First-time homebuyers made up a record share of agency purchase loans in 2023

Housing Wire

MARCH 3, 2024

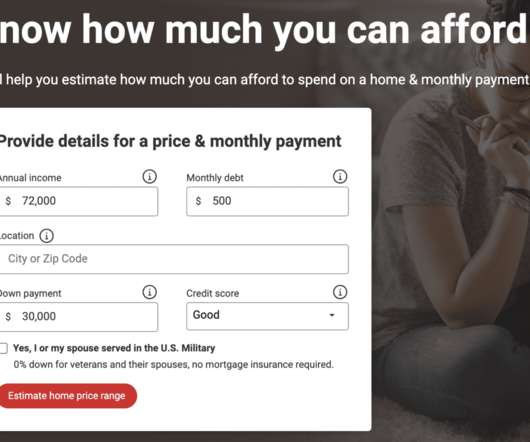

The market in which these folks purchased their first home was one of record house prices, ballooning down payments , rising rates and elevated debt-to-income ratios (DTIs). Non-bank servicers did a better job, retaining a little over one in four refinancing borrowers, while bank lenders retained only one in 10.

Let's personalize your content