Am I predictable or is the market predictable?

Or is it both?

I’ve often mused on this blog that there’s nothing I love more than watching a movie I’ve seen a dozen times!

I told somebody the other day that my “perfect Saturday night” is laying on the couch in my basement and watching TV. No, not the TV, as in Amazon Prime, Netflix, Crave, et al, but rather actual TV as in cable.

“Die Hard” is on FOX eh? Okay, let’s watch nine minutes of that until the commercial, then I’ll flip to…..ah, AMC has “Executive Decision” on, and they’re right at the part where Steven Segal is going to give himself up for the greater good! Then after twelve minutes, a commercial comes on and I flip to A&E which is showing “Con Air,” and who doesn’t love watching any random fourteen minutes of that movie? Discovery Channel has “The Martian,” FX has “Goodfellas,” and Movie Time has “Running Man.”

Well, my night is pretty much set! I’m gonna flip around like it’s 1989 and I own “the clicker” and I’ll just slide into a coma of familiarity.

It’s not a bad thing though, right?

On the one hand, I seem impulsive and with a short attention span.

On the other hand, maybe I just like what I like?

Familiarity isn’t a bad thing and I don’t believe that routine is either.

But every once in a while, you buck the trend!

The best entertainment experience I’ve had in the last year was seeing “Top Gun 2” in the theatres, and I will admit that there’s just no way to replicate that experience on the couch at home.

Some people like routine and familiarity, others like adventure.

Speaking of which, I have no clue what country my father is in right now. He’s been to something like 130 or 140 countries and he will literally head to a place I’ve never heard of before, whereas I simply want to head out to my back patio with the kids.

Different strokes for different folks.

That’s a cliché and it’s overused.

But so too was my original title for today’s blog: Expect The Expected.

I wrote a solid one-third of the post before I realized that this was the title last month: “May TRREB Stats: Expect The Expected.”

Oops!

What are the odds?

Am I that predictable?

Or does my mind always seem to go to the most familiar place?

I updated the title when I sat down to hammer out the rest of this post, but I had this eerie feeling that I had used that title again too.

“June TRREB Stats: Steady As She Goes” was the second title I came up with, but lo and behold, I had used this title two years ago!

The weird thing though – it was exactly two years ago as I used this title for the TRREB stats in June.

That’s odd.

Coincidence? Predictability? I don’t know.

But the titles would all be fitting of the June TRREB numbers, even if they’re repetitive and unoriginal.

Because if I’m being honest, the market right now is a bit unoriginal too.

I toyed with the idea of using the word “boring” in the title but I don’t know that the market is boring.

It’s just steady. It’s predictable. It’s doing what we expected it to do.

Last month, I wrote a lot about what typically takes place in the Toronto real estate market in the summer.

June 20th: Summer Slowdown?

June 22nd: Summer Slowdown? (Pt2)

Part of the analysis was looking at how or how much the average home price drops in the summer, since it does every year, but the other part was about looking at whether or not the data is skewed because there are fewer luxury listings and a far higher proportion of condos to houses in July and August.

While the average home price always drops from May/June to July/August, it doesn’t always drop from May to June.

I did expect it to drop this past month, however.

I figured that a 3-4% drop would show that prices were a bit inflated in March and April, but that something like a 1% drop would point to an extremely healthy market.

I didn’t leave any room for the possibility of a decline that was higher than 4%, for what it’s worth. It just wasn’t what I was seeing out there.

But I did feel the average home price would level off, and it did.

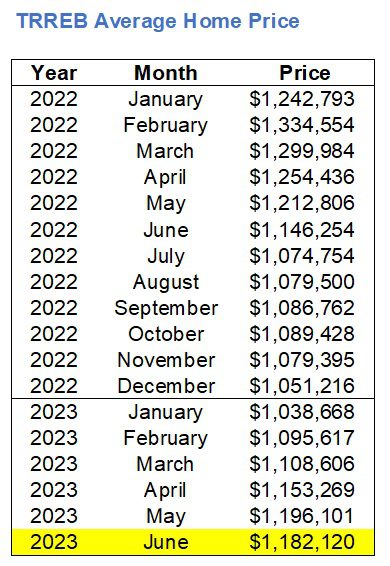

Here’s a refresher:

The average home price in Toronto dropped 1.2% from May to June, but the June price is still higher than April and way higher than March.

Some people felt that, this year, the “high season” was March and April, or March, April, and May. But the stats are showing that the high point was actually May/June, and a 1.2% decline really isn’t much more than a rounding error.

I’m surprised but not surprised at the very same time.

If that makes any sense. Just hear me out.

I predicted a 1% drop but the strength of the market still surprised me. If you had asked me in March or April, I would have thought that the average home price would have retreated more than that.

Part of the reason, of course, is simply what’s happened in the past.

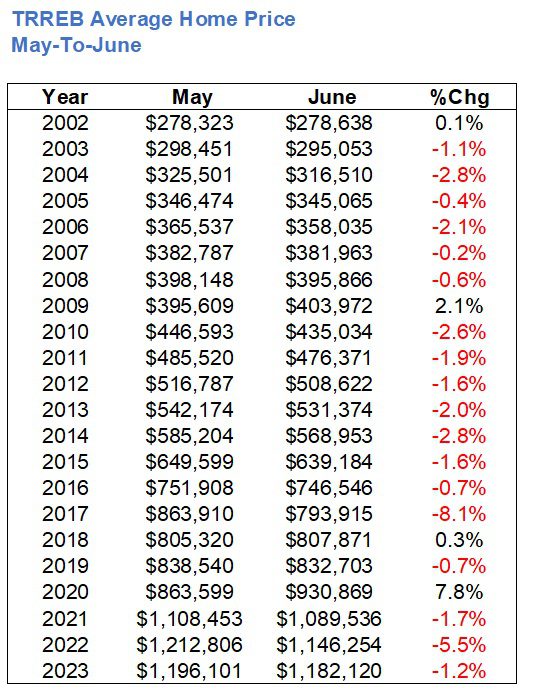

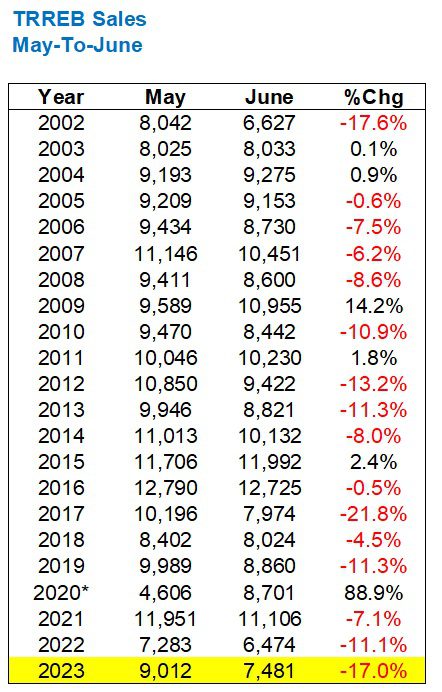

Here’s the May-to-June activity dating back to 2002:

As you can see, only four times in the twenty-two years analyzed has the average home price increased from May to June.

One of those years was 2020 during the pandemic, hence that ridiculous 7.8% increase.

Two of the years are 0.1% and 0.3% which don’t really register.

So when all is said and done, the average home price really should or at least could be moving down 2-3% just based on seasonality, and yet it hasn’t.

So what’s keeping the average home price where it is?

Is it demand?

Is it a lack of supply?

Or is it strength in particular TRREB districts?

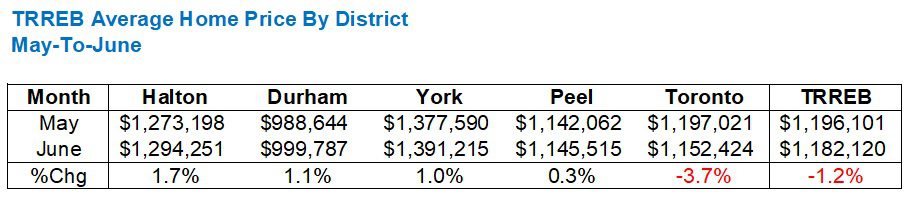

I look a look at the five major TRREB districts to see how prices moved over the last month, and this was very surprising:

The suburbs are holding strong?

While the 416 is declining?

I didn’t see that coming.

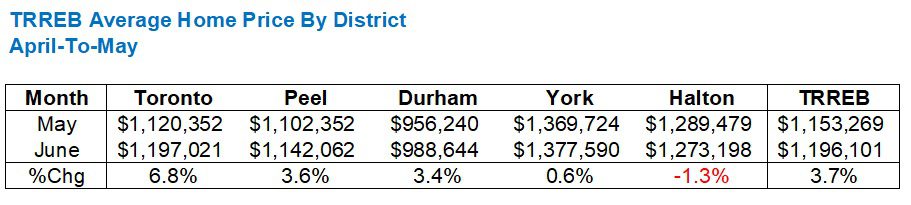

And while it’s only one month, let’s not forget how this data looked from April-to-May:

Remember, last month in this space we were talking about this ridiculous 6.8% surge in 416 home prices, as well as the strength in the suburbs.

So it’s all the more surprising to see the strength in the suburbs continue as the 416 declined 3.7% from May-to-June.

What’s the reason?

And is there anything we can glean from this, going forward?

Let’s look at sales and then new listings, specifically how things usually go from May-to-June.

First, sales:

Again, we have to ignore that incongruent 88.9% increase in 2020, and no, that’s not a mistake. That was the pandemic, which history will never be able to erase.

Sales have increased in five of the previous twenty years, not including 2020, from May to June.

So there’s a 75% chance that we’d see a decline last month and that’s exaclty what happened.

However, that decline was 17.0% and this is significant.

It’s the 3rd highest decline in the time period shown above, and what’s more interesting is that as much as the market died out in the late-spring of 2022, the decline in 2022 was only 11.1%.

This statistic surprised me too.

The market didn’t feel slow last month, and I guess 7,481 sales aren’t slow. But statistically, this shows a bit of weakness.

Then of course, there’s new listings:

How fascinating!

New listings have declined from May-to-June every year since 2002, minus the pandemic year, that is.

And yet, for the very first time since 2002, new listings increased this past month as we went from 15,194 to 15,865.

I don’t know that we can draw any exceptional conclusions from this one stat, but it certainly jumps off the page, no?

Any time you see something that you haven’t seen before, it has to possess at least some significance.

Put that together – sales down 17.0% on a month-over-month basis and new listings up by 4.4%, and it means that active listings increase as well. That’s more inventory carried over, and it pushes us more toward a balanced market.

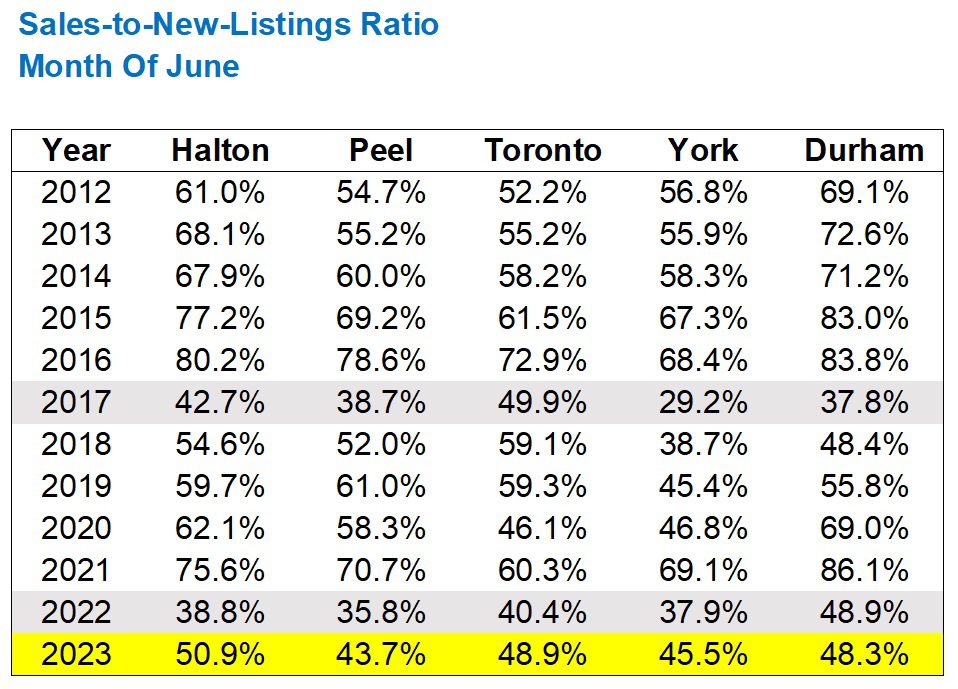

Speaking of which, check this out:

The SNLR in all five major TRREB districts declined from April to May and then May to June.

Now, this usually happens. But not always and not with this type of synchronicity.

It’s not abnormal to see a peak SNLR in April and a decline thereafter, but it’s worth noting that anything less than 50% signals, in theory, a buyer’s market.

Is it possible that we’ve gone from a red-hot seller’s market, through a balanced market, and into a buyer’s one?

I don’t think we’re there quite yet!

But the playing field has been leveled, and we’re heading into two months that often see far fewer new listings and less interest from the buyer pool.

To add some perspective, let’s look at how the SNLR has moved from January through June:

Again, pretty typical.

But let’s look at the SNLR in the five major TRREB districts in the month of June dating back to 2012:

2017 and 2022 were two periods of market decline and the SNLR was down into the 30-40% range, or even worse if you look at that paltry 29.2% in York Region which I believe is the lowest I have ever seen.

So while the 2023 data still shows an SNLR hovering around 50%, it pales in comparison to some of the previous years; even those “nothing special” years like 2012, 2013, or 2014.

What does all this mean?

In my opinion, I think we’re heading into a level playing field ahead.

I don’t expect the summer to give us any sexy headlines, but rather it’s par for the course, steady as she goes, and simply expecting the expected…

Mike

at 10:34 am

I can’t tell if you’re joking or not re watching cable tv movies and enduring commercials like we are stuck twenty years ago.

Ace Goodheart

at 12:52 pm

Best movie to watch on an old tube – TV (and if you can watch it using a VCR with a pop-in cassette, even better): Air America (Mel Gibson at his finest, before cancel culture took him out).

Hardest country in the world to visit: Hands down it is Eritrea (and I managed to get into North Korea when I was in my 20s, so I know how to get into difficult to enter countries). Have never managed Eritrea. If your Dad can do it, kudos to him!

Jenn

at 10:25 am

No kidding the market is slow. Just look at the TRB readers all on vacation!! 😜