Natural Hazard Disclosure Report (NHD): Disclosing Disaster Risk When Selling a House

- Published on

- 12 min read

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

-

Richard Haddad Managing EditorClose

Richard Haddad Managing EditorClose Richard Haddad Managing Editor

Richard Haddad Managing EditorRichard Haddad is the managing editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

A cliffside Spanish villa with spectacular views of vineyard-dotted valleys, a historic Greek Revival mansion built on the banks of a picturesque river, a retro Art Deco beach bungalow overlooking the ocean: What do all three of these dream homes have in common?

They’re all in natural hazard zones.

That gorgeous villa could tumble off the cliff during a landslide or earthquake, that historic mansion could become a swamp if the river overflows and floods the place, and that beach bungalow could be swept completely away during a hurricane.

When you’re selling a house in California that resides in a natural hazard zone, you need to disclose that fact to your buyer with the natural hazard report, known officially as the Natural Hazard Disclosure (NHD) Statement. Let’s break down the contents of this document and explain its uses so you can keep your home sale on track.

Editor’s Note: As a friendly reminder, this post is intended for educational purposes, not legal advice. If you need assistance completing California’s Natural Hazard Disclosure (NHD) Statement and Disclosure Report, HomeLight encourages you to reach out to a professional advisor.

What is a natural hazard zone?

A natural hazard zone refers to areas where homes are at greater risk for property damage or destruction by Mother Earth or Mother Nature. These risks include: earthquakes, tornados, landslides, wildfires, volcanoes, hurricanes, tsunamis, and other natural disasters.

What is the Natural Hazard Disclosure Report (NHD)?

The Natural Hazard Disclosure Report (NHD) is a California-specific report that home sellers must complete for their buyers in order to sell a home in a natural hazard zone. This is required by state law in California for sellers to be in compliance with the 1998 Natural Hazard Disclosure Act.

Source: Property ID (propertyid.com)

“The Natural Hazard Disclosure Report talks about whether the property is in a flood zone, or on an earthquake fault line, or if it’s in a fire hazard area,” says Roxanne McCaslin-Curtis, a HomeLight Elite agent with 26 years of experience working with properties in the Sacramento area. “That’s important for buyers to know because it will affect insurance rates.”

Why do I need an NHD report?

An NHD report allows you to sign the Natural Hazard Disclosure Statement (NHDS) in good faith — that you are informing your buyer of all known natural hazard risks.

“We order the NHD through a third-party company,” explains McCaslin-Curtis. “These companies have million-dollar policies, so if they have any information in there that is not correct, they could be liable for that. So we all use third-party companies.”

This puts any liability for incorrect information on the third-party company who provides you with the report, rather than on you.

What does the NHD require you to disclose?

There are six main natural hazards that must be disclosed in California’s NHD report. They are:

- Special flood zone areas

- Area of potential flooding on a dam failure inundation map

- Very high fire severity zone

- Wildland areas with substantial forest fire risks

- Earthquake fault zone

- Seismic hazard zone

But that’s not all that’s in there. The NHD is an extensive report that covers a wide array of potential hazards beyond the main natural hazards, like homes located in flood zones or on earthquake fault lines.

“It’s about 43 to about 60 pages long,” explains McCaslin-Curtis. “The NHD also covers radon gas, airports, and any industrial hazard within a mile radius of your home. It also talks about if the home has special tax assessment rates, which are known as Mello-Roos.”

What are your options if your home is in a natural hazard zone?

There is only one option if you want to sell your home and you know that it lies in a natural hazard zone — you must disclose this information.

Not doing so can put you in legal jeopardy if you knowingly sell a home without disclosing all of the natural hazard risks. That’s why it’s so important to get the NHD report from a third-party company. This transfers the responsibility for the accuracy of the natural hazard disclosures onto that third party.

Who obtains the NHD report, how much does it cost, and at what point during the home sale do I need it?

There are a number of third-party companies in California that specialize in producing NHD reports. Most of these companies offer order forms for NHD reports on their websites and cost between $50 to $150, depending on where the property is located and the length of the report.

However, these companies are not all created equal. Some might have a slow turnaround, a reputation for inaccuracies, or worse.

Your best bet is to ask your experienced real estate agent to help so that you’re sure to get a reliable report in a timely manner.

“As soon as we open up escrow on a listing, we order the NHD,” assures McCaslin-Curtis. “The seller is the one that usually pays for that as part of their disclosure packet. It costs $99, and it takes about 48 hours to get it.”

Asking your agent to assist with the NHD report is the smart move because some sellers may be exempt from needing an NHD. While rare, your agent is in the best position to know if you qualify for an exemption.

Is California the only state that requires NHD?

Since the Natural Hazard Disclosure Act is a California state law, it is the only state that requires the NHDS from home sellers. Therefore it is the only state where there are companies that specifically produce NHD reports.

That doesn’t mean non-California residents are off the hook for disclosing natural hazard zones, though.

Every state has some form of real estate disclosure laws — and if that state has natural hazard zones, it likely has a law that requires you to disclose it to your sellers. This is especially true if you live in one of the top 10 natural disaster states.

To be on the safe side, ask your agent about your state’s requirements for natural hazard disclosures, and any official natural hazard reports you may need to order as part of your home sale.

What are the risks to homes built in natural hazard zones?

Whether you’re selling a home in a natural hazard zone in California or another state with natural disaster risks, disclosing this isn’t just about protecting you from liability.

Disclosing natural hazards provides your buyers with vital information about how to properly protect their new home from those specific hazards. Lest’s take a brief look at the various natural hazard zones you may be required to disclose in one form of another when selling a house.

Special flood hazard area (SFHA)

A specialized flood hazard area (SFHA) is land that is at a high risk for flooding — a location where there is at least a 1 in 4 chance of flooding during a 30-year mortgage.

In most areas, homes located in an SFHA floodplain are required by FEMA to obtain special flood insurance through the National Flood Insurance Program (NFIP).

Source: Screenshot of National Weather Service interactive map (weather.gov)

Dam inundation zone

A dam inundation zone is an area located downstream from a dam that would be flooded if the dam were to fail.

Dam inundation areas are designated as high risk by FEMA, so if your community participates in the NFIP program, the new owner will need to get flood insurance. They should also check out their state’s dam safety program and find out if they are required to have an emergency action plan in place.

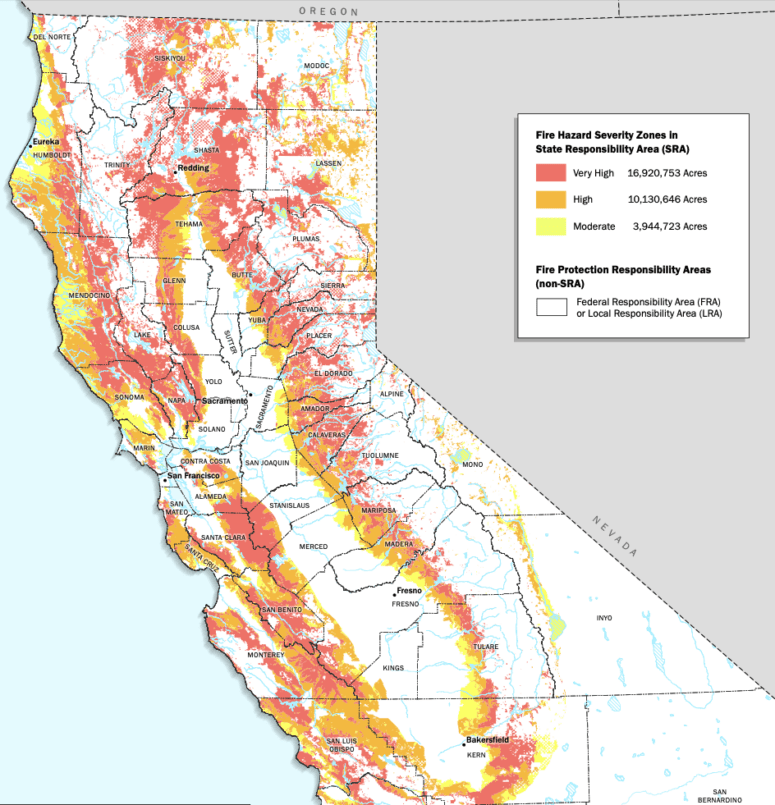

Very high fire hazard severity zone

The very high fire hazard severity zone is a California-specific designation that is addressed by the NHD report. These zones can change annually through the Fire Resource and Assessment Program (FRAP), based on vegetation, fire history, and topography.

Source: California State Fire Marshal (osfm.fire.ca.gov)

Fire risk has a huge impact on home insurance rates, and some properties may require specific fire insurance. With increased wildfires caused by climate change, some large insurance companies have pulled back from California’s home insurance marketplace, saying that rising construction costs have pressed them to stop writing new policies in the state.

The new owners also need to know that any remodeling projects they’re planning may require ignition-resistant construction.

Wildfire hazard zone

California isn’t the only state at risk for wildfires. That’s why the Forest Service of the U.S. Department of Agriculture creates the Wildfire Hazard Potential (WHP) report.

For some, standard home insurance may cover your house and belongings damaged by wildfire — but not always. Coverage can depend on the hazard zone designation or the insurance policy conditions, so your buyers should check with their insurance provider.

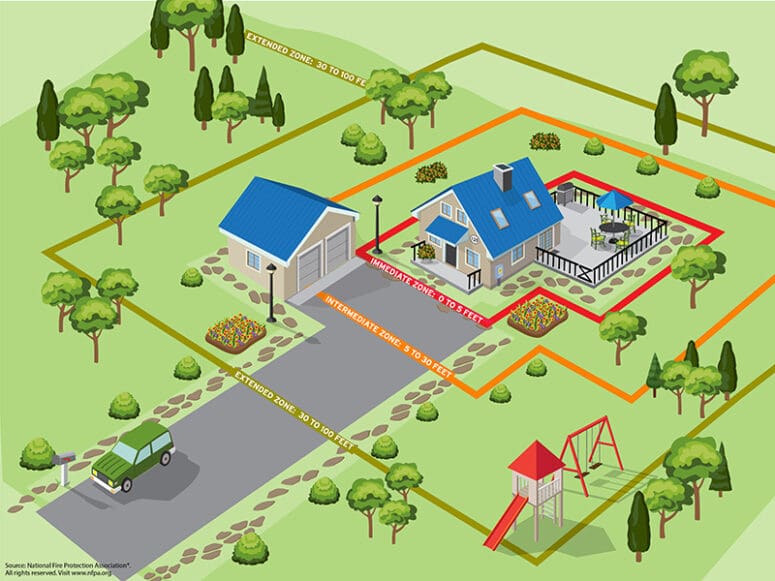

Perhaps more important than the insurance, your buyers need to know how to prepare the home in case of a wildfire.

Source: National Fire Protection Association (nfpa.org)

Drifting embers from wildfires can ignite a home even at a distance, so it’s important that the zones around the home are free of fire hazards like dead leaves and debris.

Earthquake and seismic hazards

Earthquakes are a common phenomenon in many U.S. states, not just California. In fact, you may be surprised to find your state highlighted on the earthquake hazard map. There’s even a National Earthquake Hazard Reduction Program (NEHRP).

California does have some specific earthquake-related designations that are covered in the NHD, though. They are the earthquake fault zones and seismic hazard zones — the first designates areas at high risk for earthquakes, while the second includes areas that are subject to seismic activity-related events like landslides.

Source: U.S. Geological Survey (usgs.gov)

In California, homeowner’s insurance does not cover earthquakes. If you have a homeowners insurance policy in California, your company must offer to sell you earthquake insurance. By state law, it must offer you this option in writing every other year.

You can also get earthquake insurance from the California Earthquake Authority (CEA), a non-profit company created by the California legislature.

Hurricane hazard zone

The West Coast may have earthquake worries, but on the East Coast, hurricanes are the main natural hazard risk. Your buyers need to be prepared to protect their new home with hurricane safety measures like hurricane shutters.

According to the Insurance Information Institute, standard homeowner’s insurance covers the structure of your house from hurricane damage, but there are limits. Make sure the policy dollar limit is enough to cover rebuilding your whole house, and check other potential limitations.

For example, if your home’s exterior is undamaged by the hurricane, but if your interior floods, you may not be covered, as this may be classified as flood damage rather than hurricane damage.

Tornado hazard zone

The Midwest is where there are the greatest tornado risks. This risk is so high in some areas that they’ve come to be called Tornado Alley.

Like hurricanes, homeowner’s policies typically cover tornado damage — but if you live in a high-risk area, that coverage might not be enough. Check your coverage limits on both dwelling and personal property, and be aware that any flooding caused by tornado-related rainstorms will NOT be covered.

Volcano hazard zone

Did you know that the United States has nearly 170 active volcanoes? The degree of risk varies from volcano to volcano, however, home buyers in Hawaii, Alaska, and on the West Coast have to worry about living in a volcano hazard zone.

Source: U.S. Geological Survey (volcanoes.usgs.gov)

There’s little you can do to prevent your home from damage during a volcanic eruption. Luckily, most home insurance policies cover volcanic eruption damage caused by the volcanic blast, airborne shockwaves, ash, dust, lava flow, fire, or explosion.

What other hazards does the NHD report cover?

In California, the NHD report also covers a number of hazards that aren’t strictly related to natural disasters. These include:

- Radon gas exposure

- Airport influence area

- Megan’s Law (registered sex offenders)

- Military ordnance

- Mello-Roos

Sell your California home with confidence

Selling a home in a natural hazard zone can be a daunting proposition, especially in California, with its strict Natural Hazard Disclosure regulations. By hiring an experienced agent who can help you obtain the appropriate hazard reports, you can set yourself up to sell your higher-risk home as quickly and for as much money as a low-risk property.

At HomeLight, we’re here to assist you with your real estate needs. Whether you’re looking to consult with a top California agent to sell your property or looking to buy a new home, let us help you connect with a professional you can trust.

Header Image Source: (Steinar Engeland/ Unsplash)