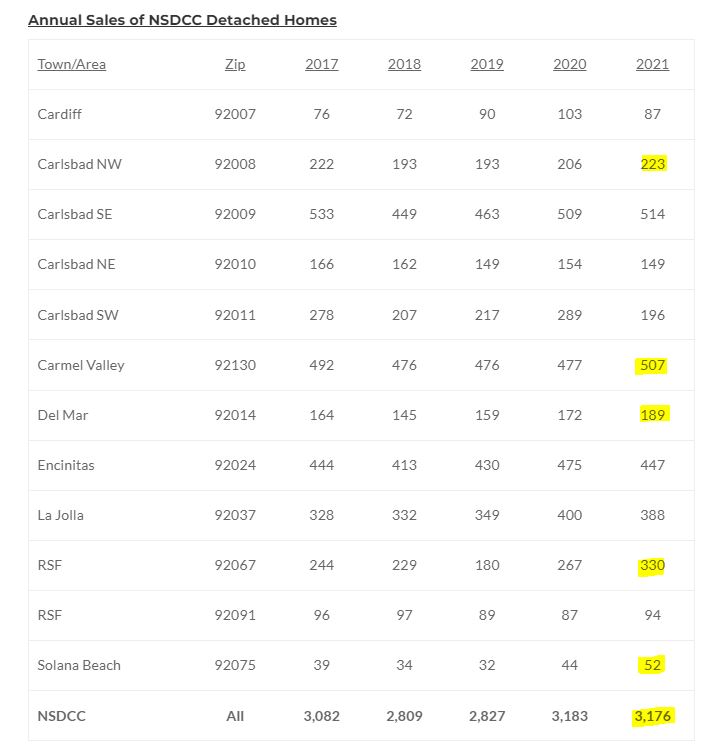

People keep saying that the inventory is low, but it means that there’s not a lot of active listings sitting around not selling (which will be the sign that the frenzy is over). Let’s determine whether the inventory has actually been lower than normal by comparing the number of sales to previous years:

The inventory must be fine, considering the number of 2021 sales in EVERY area were at least the median number of their five-year group, or higher, and the highlighted counts were the BEST of the five-year group. The total of 3,176 will probably increase in the coming months and end up #5 of all-time!

If you are a buyer and feel stymied by the lack of inventory, you may want to reconsider. It’s more likely that you’re not moving fast enough, you’re not doing it right, or you’re on the outside looking in.

Excerpted from : https://grow.acorns.com/home-values-end-2021-at-record-breaking-highs/

“We tend to expect an economic system without a balance to return to balance.”

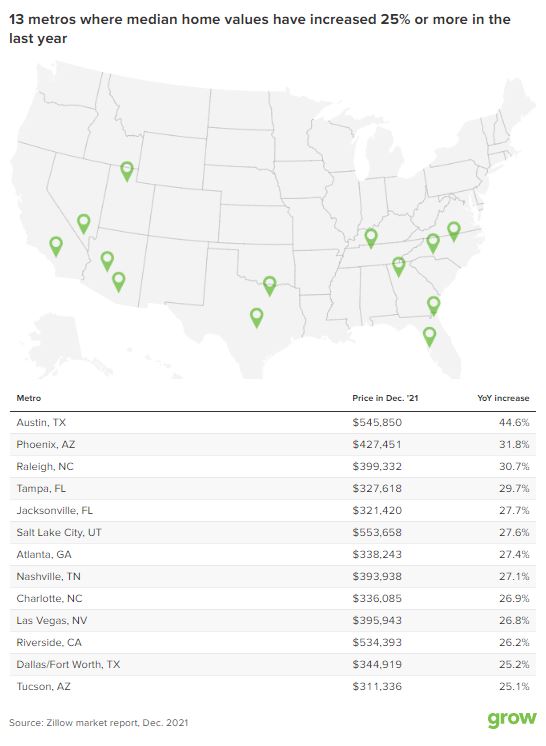

No sector of the economy has upended expert expectations during the pandemic the way the residential real estate market has. After taking a big dip in the spring of 2020, homebuying came roaring back that summer and hasn’t slowed down since, to the delight of sellers and the dismay of buyers.

Month after month, home prices keep going up. Depending on the index, home values have increased between 25% and 33% from the end of 2019 to now. That’s more than double the growth that housing prices experienced in the two-year stretch between 2017 and 2019, according to all three indexes.

“I am surprised by the longevity of it,” says Zillow economist Jeff Tucker. “I describe this market as very low inventory, very fast price appreciation. It’s very out of balance, and we tend to expect an economic system without a balance to return to balance.”

That hasn’t happened in housing. Despite all the uncertainty and all the emotional and physical upheaval Covid has created, people have kept buying property.

Demand ‘at an unusually high level’ for December

The current housing market is a confluence of factors, but the core drivers continue to be reduced supply and overwhelming demand, Tucker says.

“On the supply side, the flow of new listings [in December] was down pretty substantially year over year, more than it had been in the last few months,” Tucker says. The number of homes for sale nationally fell below 1 million in December 2021, according to Zillow: a 40% drop from December 2019 and a historic low for the site.

December was a low point for inventory, but listings have been well below demand for two years. Bidding wars are commonplace. And despite the fierce competition, demand hasn’t fallen.

No sector of the economy has upended expert expectations during the pandemic the way the residential real estate market has. After taking a big dip in the spring of 2020, homebuying came roaring back that summer and hasn’t slowed down since, to the delight of sellers and the dismay of buyers.

Month after month, home prices keep going up. Depending on the index, home values have increased between 25% and 33% from the end of 2019 to now. That’s more than double the growth that housing prices experienced in the two-year stretch between 2017 and 2019, according to all three indexes.

“I am surprised by the longevity of it,” says Zillow economist Jeff Tucker. “I describe this market as very low inventory, very fast price appreciation. It’s very out of balance, and we tend to expect an economic system without a balance to return to balance.”

That hasn’t happened in housing. Despite all the uncertainty and all the emotional and physical upheaval Covid has created, people have kept buying property.

The current housing market is a confluence of factors, but the core drivers continue to be reduced supply and overwhelming demand, Tucker says.

“On the supply side, the flow of new listings [in December] was down pretty substantially year over year, more than it had been in the last few months,” Tucker says. The number of homes for sale nationally fell below 1 million in December 2021, according to Zillow: a 40% drop from December 2019 and a historic low for the site.

December was a low point for inventory, but listings have been well below demand for two years. Bidding wars are commonplace. And despite the fierce competition, demand hasn’t fallen.

“Folks who were stymied searching in the summer just kept at it,” Tucker says. “That helped keep demand high by seasonal standards and at an unusually high level right through December.”

There are other underlying forces that are not Covid-related and are adding to the current mix of low supply and high demand.

Many renters see buying property as a way to protect their housing budgets from inflation, as the monthly cost of housing skyrockets across the U.S. Rents rose almost 16% in December from 12 months ago, according to Zillow’s national rent index.

Another underlying problem: U.S. housing stocks never fully recovered from the housing market collapse and the Great Recession more than a decade ago, Tucker says. “America really didn’t build enough homes from 2007 to about 2019, and the chickens are coming home to roost now,” he says.

“It turns out a few million extra people getting into a market that is a few million homes under-supplied is enough to create a very sustained imbalance of supply and demand.”

you’re not doing it right, or you’re on the outside looking in.

What do you mean?

I’ve had two different buyers referred to me this year that told me, “I’m following the market – just let me know if you have any off-market listings”.

‘Following the market’ only gets you up to the starting line.

To get in the game, you have to look at every new listing in person, and make offers on those that you can live with. The impact from the in-person visits – especially noticing the number of competitors – is how you get your chops up.

Plus you have to reach the same or higher desperation level as all the competitors. “Oh wait Jim, I’m not desperate”. That’s ok, stand over there on the sidelines, and if I happen to see something, I’ll let you know.

To those who tell a listing agent, ‘Let me know if you get any offers on that one’.

Don’t wait around your phone.