Are you reading your very first blog post here on Toronto Realty Blog? Or are you a ten-year veteran?

Those who know me – at least, through TRB, are fully aware of my thoughts on pre-construction condos, the pre-construction condo industry, and the way that pre-construction condos are sold and eventually built.

But for those that aren’t aware, let me say this:

Through twenty years in this business, I have never sold a pre-construction condo.

Not one.

No, I’ve never been lured in by the 6% commissions, the opportunity to “win” a Mercedes if I hit a certain sales threshold, or the chance at being a VVVIP agent with this developer or that developer.

Instead, I’ve been writing about the perils of pre-construction condos since I started this blog back in 2007.

Time flies when you’re having fun, right?

And when I look back at some of the videos that I shot years ago, I simply can’t believe it!

2011 was a long time ago, but it doesn’t seem like it was before this thing called the “tripod” was invented, let alone a wireless microphone, and yet I was still able to produce the following masterpiece, comparing pre-construction condos and resale condos to cake-mix and cake:

A blog reader coincidentally reached out this week and said:

I’ve been a blog follower since 2014 and I’m very glad to say that you’ve still managed to keep things new and fresh for the past decade. Your “Buying Pre-Construction Condos and CAKE!” video was actually my go-to procrastination video in undergrad. Just seeing a box of Duncan Hines cake mix still brings back memories of late night essay writing. But, I digress.

Well, colour me flattered!

But the point is the same today as it was back then: pre-construction condo pricing makes absolutely zero sense.

In fact, since I filmed this video, pre-construction condo prices rose above that of resale! For many of you reading this, you can’t even remember a time when pre-construction condos were cheaper than resale condos, and you’d simply have to watch the 13-year-old video above to understand today’s pre-construction market.

As I detailed in the video, once upon a time, with resale condos selling for $475/sqft, pre-construction developers would have to price at $350/sqft to attract buyers.

That made sense, right?

After all, with the risk involved in pre-construction condominium purchases – cancellations, delays, deficiencies, material changes, material defects, etc., a buyer should expect to receive a discount. And once upon a time, buyers did.

When I was starting out in 2003, that’s how pre-construction condos were priced. Resale condos cost more. It made sense.

Then somewhere around 2010 or 2011, essentially when I filmed the above video, pre-construction prices drew even with resale prices, and eventually surpassed them.

It boggled my mind.

I wrote about this on my blog constantly, and yet people still lined up for the magic beans.

Eventually, I tried to make my point through an analogy of buying a simple item like jeans and whether a consumer would act in the same manner…

That’s from 2015.

And yes, those are all my shirts…

But I still couldn’t understand why 99% of the buyer pool for pre-construction units (to be fair, I’m excluding the 1% who are actual “experts” in trading pre-con, because these people exist) continued to buy, and eventually pay more – much more, for pre-construction units that would take 4-5 years to build or could be outright cancelled.

Of course, we’ve only ever really seen a market that’s gone up.

We always wondered: what would happen if the market stayed flat or went down?

And as the gap between pre-construction and resale began to widen, it became even more incredulous to me.

Imagine paying $1,600/sqft for a condo in pre-construction when comparable resale across the street was $1,100? So this “investor” was banking on the market increasing 45% just to draw even?

Interestingly enough, my colleague at Bosley Real Estate, Anya Ettinger, was recently on the panel at Post City’s Real Estate Round Table. She asked renowned condo developer, Brad Lamb, about the spread between resale condominiums and pre-construction condominiums. Here’s the video:

View this post on Instagram

And for those who don’t want to click the link, here’s the question and the response:

Anya Ettinger: “One thing I’ve really struggled with, with pre-construction, is how to justify the, I think you said, the $400 gap with what you need to sell it for, versus the current resale price that it’s trading at. So, how is it that you, with your target demographic or target buyers are able to justify that? And where are you kind of seeing people being able to forego buying something cheaper today than buying something more expensive that they’ll get in six years?

Brad Lamb: “Well, it’s unjustifiable. You can’t justify it, and that’s why they’re not selling. As I said, 13,000 condos sold last year spread out over hundreds of projects, and nobody achieved even close to the numbers to start building. They’re all offering, ya know, discounts on parking, rent guarantees, Rolls Royces in buildings to drive you around to your appointments. It’s not jusifiable. What is justifiable, and we’ve seen this for the last eight or nine, there used to be a smaller gap when prices were lower, what is justifiable is about $200.”

It’s easy to justify a $200 gap when you’re coming down from a $400, $500, or $600 gap.

That’s called “anchoring” and we discussed this in Monday’s blog.

But there shouldn’t be a gap, in my opinion. And I don’t understand people who pay 2024 prices in 2019.

Speaking of which, let me get to the real point of today’s blog post.

Over the last two days, nine people have forwarded me this article

“Pre-Construction Condo Buyers Forced To Off-Load Units For As Much As $150,000 Less Than They Paid”

The Toronto Star

March 26th, 2024

From the article:

A growing number of pre-construction condo buyers in the GTA are struggling to close deals as appraisals fall short — leading to a sell-off that’s seeing unit prices up to $150,000 lower than the original purchase price.

Industry insiders say the sell-off could put entire buildings at risk of seeing unit valuations drop, which would lead to a loss in equity for all buyers in new buildings and could eventually cause a delay of units coming to market.

Define “value.”

I mean, a property is worth what somebody is willing to pay for it, right?

Except that when it comes to pre-construction condos, I don’t think anybody ever truly “valued” properties at what they paid at the time of purchase.

That’s the crazy part in all of this!

Think back to 2019. Consider buying a pre-construction project in King West for $1,600/sqft. Now think: are there any condos in the neighbourhood where prices are that high?

It made no sense.

And only now, since many of these projects are coming to completion, are we seeing how royally F’d people are.

There are two reasons why people can’t close on these:

1) They can’t obtain financing. Either because the appraisal is below what they paid in 2019, and they can’t make up the difference, or because the bank won’t loan them money because they never would have qualified in 2019, and certainly wouldn’t qualify today (this is also a topic for another day – pre-construction units are sold without any mortgage qualifications).

2) They don’t have the money to close. Either because they never expected to close (ie. they thought they would sell the unit as an assignment and make lots of money), or because they simply don’t have the funds.

The Toronto Star article says that some people are trying to sell $150,000 below what they originally paid.

Is there any truth to that?

I get a lot of emails from brokers trying to flog pre-construction assignments, so let me show you a few of those now…

Here’s one that’s asking $855,900 for a 708 square foot unit, but know little else about it, ie. what floor, what exposure, etc.

This is priced at $1,209 per square foot, which isn’t awful, but which certainly isn’t a “deal” when compared to resale units in the area.

But this is being sold $130,000 lower than the original price.

That means the buyer paid $1,392/sqft for this unit in pre-construction.

I don’t see any units out there selling for this price today, do you?

But what was somebody thinking paying this 4-5 years ago?

–

Here’s a beauty:

This is insane.

This is $1,270/sqft as an assignment.

However, this is $152,000 lower than the original purchase price – which was a whopping $760,390 for a one-bedroom.

That’s an absurd $1,587 per square foot, quite possibly purchased in 2018 or 2019.

–

Here’s one in North York:

This is a modest $1,014 per square foot, but remember – these aren’t downtown prices!

Factor in the $126,000 discount from the purchase price, and somebody paid almost $1,200 per square foot for a condo at Allen Road & Sheppard.

Not only that, this is described as a “2+1 bedroom” but I barely see two bedrooms in that floor plan above.

–

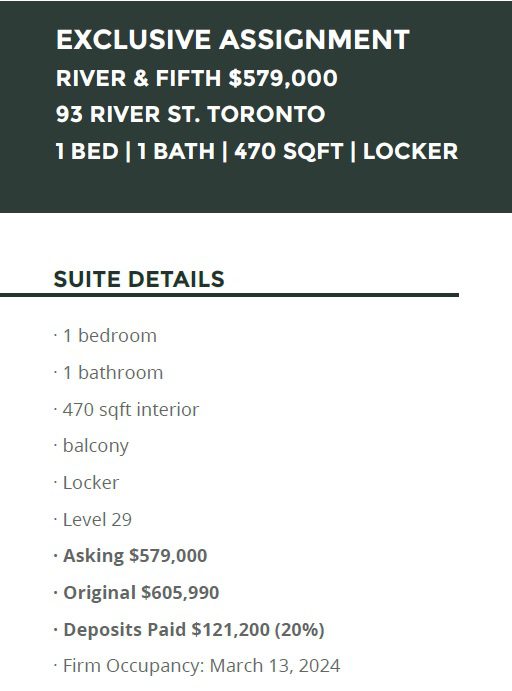

Here’s one that I can believe, since I remember being shocked at this building selling out:

“River & Fifth”

River & Gerrard.

A gentrifying area, but back in 2018-2019, were people really paying $1,300 per square foot in pre-construction?

This is a 470 square foot unit, originally selling for $605,990, where the assignor is willing to eat $26,000.

No kidding.

The assignor has $121,200 in outstanding deposits. Why not eat $26,000 to get back about $95K, and not have to sink any more money into the investment?

–

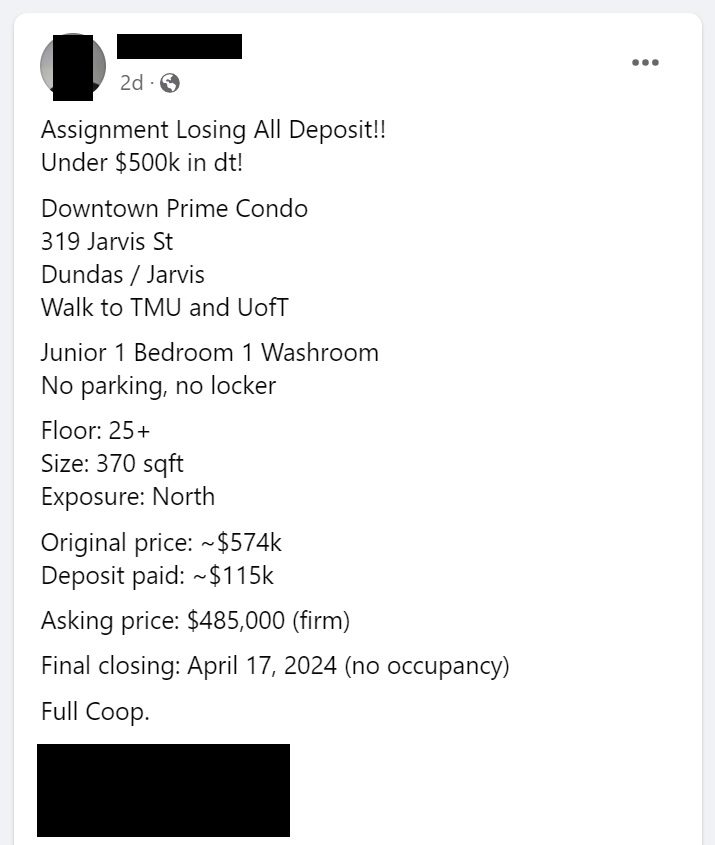

Lastly, if you want to find under-water assignments, just head over to Facebook.

It took me less than five minutes to find this one:

Starting with “Assignment Losing All Deposit” isn’t a bad idea.

But what was a bad idea?

Paying $574,000 for a 370 square foot condo four or five years ago.

That’s $1,551 per square foot.

–

The pre-construction agents, er, sorry, the VIP pre-con agents throughout Toronto might find fault with today’s post, but I would love to hear an argument in favour of paying $1,551 per square foot for a studio condo in 2018, if there is one…

And if you want to ask, “David, how can you be bullish on the real estate market but be so ready to point out people selling at a loss?” just consider that I have never sold pre-construction before and I have long maintained that it’s a bad idea.

Resale condos and pre-construction condos are not the same thing. They’re entirely different investments. They’re entirely different asset classes!

Now, do I have sympathy for the person who is losing his entire deposit in the Facebook ad above?

No.

I don’t.

Pre-construction “investing” is mad speculation. It’s gambling.

Play long enough, and it’s quite possible that you’ll lose everything you came to the table with…

Marina

at 8:41 am

Reader since 2009. Found your blog when we were looking for our house. I still remember your stories about some condo you had bought pre-con on the west side, that was delivered in a deplorable state.

The whole thing with pre-con became pure FOMO. When everyone you know, and their grandma, seems to be making money hand over fist, it’s tempting to jump in, for whatever you can afford. And given how little financial education there is in school these days, it’s small wonder people get caught up.

One of our friends is a semi-professional condo buyer, but she doesn’t flip the properties, just holds and rents. She has seven (might be 8 now). I don’t for a moment think I can replicate her success by just buying crap at random and crossing my fingers. But I’ve seen the finances of people who did roll the dice and it’s just sad. People literally putting their life savings on the line because their neighbor’s dentist has flipped three condos and now has a boat. And now they are losing their shirt because they bought something sight unseen without running any scenarios or planning for any contingencies. It’s madness.

Sirgruper

at 9:30 am

David

Firstly I remember the cake video when it came out. Where have the years gone. The reason per-cons can make sense in a different market is that they are simple poor real estate futures contracts. People pay money for the right to buy $2,400 gold in 2025 but you can buy it now for around $2,200. The reason is inflation and speculation and to a far lesser degree you are buying something new.

Also no one talks about the issues of assignment fees, increased legal costs, HST rebate losses if done wrong, HST on deposits and income tax ramifications. I hate assignments.

The problem is the condo market is broken. You need the spread as you can’t build a condo now for replacement cost at $1,000 a ft downtown. And you need 75% pre-sales to get financing. That’s why we are in the current stalemate.

Finally, most condo deliveries today are terrible in quality. Builders want their money back so quickly that an occupancy unit is barely habitable with sometimes a hundred deficiencies that will be fixed later.

Geoff

at 7:55 am

Not quite the same thing. An option (like to buy gold in future) gives you the right but not the obligation to buy. Pre con makes it an obligation.

Adrian

at 12:22 pm

I fully agree with most of this post with one small caveat. In 2018 most pre-sale condos downtown were around $1000 psf. The gap between pre-sale and resale was lower as Brad stated. But before the market tanked in 2022, pre-cons downtown were hovering at $1,700 psf. If you think there’s distressed assignments now, wait until all those 2022 condos finish… Even if interest rates come back down I struggle with thinking that those units will be worth $1,700 psf (~$800K for a 1-bedroom) in 2026-2027.

Francesca

at 12:42 pm

Is the price per square foot as high for pre construction freehold properties too? Many suburbs are still building brand new houses so I wonder if there is any logical reason to buy pre construction at higher prices when one could buy resale and move in immediately too.

To Marina’s example of her friend who buys a lot of investment condos, we had friends who back in 2003 left Toronto to go live in Kelowna. They bought a pre construction condo townhouse there, retired from their jobs at the ripe age of 32 and literally started flipping properties and buying pre construction every 2-3 years. They would sell their current place, move into the new one once built and then buy again pre construction and start the cycle all over again. They did this successfully for about 10 years. The pre construction market must have changed in BC too cause suddenly they decided to sell and move back to Ontario and actually buy a resale house and get jobs again! I guess this way of making money could only last so long.

I don’t know how anyone is considering buying pre construction nowadays when the prices are so high compared to resale. There is a brand new building on Yonge street just a block or two north of sporting life where a ton of units are for sale now for an insane amount of money. The building is a few months old and although very luxurious and in a great area I don’t understand how anyone could have bought there to begin with and why anyone would buy to live there now.

RPG

at 1:45 pm

David, what do you think about a blog post detailing current preconstruction prices?

Vancouver Keith

at 2:28 pm

I was born in the sixties. The square footages and layouts of these pods are terrifying.

Zez

at 10:23 am

OUR HOME! REAL STATE SURE HAS NEW CHALLENGING EXPERIENCES in TODAY MARKET!

MB

at 9:27 pm

If you consider it an illiquid futures market, The market has been in steep contango and now it has to flatten but unlikely to go into backwardation given the cost structure of real estate. However, the analogy to a futures market only goes so far. Also look at the presale market as a European call option on real estate, with deposit as a premium, the longer to expiration and more volatile prices the higher the premium relative to the square footage strike price. Premiums are too high now but were good in 2017/2018, and made good money, but been out since the higher interest rates.

Bev Kennedy

at 4:39 pm

Ah. It for resale or a preused condo what of those overly shallow reserve pool funds. These structures don’t magically maintain or repair themselves any more that the purpose built social housing rental of the 1960 s or 70 s now lining up to be demolished

Regardless of the income level the building structures all degrade over time unless well maintained but this apparently falls into the magical thinking zone for planners of housing

As for cost pressure to maintain aging structures won’t the focus on building new not add rather than reduce those cost items ?

And awkward question why exactly was it NRCan green home program. Deliberately excluded mid amd high rise MoCA aka condo where owners not investors dwell?

Johnny Chase

at 12:42 pm

A bit of a disappointing read Dave… We’ve all read and seen the assignment advertisements. We’ve seen dozens of agents flaunting assignment sales with $100K to $200K off the previous sales price.

What we don’t know is if they are actually selling and if they are how much of a discount are owners are takings… and what type of buyer is buying these? Investors?

End Users? Is assignment inventory increasing, staying flat or decreasing?

Now that would be insightful.