With Home Values Surging, Is it Still Affordable to Buy Right Now?

Keeping Current Matters

DECEMBER 2, 2020

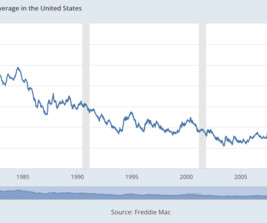

Note: During the housing crash from 2009 to 2015, distressed properties (foreclosures and short sales) dominated the market. The number one factor impacting today’s homebuying affordability is record-low mortgage rates. However, mortgage rates have fallen dramatically. Why are homes still affordable today?

Let's personalize your content