NewRez now offers Freddie Mac’s revamped downpayment assistance program

Housing Wire

MAY 8, 2023

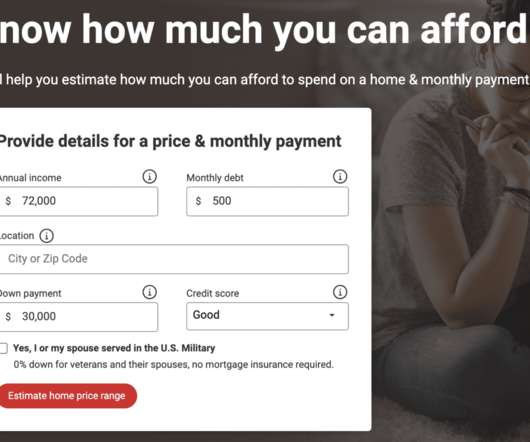

The program offers $3,000 or more in closing cost assistance if borrowers in select metropolitan areas meet a minimum 3% downpayment, complete a one-on-one homeownership counseling, and earn less than or equal to 140% of the area median income (AMI). The credit goes up to $2,500 if a borrower makes 50% or less of AMI.

Let's personalize your content