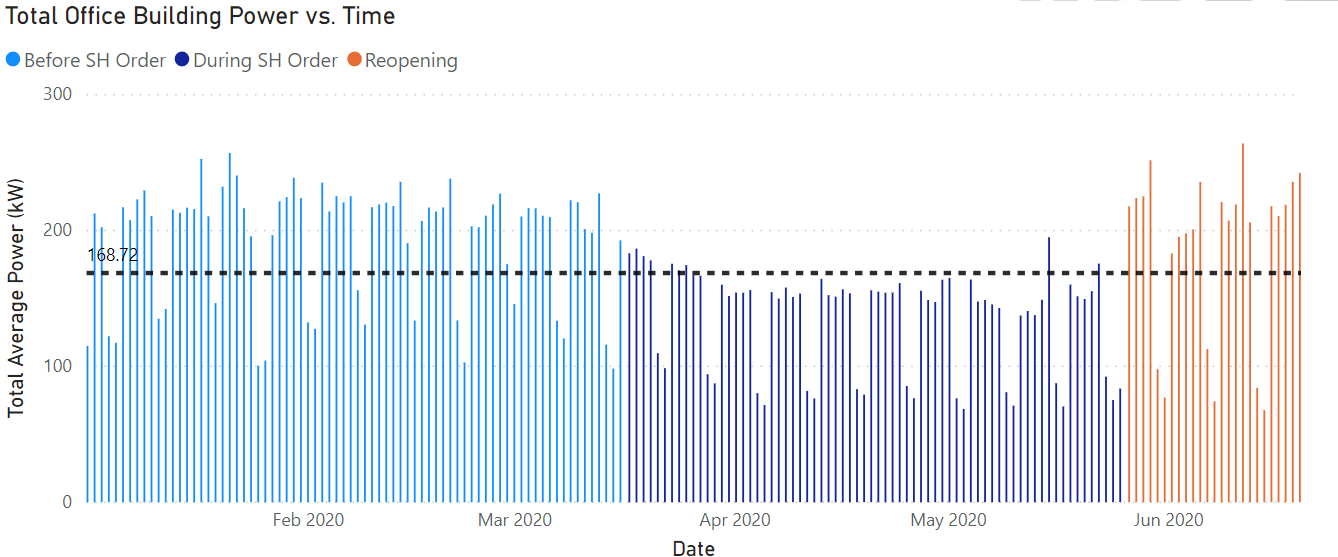

Overall, offices are operating at similar levels to before stay at home orders were enacted. That being said, this does not tell us the full story.

When we dig into the per day usage, it turns out that on weekdays, usage is up slightly despite the low occupancy (more on that later). Weekend usage is much lower during reopening than before the shutdown occurred.

Why? The most likely explanation is that the combination of unoccupied buildings and the risk of reduced rental revenues created a powerful incentive for operators to look closely at the each piece of equipment.

Of course, you don’t want to wait until a global pandemic to get your assets running optimally, but this should be encouraging for the industry. While operating expenses will necessarily be higher due to new ventilation and filtration protocols, there is likely enough waste in existing processes to offset a significant portion (or all!) of those costs.

Operators Took Reopening Seriously

While wear and tear is a concern for building operators, it is much better than systems sitting idly for an extended period of time from an equipment and tenant health perspective. Given this, it is encouraging to see what happened immediately before reopening began.

That downward spike down is likely due to shutting down systems to perform thorough maintenance on critical equipment. Without this, tenants would be at risk of health issues from poor indoor air quality, legionnaire’s disease and a host of other non-coronavirus problems.

This is precisely why good governance from public officials matters so much. Clear communication about the expected length of stay-at-home orders, the date of reopening and updates on any setbacks is critical to getting this process right. In New York, it appears that the industry was coordinated in their maintenance indicating a job well done in this respect.

HVAC Costs Have Increased, As Expected

When we dig a little deeper, from the building level to individual pieces of equipment, we see evidence of exactly what owners are concerned about from a financial perspective.

HVAC costs dropped off slightly during the period of low occupancy. This was marginal because operators could not simply shut down ventilation in the building; the systems still needed to run, and the building needed to be flushed routinely to make it viable for reopening.

Now that buildings have reopened, these fears can be quantified. HVAC costs are up 36% from before the shutdown, normalized for the higher temperatures. As a share of total energy costs, HVAC has increased from 30% to 48%.

Multifamily is Not as Static as Assumed

There was concern initially that while office buildings emptied out, multifamily buildings would be crushed by higher occupancy than what operators are used to and systems are designed for.

This turned out to be wrong. It appears that instead of staying in multifamily units, many New Yorkers left the city during the stay-at-home order and have since returned.

As such, costs have returned to before the crisis began. However, as multifamily operators also must follow ASHRAE guidelines, there are higher spikes of usage than previously, something that will affect the peak demand rate charged by the utility.

Even Multifamily Has Become More Efficient

In general, offices have more engineering talent on site and have more equipment that run on schedules, meaning more room for “performance drift.”

However, there were still opportunities uncovered in multifamily assets that likely would not have happened without the pandemic.

The changes to occupancy because of the coronavirus also gave multifamily operators the incentive to take a hard look at their buildings. One example is lighting, where operators clearly found opportunities to improve schedules and save costs.

Conclusion

Office and multifamily are two sectors of commercial real estate that have been able to tread water so far in the nascent recession.

Landlords are betting on the fact that, while there may be less demand for office due to work from home, it will be offset by the additional space per employee that will be required due to COVID-19. Likewise, multifamily owners expect the sector to remain as resilient as it has time and time again.

This optimism is partially offset by the concern over higher operating expenses that are specific to mitigating coronavirus spread within buildings. Bringing in more outside air, high efficiency filters, and cleaning equipment will all add to the balance sheet.

The data indicates that net-net, there is likely enough waste in existing operating budgets to significantly offset these increases. Of course, these efficiencies were identified and implemented during a period of extremely low occupancy, this cannot be counted on as a strategy going forward.

Instead, the case for a digital transformation has never been clearer. The data and insights derived from digitizing routine processes, capturing equipment performance, and monitoring the indoor environment can ensure that buildings do not return to their inefficient ways as occupancy returns.

Interested in locking in the efficiencies found during the shutdown? Schedule a demo to see how the Enertiv Platform works.