Fed’s Beige Book shows recent moderation in mortgage rates propped up demand for homes

Housing Wire

MARCH 6, 2024

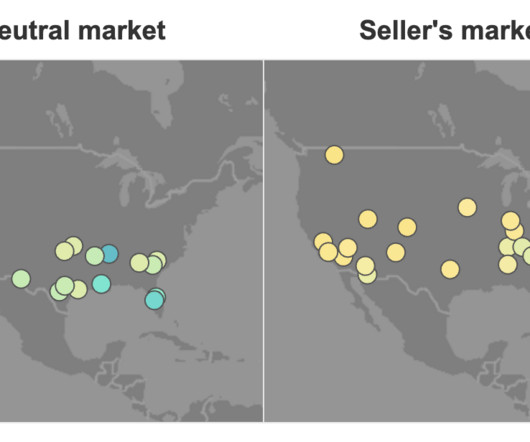

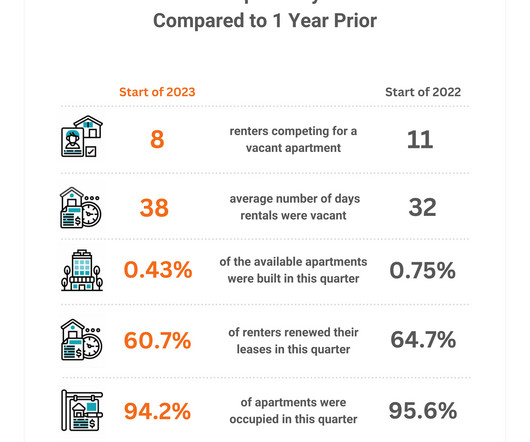

Moderation in mortgage rates led to a pickup in demand for residential real estate, but limited inventories across the country hindered actual home sales , the Federal Reserve reported in its Beige Book survey of regional business contacts that was published Wednesday.

Let's personalize your content