Commercial real estate has long been considered a pillar of stability and prosperity. However, recent developments have cast a shadow of uncertainty over its future.

The global economic downturn triggered by the COVID-19 pandemic has left a lasting impact on businesses worldwide. With many companies transitioning to remote work setups, the demand for office spaces has plummeted. Consequently, office space vacancies have surged, leading to a substantial decrease in rental income for commercial property owners.

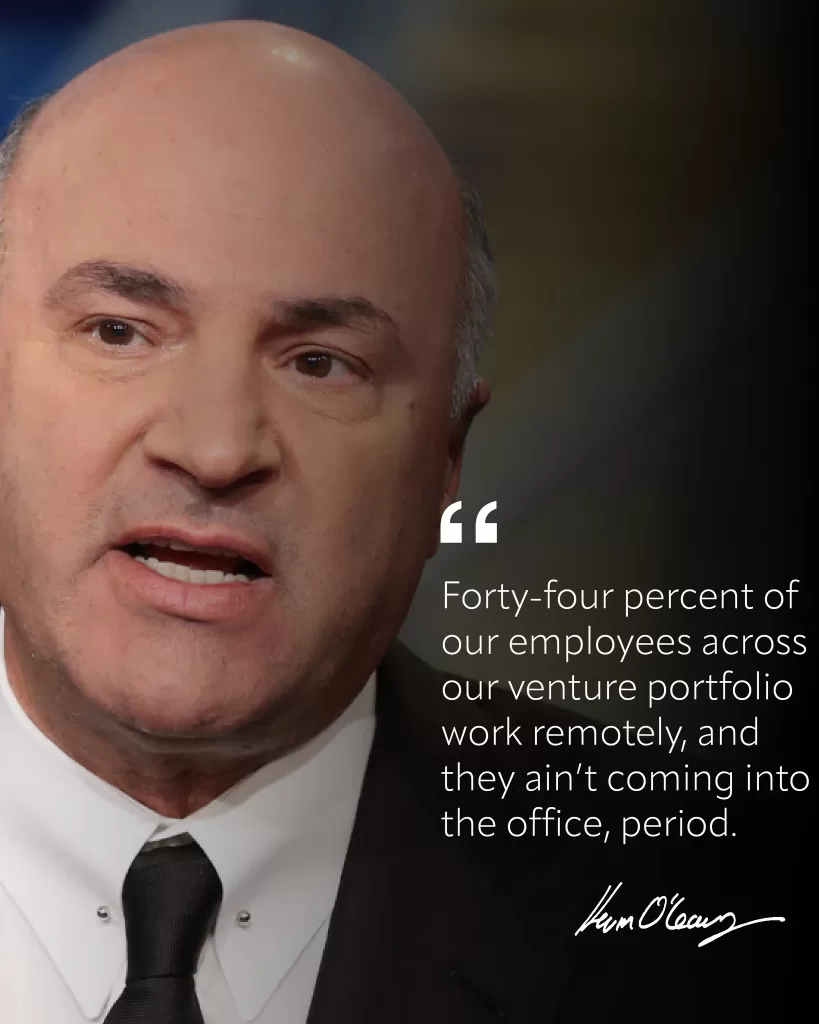

Despite the return of many large-scale companies to in-office work, numerous small businesses are opting to continue remote operations. As a result, a significant number of office buildings remain unoccupied. According to "Shark Tank" star Kevin O'Leary, this vacancy trend is prevalent in sub-grade markets and cities like Boston, where up to 40% of buildings remain unoccupied. The impending correction in the real estate cycle, triggered by rising rates, poses a challenge as these buildings require refinancing. Furthermore, many of them have depleted equity, exacerbating the situation. Consequently, regional banks heavily invested in these properties will face severe repercussions:

"These banks are going to fail because up to 40% of their portfolio is in commercial real estate," O'Leary said in an interview on GoBankingRates.com.

The rise of e-commerce has significantly altered consumer behavior, exacerbating the challenges the commercial real estate sector faces. The once-thriving retail industry is experiencing a steep decline, with brick-and-mortar stores struggling to compete against online giants. This shift in consumer preference has resulted in countless store closures and increased vacancies in retail properties.

The hospitality industry, a vital commercial real estate sector component, has taken a severe blow due to travel restrictions and reduced tourism. Hotels, resorts, and restaurants grapple with low occupancy rates, cancellations, and financial strain. As the recovery timeline remains uncertain, many businesses in the hospitality sector need help to survive.

In recent years, the commercial real estate sector experienced a surge in property valuations, fueled by investors seeking high returns. However, the rapid increase in property prices has led to concerns of an impending bubble. This burstiness is further compounded by the substantial debt burden carried by property owners, making them vulnerable to default in a downturn.

Financial institutions, wary of the potential risks, have become more cautious in lending to the commercial real estate sector. Tighter lending standards, coupled with economic uncertainty, have reduced the availability of financing options for property developers and investors. This restriction on capital inflows further intensifies the strain on the sector.

The looming collapse of the commercial real estate sector poses a significant threat to property owners and investors. Plummeting property values and dwindling rental incomes can erode the returns on their investments. Furthermore, defaults on mortgages and loans may result in foreclosures and financial ruin for some stakeholders.

Regional banks have ceased lending to small businesses due to the imposition of capital call requirements resulting from the strain on the commercial real estate sector.

As the sector faces turmoil, tenants and employees are also at risk. Job losses and business closures in the retail, hospitality, and office sectors could have far-reaching consequences. The uncertainty surrounding the sector's future makes it challenging for individuals and businesses to plan for the long term.

The commercial real estate sector is vital in driving local and national economies. A collapse in this sector could have ripple effects on related industries, leading to broader economic repercussions. Governments may need to intervene with policies and initiatives to mitigate the impact on the overall economy.

Another possibility is to repurpose commercial real estate. However, due to the changing economy, most of these properties cannot be repurposed as office spaces. While it is theoretically possible to convert these buildings into storage or housing units, accomplishing this task is challenging. Zoning changes and policy adjustments are required, making the conversion process difficult. Demolishing these structures and constructing new ones may be a more feasible long-term solution. Still, who will finance these ventures as the overall cost is estimated to reach trillions of dollars? Regional banks are likely to face significant issues in the next three years.

"Most of these buildings were built over the last 30 years and [have mortgages with] interest rates of less than 4%. Now the Fed has raised rates to 5.5% terminal rate, which means these mortgages are going to be refinanced at 9% to 11% — so a 3x cost. So many of these buildings won't be economically viable," concluded Kevin O'Leary.