I figured that I would start today with an analogy, as I often do, but I can’t decide on which one to use.

Is this the classic case of trying to sell a $20-bill for $25?

Or is this the case of forcing bar patrons to line up outside a nightclub when the club inside is one-quarter full?

I’m not entirely sure.

Maybe you can come up with a better analogy for me?

What does it mean when the real estate market is slow, prices have declined, pre-construction sales and prices are even more sluggish, and yet some pre-construction condominium developers in the midtown area are currently charging up to $2,000 per square foot?

Like I said: this is just begging for a solid analogy.

After all, magic beans stay magic forever, otherwise, they wouldn’t be magic.

(duh)

$2,000 per square foot.

Just….wow.

And all this, despite the fact that condo assignments are non-existent and that many pre-construction condo buyers are unable to obtain financing to proceed with final closing, plus, some buyers are looking to get out of their deals by walking away from deposits.

Yup. But it doesn’t stop many condo developers from living in denial and pushing the “buy now before it’s too late” narrative.

Denial is an essential part of any pump-and-dump.

It’s like the last scene in Boiler Room where Vin Diesel tells Giovanni Ribisi, “That’s right, shut the f*ck up, that’s all you had to do. Didn’t you learn anything?”

Or maybe these developers know something I don’t.

Maybe they’re the multi-million-dollar developers who sell and build condos for a living and I’m just a cynical blog-writer?

Yeah, well, not even Seth Davis and Chris Varick from J.T. Marlin could sell condos for $2,000/sqft in pre-construction right now. They’d have a better chance of selling shares of Farrowtech…

(Ben Affleck’s greatest performance ever, btw…)

I received some marketing for a pre-construction condo this week and I was shocked at the package.

The pricing, the floor plans, the bullshit claims like occupancy dates and maintenance fees – the whole package was, well, exactly what I have come to expect from pre-construction.

But even in this market? Really?

$2,000 per square foot, really?

It’s like comedian, David Cross, says about those adult magazines at the airport: “They’re obviously on the rack because people are buying them. The store isn’t just showing off its collection, right? Those magazines are there out of necessity, ie. demand.”

Likewise, I don’t think these developers would be floating these prices if they weren’t getting it.

I just have no clue who, of sound body and mind, is buying…

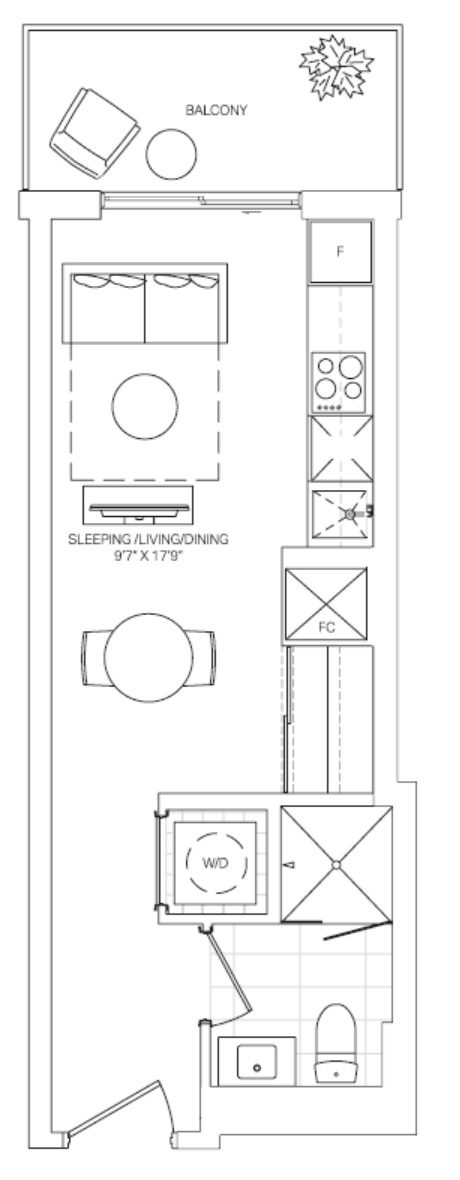

Check out this floor plan:

This sexy little angel is a whopping 302 square feet, with a window at the very back of the condo that looks like it’s about five-feet wide.

The twin bed fits nicely inside the….kitchen, albeit wedged against the west wall on one side, and without room for an end table on the other – I mean, not if you want to open your…..stove.

The price?

Only $588,900!

Or $1,950 per square foot.

This is down from $598,900, per the marketing I received, but all the asterisks (*) really make me question what else there is.

Maybe a $3,000 premium for every floor you rise in the building? Who knows!

Lockers are only $7,500, which would push the base price to $1,974/sqft.

But the pricing, folks, is only one of the things I want to talk about today.

The other is the “incentives” that the developer is currently offering.

Some of these have merit, but most of them, as you’d expect, don’t.

Let’s have a look…

–

Incentive #1: Buyer’s Choice!

80% Vendor Take Back Mortgage at 3.99% for 1 Year*

OR

$25,000 credit on closing for Studio, 1 Bedroom and 1 Bedroom + Den Suites

$35,000 credit on closing for 2 Bedroom Suites and Townhomes

$45,000 credit on closing for 3 Bedroom, 3 Bedroom + Den/Media Suites and Townhome

It feels like a game on “Price Is Right.”

Pick the first option, or, pick one of the three options for the second option. If you get confused by the options or the wording, good.

What is a vendor take-back mortgage?

Well, in a resale transaction, it’s when the seller agrees to provide you with a private mortgage, ie. they would “take back” some of the debt that you’d otherwise secure to pay them.

In this case, it could actually be a mortgage or it could be semantics and clever word-play.

Note that there’s an asterisk (*)

The asterisk, in fine print at the bottom, reads: Subject to the terms and conditions as referenced in the related Amendment to the Agreement of Purchase and Sale.

I don’t have this APS, but I’m going to make some stipulations here.

The “one year” could mean either, a) the first year of occupancy, or b) the first year of actual ownership.

If this is “one year” from the date of occupancy, then it’s meaningless. The buyer pays a phantom mortgage or occupancy fee to the developer anyways, at a rate set in advance, so this 3.99% offer could merely represent a discount on a higher rate.

If this is “one year” from the actual closing, which can take place eight, twelve, or twenty-four months after occupancy, then we’re on to something here. Assuming rates are higher than 3.99% at that time, of course, which could be in four years.

Then again, the buyer might have to qualify for a mortgage with a major bank in order to qualify for the vendor take back, as is the case with other developments.

That asterisk (*) could have all kinds of fun footnotes!

As for the credits, this is really just taking from Peter to pay Paul.

A $25,000 credit on a $600,000 condo is only worthwhile if that condo was priced at $600,000 before the credit was offered.

It’s like when I bought jewelry for my first girlfriend, circa 2002. This gold necklace was only $200, which was 50% off! I bought it on the spot. But only after walking through the mall and seeing every other jeweler did I realize that ALL jewelry was advertised at 50% off.

And is the “credit” cash back, or is it lopping that amount off the top at closing? There’s a big difference, since a $25,000, $35,000, or $35,000 cash-back offer, assuming the buyer obtains a mortgage for 5%, is about 3-5% lower than what you’d pay on an unsecured line of credit, and thus it’s a deal.

–

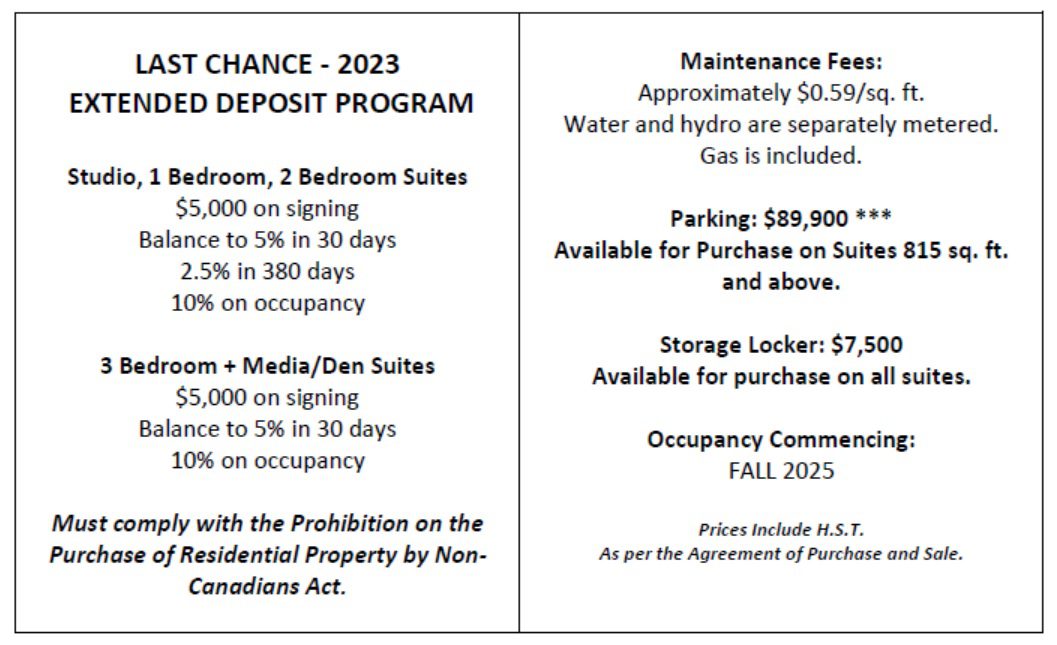

Incentive #2: Extended Deposit Program

Studio, 1 Bedroom, 2 Bedroom:

-$5,000 on signing

-Balance to 5% in 30 days

-2.5% in 380 days

-10% on occupancy3 Bedroom:

-$5,000 on signing

-Balance to 5% in 30 days

-10% on occupancy

This “incentive” only holds value if we had a copy of the deposit structure from last month, six months ago, last year, etc.

Every car dealership has the “December to Remember” promo, followed by the “Jump into January sale, leading to the “Fabulous February” clear-out, when all the while, the prices are the same.

For the smaller units, the developer wants 17.5% down.

For the larger units, the developer wants 15% down.

It sounds like less than the 20% which is typical, but you never know.

I will say, however, that “only” paying 5% in the first 379 days is not common, so this is, in fact, an incentive.

–

Incentive #3: Assignments

FREE ASSIGNMENT****

All capital letters?

Go on.

Four exclamation marks?

I’m listening.

*****Restrictions may apply. Please speak to a Sales Representative for details.

Ah ha.

I mean, define “free” anyways?

But even if the assignment is 100% free, which it should be, since no sane person should buy a pre-construction condo without a free assignment…

…(editor’s note: I do not advise the purchase of ANY pre-construction condo, ever, ever-ever-ever, and never have, and never will, but I digress….)

Anyways…more ellipses…

The funny thing about assignments, er, not so funny thing – if you’re stuck with one now, is that if you can’t list them on MLS, then you’re going to have a hell of a time getting rid of them.

–

Incentive #4: How About That Occupancy?

RIGHT TO LEASE DURING OCCUPANCY

I find this funny yet it angers me.

The right to lease during occupancy.

It’s like if you made a poor decision and even poorer investment, and while buying the complete unknown, you were forced to pay a phantom mortgage for a property you “occupy” but don’t “own,” and instead of bleeding $3,500 per month, the developer says, “Okay, alright, I guess we’ll LET you lease this empty unit out…”

And you’re supposed to be……grateful?

For those who aren’t experts in all things pre-construction, consider that there is a period of time between occupancy and final closing, called “the occupancy period,” where the buyer pays an occupancy fee to the developer, based on the financing cost of the remaining principal, expected maintenance fees, expected utilities, and expected property taxes. This is a substantial amount – it’s basically what the carrying cost of the condo would be when the buyer closes the purchase and registers a mortgage with the bank.

So imagine a developer not allowing a buyer to lease out the condo during this period?

It could cause financial ruin!

There are some condos in Toronto that have taken two years to register!

A larger condo with a $5,000/month occupancy fee would result in a $120,000 loss for that pre-construction buyer.

Years and years ago, leasing during occupancy was forbidden.

And insane.

Today, I don’t see any pre-construction projects with an outright ban on leasing during occupancy, but there are always asterisks and caveats.

I remember one such example where my client wasn’t allowed to rent his unit – for less than a certain, er, um, fixed amount.

It was criminal. That is, if it could be proved. And I wrote about it here:

July 23rd, 2018: “Price-Fixing In The Toronto Rental Market?”

–

Incentive #5: More Discounts!

1 YEAR FREE MAINTENANCE **

$10,000 OFF THE PURCHASE PRICE ***

Studio, 1 Bedroom and 1 Bedroom + Den Suites$20,000 OFF THE PURCHASE PRICE ***

2 Bedroom Suites and Townhomes$30,000 OFF THE PURCHASE PRICE***

3 Bedroom, 3 Bedroom + Den/Media Suites and Townhome

Again, I see a lot of asterisks there!

What does the double-asterisk next to the “maintenance fees” mean?

An amount equal to the aggregate amount of the Purchaser’s common expense fees for the Residential Unit for 1 year (as set out in the first year Budget Statement) will be credited on the statement of adjustments on the Title Transfer Date.

So the buyer is paying the fees every month but is credited upon final closing.

“Net” free, I would call it. This doesn’t change the buyer’s monthly cash flow position.

As for the triple-asterisks, we talked about these at the start. The prices have already been reduced with a slash through the old price on all the marketing material, but we’re not shown the “old” marketing material at the “old” prices.

–

The brochures for the project are littered with the words “LAST CHANCE.”

It’s on every page.

The PDF is actually called “Last Chance 2023.”

If fomo is alive and well in the Toronto real estate market, then these folks are hoping to capitalize on it.

But I don’t know that it’s going to work.

I’m just too cynical, and the more I look through these pages, the more I see that I don’t like.

Have a look at this:

What do you see in here that’s complete nonsense?

I mean, we’ve already discussed most of this, so what else is there?

How about those maintenance fees of $0.59/sqft?

Sure, if this was 2005.

But any buyer has to know that if the builder sets the maintenance fees at $0.59/sqft in occupancy, those fees will be up substantially after the first year of this condominium’s operations.

There’s just no way to run a building on that amount anymore in 2023.

At this juncture, perhaps what’s worth exploring are the incentives do I not see in this package that I have seen elsewhere.

Notably:

Capped development charges.

In case you’re not aware, it’s very common for developers to attempt to pass on their absurd costs from the City of Toronto directly to the buyer. A smart buyer has a real estate lawyer go over their Agreement of Purchase & Sale during the government-mandated “ten-day cooling off period,” which exists for reasons exactly like this situation. But some buyers don’t cap their levies, and some buyers end up having to pay tens or even hundreds of thousands of dollars upon closing. It doesn’t happen as much as it used to, but I recall some horror stories back in the early 2010’s, some of which were detailed in the media.

An outright incentive to cap development levies is great, but no buyer out there should be proceeding without a cap on levies included in their APS.

Other developments are offering this as the first incentive, like this one:

–

As I said at the onset, I have never sold pre-construction condos for oh-so-many reasons, and I never will.

But for those who have bought or sold, and for those who are wondering what the temperature is like for these projects right now, I’d have to think the lengthy “incentives” tell you that it’s a buyer’s market.

Don’t even get me started on assignments because that’s a sad can of worms that need not be opened today…

Izzy Bedibida

at 10:38 am

I would much rather deal with the sleezy-slimy sales man at a domestic car dealership

Ace Goodheart

at 2:10 pm

Is it just me or are Toronto bachelor condos starting more and more to resemble private jail cells at US minimum security prisons?

Sleeping in the kitchen? What is next? Just get rid of the kitchen wall entirely and have a bathroom/bedroom/living/dining/kitchen combination room?

Sirgruper

at 11:40 pm

Have you seen the newest clause in builder agreements? Should construction costs rise by more than a set formula, then the purchase price is adjusted upwards to a maximum of 3% on the total purchase price.

At one point new builds made some sense but certainly no longer. I think that market is getting ugly and fast.

Nobody

at 10:06 am

Took a look at Q showroom. Going in behind Waterclub at York and Queens Quay, replacing what is now a multi floor above ground parking garage.

They’re pitching delivery in 2030. So actually 2031 or 32. So buy a unit for your 10 year old to have a place to live in university…

Nothing makes any sense.

Seeing how much product in good projects by great builders is available in buildings that are delivering right now things are very bad. Plus there’s those deliveries that are failing as buyers can’t get mortgages.

Talked to a bunch of developers who stopped buying properties in March 22. The best firms are on the sidelines and more questionable ones are launching projects. I expect more failures like Vandyk. Going to be a bloodbath.

sam

at 2:20 pm

Thanks David for sharing your perspective. What are your thought on pre-construction single family homes, do you recommend those over resale?

Izzy Bedibida

at 2:38 pm

I think its the same type of chicanery.

Nobody

at 5:28 pm

Single family developments typically are much shorter timelines. So less opportunity for dodgy things happening.

We have been seeing a bunch of “interesting” fires of entire developments in the GTA. Which ain’t great.

Most risk is going with a smaller builder who might be more likely to have a “tragic accident”. Not as likely with Tridel, etc.