No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

Home sales will likely bottom out this year, but the likelihood of a 2024 rebound could hinge on whether mortgage rates come down next year and by how much, according to diverging forecasts from economists at Fannie Mae and the Mortgage Bankers Association.

Home sales are likely to remain subdued next year regardless of whether rising interest rates tip the economy into a mild recession or Fed policymakers manage to pull off a soft landing, economists at Fannie Mae forecasted on Wednesday.

While Fannie Mae economists do expect a mild recession in the first half of 2024, the larger risk to housing is that inflation picks up again, forcing the Federal Reserve to resume interest rate hikes.

TAKE INMAN’S INAUGURAL SURVEY ON AGENT COMMISSIONS

“It is easy to run your forecast ship aground by underestimating the American consumer,” Fannie Mae Chief Economist Doug Duncan said in a statement. “Despite reduced saving, increased rollover credit card balances, and rising credit costs, consumers are sustaining consumption, supported by a decline in inflation.”

Home sales projected to bottom this year

Source: Fannie Mae housing forecast, August 2023

Fannie Mae economists say they now expect home sales to dip 14 percent this year to 4.9 million, with a projected 7 percent increase in sales of new homes not enough to offset the expected 16 percent decline in sales of existing homes.

Home sales are expected to stay in the same range next year, with sales of existing homes projected to rise by less than 1 percent to 4.24 million and sales of new homes remaining flat at 687,000.

“Regardless of whether a soft landing is achieved over the coming year, we expect existing home sales to stay subdued and within a tight range,” Fannie Mae forecasters said in commentary accompanying their latest forecast. “If a recession is avoided, then ongoing limited supply of homes for sale on the market combined with continued affordability constraints and the ongoing ‘lock-in’ effect, whereby existing owners do not want to give up their current low mortgage rates, is expected to lead to a low pace of sales.”

In a forecast released Monday, economists at the Mortgage Bankers Association said they expect sales of existing homes will rebound by 7 percent next year to 4.6 million homes.

Source: Fannie Mae and Mortgage Bankers Association forecasts

MBA economists are sticking to previous predictions that mortgage rates will fall dramatically next year from an average of 6.8 percent during the third quarter of 2023 to 5 percent during Q4 2024.

Like their counterparts at Fannie Mae, MBA economists think the Fed is done raising short-term interest rates. And while MBA economists expect the Fed to keep the federal funds rate at the current target range of 5.25 percent to 5.50 percent until at least Q2 2024, they think mortgage rates will start coming down gradually this year as the economy slows and rate volatility settles.

MBA economists say they’re also assuming that the unusually wide spread between mortgage rates and Treasurys narrows, which would bring mortgage rates down faster than yields on government bonds.

At 3 percentage points, the primary mortgage spread is a full percentage point above historical norms but could narrow as rates come down because investors in mortgage-backed securities will have less to fear from prepayment risk.

But in the eyes of Fannie Mae forecasters, the economy’s surprising strength in the face of Federal Reserve rate hikes doesn’t bode well for mortgage rates to ease much next year, raising the odds that the Fed will implement a “higher for longer” rate-hike strategy.

“Our base case forecast is a mild recession, and it looks as though the alternative is a soft landing, which is slow growth with only a small increase in unemployment,” Duncan said. “The difference between those two alternative outcomes is not expected to make much difference to home sales. The risk to housing activity is that inflation has bottomed out and begins to reaccelerate, requiring additional tightening from the Fed.”

While Fannie Mae forecasters do see mortgage rates coming down next year, they no longer envision that rates on 30-year fixed-rate mortgages will dip below 6 percent, on average, during the final three months of the year.

Source: Fannie Mae housing forecast, August 2023

While scarce inventories of existing homes for sale helped spur new home sales this year, Fannie Mae projects homebuilders will continue to scale back construction of both single-family and multifamily housing.

Single-family home starts are expected to fall 9 percent this year to 912,000 and remain essentially flat at that level next year. After growing by 15 percent last year, multifamily housing starts are expected to slide by 9 percent this year and another 20 percent next year.

“Since October, a mortgage rate of around 7 percent seems to be a psychological barrier where many buyers begin to retrench,” Fannie Mae economists said. “As such, the short-term outlook for single-family home construction likely depends on whether a 7 percent plus mortgage rate is sustained.”

While Fannie Mae’s baseline forecast is for “a modest pullback in construction due to a slowing economy,” a soft landing might have a similar effect, “if accompanied by higher for longer mortgage rates leading to slower housing construction and sales. In fact, somewhat softer housing construction and sales may be needed to make a soft landing possible.”

In a separate report Wednesday, the Mortgage Bankers Association said demand for purchase loans dropped to the lowest level since 1995 last week, as mortgage rates hit new post-pandemic highs on inflation worries.

Source: Fannie Mae housing forecast, August 2023

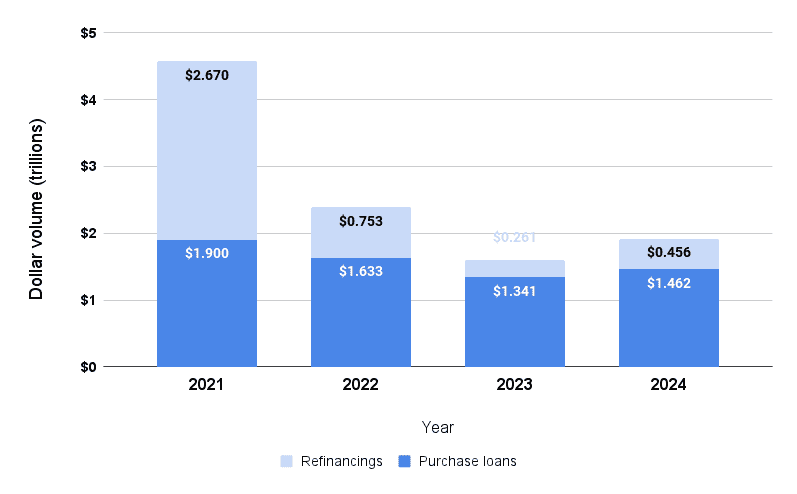

With higher interest rates denting both home sales and mortgage refinancing, Fannie Mae economists expect purchase mortgage originations to drop 18 percent this year to $1.341 trillion, and refinancing volume to be down 65 percent from a year ago to $261 billion.

But high mortgage rates and inventory shortages are also providing support for home prices, so Fannie Mae economists expect purchase mortgage originations to rebound by 9 percent next year, to $1.462 trillion. With mortgage rates expected to decline modestly, Fannie Mae forecasts refinancing volume will grow by 75 percent next year, to $456 billion.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.