Anthony Phillips, Realtor at Luxury Real Estate Advisors Las Vegas, is counterpointing claims asserted by the top US legal firms to prevent detrimental changes that may impact future Veteran and FHA borrowers. Disclosure: Mr. Phillips does not speak for any of the named Defendants.

An anti-trust lawsuit is progressing through the courts and scheduled for trial in February of 2023 that could materially impact how real estate agents receive compensation.

It appears that plaintiff and plaintiffs counsel’s goal is to force buyers to pay buyer agents directly (out of pocket) versus the buyer absorbing fees into a mortgage.

Claims assert that the seller is harmed when a selling agent shares their commission with a buyer’s agent. This is not an adversarial transaction, all parties have the same goal, and the seller has committed to paying a fee to achieve their NET PROCEEDS goals. Seller agents partnering with buyer’s agents benefit the seller in achieving their net proceeds goal.

Per the VA: “Fees or commissions charged by a real estate agent or broker in connection with a VA loan may not be charged to or paid by the veteran-purchaser.”

Suppose buyers must pay their agent directly out of pocket up front versus absorbing fees into a mortgage. This eliminates the VA Loan program and drastically increases fees for consumers seeking FHA loans, comprising ~20% of loan originations.

The impact will disproportionately harm low-income buyers.

I do not assume that the intent is to diminish the path to homeownership for millions of US citizens, including Seal Team Six; however, the collateral damage from this case could cause this event. The real estate market could crash, harming the same sellers seeking relief.

The detriment to US citizens and the broader commercial markets FAR exceeds any benefits to sellers, thus the status quo is permissible per anti-trust statutes.

Furthermore, the seller is not required to accept an offer. Net proceeds are the only metric that matters, and sellers can counter $5,000+ to offset any fees they believe are unjust. Those same sellers subsequently benefited from this invented “scheme” when they acquired a new home.

To the plaintiff’s legal team, your complaint is complete garbage.

May the following counterpoints to the anti-trust suit enlighten you:

1. Consumers bank dollars, not percentages, so claiming damages based on percentages versus aggregate fees paid is disturbingly misguided. Studies often cited by other plaintiffs include markets like Singapore and Australia. Although Singapore’s average commission percentage fee is 3%, thus lower than NAR members’ average fee of 4.94%. Studies state that the average home value in Singapore converted to USD is $1,497,034; thus, factoring in a 3% commission, the average selling fee in Singapore is $44,911.

2. Continuing the narrative that consumers bank dollars, not percentages, let us explore Australia, the plaintiff’s selected market, to corroborate excess fee assertions. The average home value in Missouri, where the case was brought, is $227,286. Consumers in Australia pay an average home price, converted to USD, of $735,104. Assuming Missouri sellers pay 4.94% in fees, this would total $11,227 while a 2% transaction in Australia would total $14,702.

Arguments factoring plaintiff’s selected market fail. I can provide a list of a dozen international markets which are even more detrimental to excess fee allegations.

Your cherry-picking of markets and muddying the waters is impressive.

3. Your “experts,” economists Natalya Delcoure and Norm Miller compared international real estate commissions with those in the United States. They concluded: “Globally, we see much lower residential commission rates in most of the other highly industrialized nations, including the United Kingdom (UK), Hong Kong, Ireland, Singapore, Australia, and New Zealand… In the UK, the [total] commission rates average less than 2%… In New Zealand and South Africa, [total] commissions rates average 3.14%. Singapore’s [total] commission rates also tend to run around 3%.” Moreover, In comparison, the total broker commissions (i.e., the aggregate commission paid to the seller broker and buyer broker) in the areas in which the subject MLSs operate average between 5% and 6%, with buyer broker commissions by themselves holding steady in a range between 2.5% and 3%.

I lack a Ph.D. in Economics, however I have a dictionary. In mathematics, a percentage is a number or ratio that represents a fraction of one hundred.

Aggregate fee means the sum of all fees payable under an agreement during the contract term. Fractions and aggregate fees are entirely different metrics, despite your feeble attempt to conflate.

a. If a home sells for $200,000 at 4.94%, the aggregate commission paid is $9,880.

b. If a home sells for $400,000 at 4.94%, the aggregate commission paid is $19,760.

If I asked you about gas prices, you would not reply with “3% of the cost of a barrel of oil.”

Moreover, the case cites the study: See Natalya Delcoure & Norm G. Miller, International Residential Real Estate Brokerage Fees and Implications for the US Brokerage Industry, Int’l Real Estate Review (2002)

2002? Are studies from 1937 unavailable?

4. Regarding markets that attempt to corroborate that Realtors charge supra-competitive fees, there was no need to use Australia, 8,734 miles away, when there are domestic and northern hemisphere comparables. Canada has a similar fee structure to US and iBuyers (whose goal was to reduce the role of or eliminate agents), have all reduced their fee structures to compete with the MLS.

5. The average fee charged by a NAR member is 4.94% (historically reduced from 7%) and OpenDoor recently disclosed that they are under federal investigation regarding claims of superiority over traditional Realtors and fees imposed. OpenDoor now claims, “Pay just 5% in fees.”

Moreover, they now disclose; “Beginning on September 30, 2020, for new offers, OpenDoor’s service charge will be no more than 5%. Service charge is subject to change and has historically been as high as 14%.”

Offerpad reduced fees from 7.5% to 5%:

6. If anything, the MLS aids in placing downward pressure on fees.

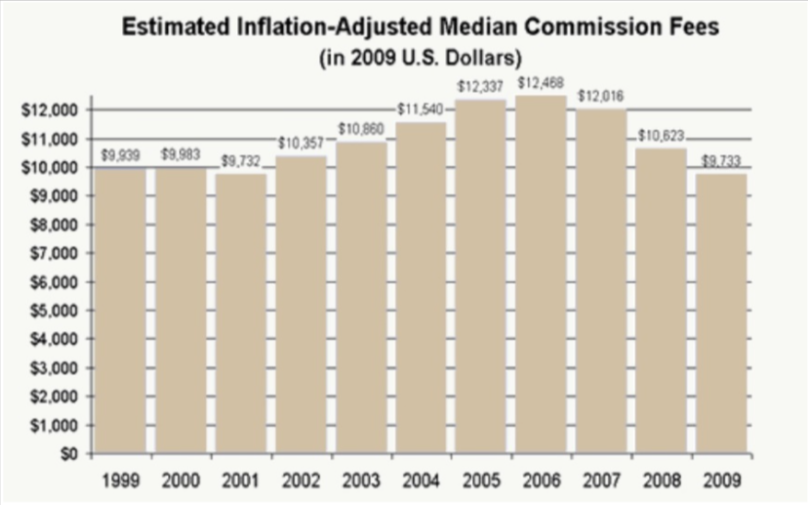

7. Further, the complaint mentions the DOJ complaint, yet the DOJ claims that buyers pay the commission as it is “baked” into the price. It would be nice if opposing parties would elect a final position on this matter. Additionally, the DOJ published this report showing aggregate fees fluctuate based on market conditions, and commission fees diminished further in 2010 and again in 2011.

8. Regarding claims that sellers are paying excess fees to Realtors and that Realtors are overcompensated because technological advances should reduce fees comparing industries, including “Book Stores.” I am ignorant of the metrics related to operating a bookstore; however, IBM Watson’s legal solutions state they can reduce Attorney expenses by up to 80%.

Should I assume you have reduced your firm’s fees by 80%, factoring in “technological and social changes?”

9. The onslaught of Wall Street-backed PropTech startups who claimed their technological advantages would create profitable companies while reducing fees to consumers have failed.

The PropTech iBuyer market has seen better days:

10. Also, if a PropTech startup fails to profit despite millions in investment proceeds and operating in an appreciating housing market, then THEY ARE UTTERLY UNQUALIFIED TO CLAIM REALTORS AS OVERPAID. BECOME PROFITABLE BASED ON A REDUCED FEE MODEL, AND WE CAN HAVE A CONVERSATION.

11. The complaint claims, “Most Buyer brokers will not show homes to their clients where the Seller is offering a lower adversary/Buyer commission, or they will give priority to showing homes with higher adversary/Buyer commission offers first,” while simultaneously asserting that “Many home Buyers no longer search for prospective homes with the assistance of a broker, but rather independently through online services.”

These assertions conflict – if a buyer finds a home they want to tour online, how can an “Agent not show homes to their clients where the Seller is offering a lower adversary/Buyer commission, or they will give priority to showing homes with higher adversary/Buyer commission offers first?”

12. Moreover, the ability for many home buyers to search for prospective homes through online services is a direct benefit of the MLS system.

The MLS system syndicates listings to portals like Zillow, which do not filter properties based on commissions. Average monthly portal visits exceed 559M, yet there are only 331M US citizens. Listings are not concealed, nor is there massive steering. If a buyer asks an agent to view a home, and they refuse, the client will find another agent. The steering argument fails.

Anti-Trust Claims:

The MLS (and its commission framework) is the preeminent marketing tool to market seller listings, discovery tools for buyers, and simplify a path to homeownership for millions.

The benefit of the current structure far outweighs any detriment.

Moreover, per the FTC, “The Sherman Act outlaws ‘every contract, combination, or conspiracy in restraint of trade’ and any ‘monopolization, attempted monopolization, or conspiracy or combination to monopolize.’”

Long ago, the Supreme Court decided that the Sherman Act does not prohibit every restraint of trade, only those that are unreasonable.

Fees to join the MLS are often less than $500/year, so the restraint of trade claims fails. Ask Jack Ryan from Rex Homes if failing to display properties on the MLS is favorable.

To evaluate if “the participants could have achieved or could achieve similar efficiencies by practical, significantly less restrictive means,” let us explore https://www.forsalebyowner.com/search/list/89135.

When searching for homes for sale in zip code 89135, the top and featured property depicts a home in 89123:

FSBO claims 618 homes for sale by Owner in 89135, yet many of those listings have been sold:

Should every real estate portal get to select which listings to display and if so, how does this benefit consumers?

THIS would result in “steering.”

In an absurd claim that the MLS obstructs innovation, so-called innovators join the MLS to benefit from its capabilities while deploying their proprietary features.

Redfin, which uses advanced technology and offers rebates that diminish commissions paid, received 73.1M visitors in May.

Independent brokerage firms which do not enjoy massive, free website traffic would need to pay $1.36 per visitor/click on Google Ads to achieve the exact visitor count. Their MONTHLY marketing budget would require $99,461,000 in spending.

Despite Redfin’s significant advantages of sales, referral, mortgage, title, and rental service revenue streams, Redfin disclosed:

“We may not have sufficient cash flow to make the payments required by our convertible senior notes, and a failure to make payments when due may result in the entire principal amount of the convertible senior notes becoming due prior to the notes’ maturity, which may result in our bankruptcy.”

Overall competitive affect:

Per DOJ, “If the relevant agreement is reasonably necessary to achieve cognizable efficiencies, in most cases, the Agencies’ enforcement decisions depend on their analysis of the overall effect of the relevant agreement over the short term. The Agencies also will consider the effects of cognizable efficiencies with no short-term, direct effect on prices in the relevant market. Delayed benefits from the efficiencies (due to delay in the achievement of, or the realization of consumer benefits from, the efficiencies) will be given less weight because they are less proximate and more difficult to predict. assess the likelihood and magnitude of cognizable efficiencies and anti-competitive harms to determine the agreement’s overall actual or likely effect on competition in the relevant market.”

The US is headed into a recession “in the short term,” and eliminating a path to homeownership for ~20% of buyers will immediately have a negative “direct effect on prices in the relevant market.”

In my view, every consideration listed favors the MLS system.

In summary, this is not an adversarial transaction, all parties have the same goal, and in my view, these unjust claims could be detrimental to millions of US citizens.

The burden of proof requires a preponderance of evidence and considering three class action firms have claimed the seller was harmed, and three have claimed the buyer was harmed, which the DOJ agreed with. Therefore, the overwhelming evidence that a consensus can’t be made thus fails the preponderance of evidence rule.

Based on the arguments outlined, in my view, this case lacks merit and should be voluntarily dismissed.

Anthony Phillips is the Co-Founder and President of Luxury Real Estate Advisors and non-profit, Luxury Cares. Luxury Real Estate Advisors is the preeminent provider of sales, leasing, property management, home and investor services to the Las Vegas luxury real estate segment.