Days on market grow despite low inventory for existing homes

Housing Wire

NOVEMBER 18, 2022

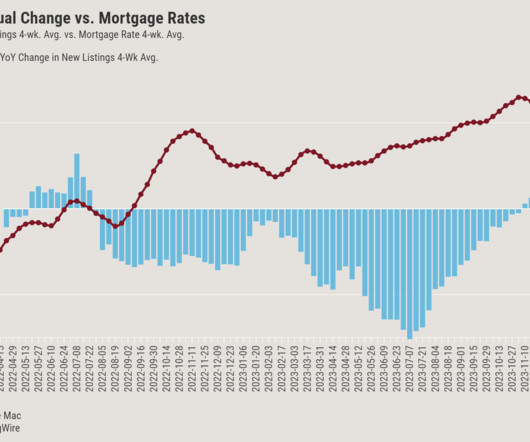

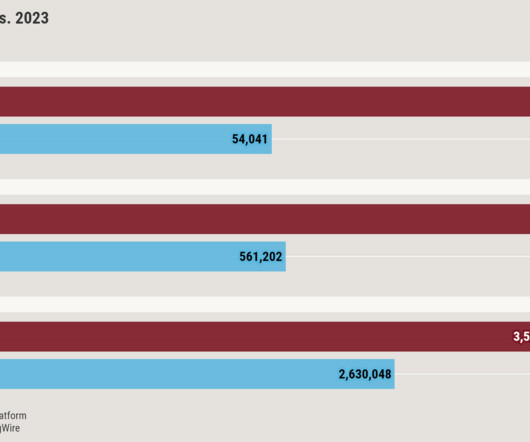

As mortgage rates rose more and more, the October to January data was going to show big negative prints. Price growth has been cooling off more noticeably, similar to other periods when mortgage rates rose. It was a funky time with housing data last year; people needed to make COVID-19 comp adjustments. million in October. months to 3.3

Let's personalize your content