I suppose I spoiled the ending, didn’t I?

The rental market is no longer “tough,” I said.

But maybe it depends on who you ask, what you read, and where?

“Weak Condo Market In Downtown Toronto Leads To Dip In Rental Rates, Increased Vacancy”

Globe & Mail

February 7th, 2024

That headline definitely jives with what I saw and felt over the past three months, and you’ll see this shortly in the Q1 rental stats.

But I also noted this headline:

“It’s Never Been Harder To Rent In Canada – Vacancy Rates Fall To 35-Year Low”

RBC Special Reports

February 1st, 2024

Of course, that headline refers to Canada as opposed to Toronto, and it’s looking longer-term, but I think the point is clear: the headlines are never the same.

No matter the market, there will always be two news sources telling different stories.

From the article above:

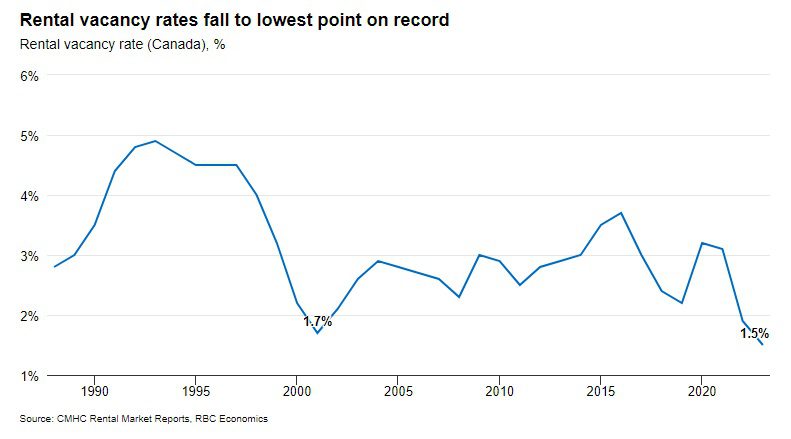

Acute supply-demand imbalances have pushed the national rental vacancy rate to 1.5% – the lowest point since at least 1988, according to the latest Canada Mortgage and Housing Corp.’s (CMHC) rental market report.

Edmonton and Calgary reported the sharpest drops among Canada’s six major census metropolitan areas (CMAs) last year – due, in part, to the substantial inflow of interprovincial migrants to the province which kept demand for rental housing robust. Calgary now rivals Toronto as the second tightest major rental market in the country. Though the rental vacancy rate in Edmonton is still the highest of the six major markets, a drop to 2.4% indicates that even this city is suffering from a rental supply shortage.

Vancouver’s rental vacancy rate continues to sit below sub-1%, making it the tightest (and most expensive) market in Canada. But tight conditions have spread beyond urban boundaries. Belleville is now the only CMA in Canada with a vacancy rate at or above the optimal 3% rate, which indicates a balance in the market.

Belleville, eh?

I hear it’s nice this time of year!

But let me borrow a chart from the RBC Special Housing Report just to flush out that thought:

Again, this is Canada-wide, and we want to know about Toronto, for our purposes.

For now.

I mean, it’s not unreasonable to assume that I pack up my family and start the YRB, er, um, Yukon Realty Blog.

I’m not sure if I’d be welcome up there, however. We all remember what happened in 2022.

Here in Toronto, we witnessed a very weak first quarter in the rental market.

At one point, poor Tara had seven rental listings on her plate!

The irony is: some of these rental listings had no showings and no offers and other rental listings had too many showings and too many offers.

What do I mean by that?

Well, since I don’t want to be accused of rental discrimination, let me tell you about a hypothetical situation about a guy I know, who knows antother gal, who is the one actually telling this story.

Let’s say that you had a rental listing for a basement apartment in North York, and while it was really nice “for a basement,” it was still just a basement. But because of the price point and the size, it attracted many suitors.

What’s the problem with that, you’re asking?

Well, let’s say that this was a 2-bedroom, 1-bathroom condo. Now, let’s say – again, hypothetically, that every appliation was for eight people who wanted to crowd into the basement like they were worms under a rock. And let’s also say that six of the eight people were unemployed.

Yeah, that sort of situation. Hypothetically.

Of course, there’s a movement out there in society today to simply do away with the rights of a home-owner and for one to be forced to rent to anybody, anywhere, no matter what, and if/when the rent isn’t paid, to simply shut up and eat it – “because you can afford it!”

Rabbit hole. Avoid.

Breathe.

Digress…

We have a client who would rather keep his or her property vacant than “rent to the wrong people,” and thus the property has now been on the market for three months.

We had a rental listing that was reduced in price twice.

We had three rental listings take over one month to lease.

And all the while, I’m thinking, “Isn’t this supposed to be the hottest rental market on earth?”

Maybe we’re just spoiled.

Maybe we’ve grown so accustomed to listing a condo for lease, receving six offers in the first forty-eight hours, and having applicants offer a full year’s rent up front?

In any event, the Q1 rental stats proved that what we were “feeling” out there was real. Let’s have a look…

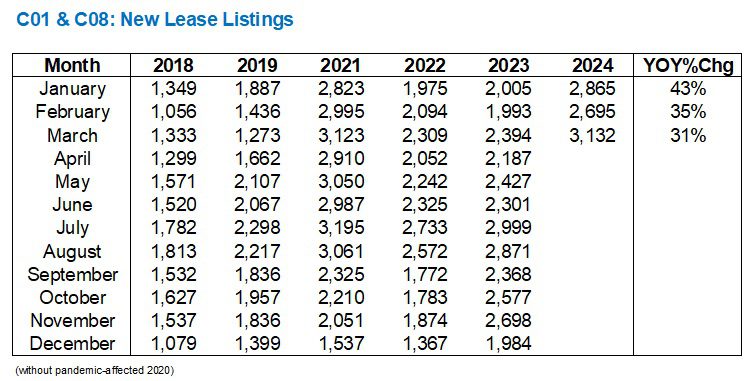

First, let’s look at new condominium listings in C01 & C01, aka “downtown” in January, February, and March:

Those are substantial increases!

To see a 43% year-over-year increase right out of the gate in January speaks volumes about the rental market right now.

And while the year-over-year increases in February and March were lower, the overall volume in March actually set a new record, beating out 2021 by a hair.

You can clearly see this in the graph below:

We went from a record-high in January to a slight dip in February, then back to a record in March.

Comparing 2024 to 2018, 2019, 2022, and 2023, it seems as though 2024 and 2021 were in their own league. At least as far as Q1 goes. The 2022 rental market caught up to 2021 by the summer, then surpassed it in the fall.

Note that in four of the last five years, listings have declined from March to April.

2019 was the lone exception.

Without putting too much emphasis on this one stat, I will certainly be on the lookout for the increase/decrease in listings next month. If listings do increase, then it could be a sign of a shift in the rental market.

As for properties leased, the trend was similar but not on par:

Year-over-year, we saw increases in units leased for January, February, and March.

But 23%, 25%, and 19% are well below the 43%, 35%, and 31% respective year-over-year increases in listings.

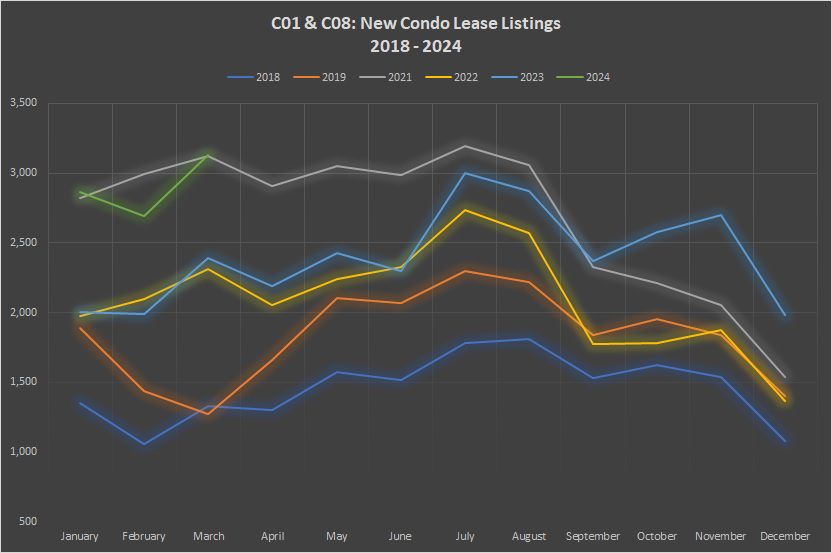

If we look at this on a chart, without my preceeding commentary, it might seem as though the market is healthy and perhaps doing exceptionally well:

But those are absolute numbers.

January, February, and March – as evidenced by the green line above, are second only to the same period in 2021 for units leased.

But on a relative basis, the market showed weakness.

The relationship between listings and units leased tells us how much competition there will be for rentals.

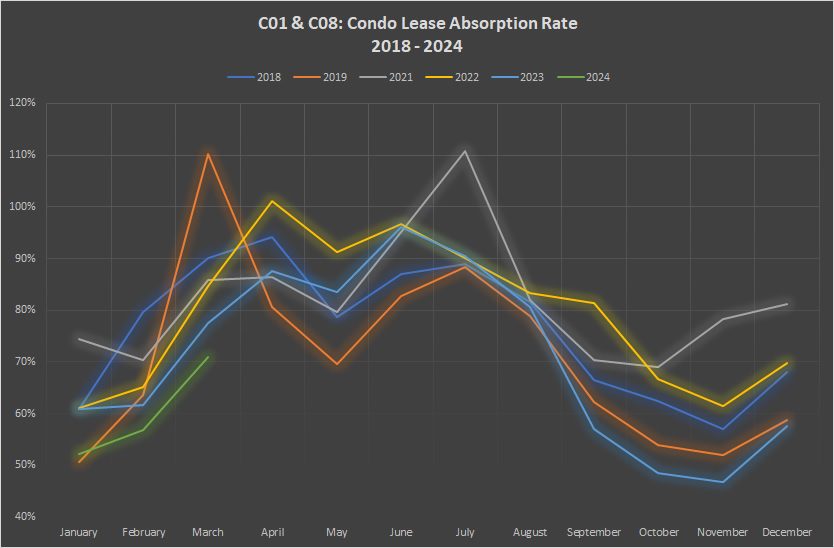

This is our “absorption rate” or the “sales to new listings ratio,” which we are accustomed to using in all of our market analysis for the resale market, but this can also give us a picture of the relationship between supply and demand in the rental market.

Here’s how Q1 looked in that regard:

The absorption rate of 52% in January is well behind the 61%, 74%, 61%, and 61% rates posted in four of the last five years, and only slightly ahead of the 51% figure from January of 2019.

And while you woudl ordinarily conclude than an absorption rate of 71%, ie. the rate from March, signals “seller’s market,” this is well below the 90%, 110%, 86%, 85%, and 78% rates posted in March of the prior five years.

That figure to me is shocking.

And graphically, it really drives the point home:

“Thin Red Line” might have been an underapreciated and under-awarded late-90’s war movie, but the thin green line shows that the rental market, statistically speaking, was as weak as it’s been in in February and March since at least 2017.

This data wasn’t enough for me, however.

So I went searching for something else to confirm both my feeling as well as the data above.

I decided to look at how condos were being leased. Not the number of listings, nor the absorption rate, but rather how many were being leased for under the list price, at the list price, or over the list price.

This required the copy-and-paste of a stupid amount of data, since TRREB got rid of its “export” tool some time around 2005 or 2006. Sidebar: we had a new team member start with us this week, and while watching me copy-and-paste, she asked, “Why can’t you just export that?” I told her that TRREB doesn’t give us the tools that we need or want, and she said, “But doesn’t TRREB work for you?”

And it was only her third day…

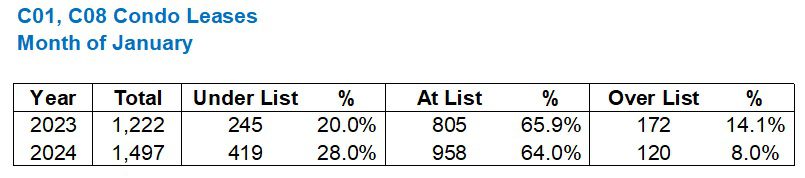

Alright, so let’s look at all the condos leased in C01 and C08 in January and see:

a) How many were leased below the list price?

b) How many were leased at the list price?

c) How many were leased above the list price?

And in order for this to be useful, we need to compare this data to 2023.

As the kids say, “That tracks.”

The percentage of units being leased under the list price went UP, and the percentage of units weing leased above the list price went DOWN.

The percentage of units being leased at the list price was a nominal difference, but there are still fewer in 2024 than in 2023.

Now, just to support this data even further, I decided to waste another fourteen minutes of my life and look at February as well…

Fewer properties being leased under list and more being leased over list – compared to January. But overall, still well, well behind 2023.

No, I didn’t do March. But I also didn’t use those new-found fourteen minutes to meditate, even though I promised myself in January that I would start doing it daily. To answer the question you now have in your head: once. I’ve done it once.

Tricky rental market so far this year, isn’t it?

If you’re trying to rent your property, or did so over the past three months, we would love to hear your stories!

Adrian

at 10:06 am

We do a lot of research on available rental product at my work and our thesis on rental rates is as follows:

Higher than average condo completions downtown in Q3 2023 lead to the weakness in the rental market that is still happening now. It’s likely to take a while for all that extra product to be absorbed. As well, if the government continues with their plan to reduce the proportion of non-permanent residents over the next 5 years then rent growth could be impaired for a couple of years as population growth should slow appreciably. Right now, starts of condos and rental buildings are at historic lows. But that won’t restrict supply until 2027/2028 when you’ll see low completions, potentially leading to stronger rent growth again.

natrx

at 3:25 pm

Corporate hiring of entry level, new-grads, contractors, etc. has fallen sharply. Venture capital funded companies are also suffering due to higher interest rates/risk aversion. They are the ones hiring in tech, marketing, and in turn, agencies, support businesses. The workers absolutely because of their salary offers, need/want to be close to work and yearning for experiencing life in the big city crowded the downtown rental market.

There was also large backlog as well once border/immigration processing fully reopened. This is for PR, student visas for higher educated students and professionals that came en masse in 2022/early 2023. Those have all relatively slowed down. Then you add the higher completions as mentioned. There is definitely going to be tougher time trying to find and rent out to the ‘AAA’ tenant at optimum pricing recently seen.

Appraiser

at 7:43 am

A ‘weaker’ rental market in Toronto should be good news all around. As we all know rental price acceleration has been exceptional to say the least the past few years.

Also it appears that weak is a relative term. Calgary rental market hot. Toronto weak. Yet both cities have similar vacany rates.

Historically Toronto is back to 2012 & 2013 with a vacancy rate of 2.1%, after experiencing years of ultra low vacancies per CMHC. https://www03.cmhc-schl.gc.ca/hmip-pimh/en/TableMapChart/Table?TableId=2.2.33&GeographyId=2270&GeographyTypeId=3&DisplayAs=Table&GeograghyName=Toronto

hoob

at 4:10 pm

You may be remembering The Thin Red Line more fondly than it merits.

I recall it as a tremendously disappointing over-hyped piece of overly long self-importance. It had its fair share of fan and critics who touted its “art” but it was pretty much a dud.

David Fleming

at 7:58 pm

@ hoob

What’s your favourite war movie and why?

hoob

at 8:33 am

Forrest Gump, for its unflinching historical accuracy.

David Fleming

at 10:21 pm

LOL

I didn’t see that response coming.

I don’t know what makes a great war movie.

I think Saving Private Ryan changed the game with the opening scene. I can’t imagine what that was like to film.

“1917” clearly topped that twenty years later.

My top five war movies in no particular order:

Saving Private Ryan

Thin Red Line

Platoon

Black Hawk Down

Apocalypse Now

They’re all very, very different.

I watched “The Bridge On The River Kwai” when I was in a film-buff phase in my early-20’s. I’m sure I’d appreciate it more now. Same with “Patton,” although what I enjoy the most about war movies are the battle scenes, and obviously the newer films are superior in this regard.

“Full Metal Jacket” is amazing but it’s so dark and twisted that I can’t really put this into “favourite” territory.

Does “The Deer Hunter” qualify as a war movie? I saw this in my film-buff phase as well and it scarred me. I still feel awkward when I picture Christopher Walken with that red banadana. I can see it in my mind’s eye and I watched the movie twenty years ago.

I have yet to watch “Napoloeon.”

Ace Goodheart

at 9:04 pm

The BoC raised interest rates, crushing house prices in the process.

The Feds, always ready to do the opposite of what is needed, offered a tax free savings account for house buyers, 30 year mortgages, and more taxpayer funded mortgage insurance, in an attempt to push house prices back up again…

Now that rental prices are coming back down from the stratosphere, we have a host of new government measures for rental properties, designed to make landlords a rare breed of person and to push rents back up again.

Does big government actually benefit anyone?

It is hard to see whom, other than perhaps the government workers themselves.