We’ve talked a lot this year about tenancy.

I’ve written blogs from the perspective of both tenants who have a bad landlord, and landlords who have a bad tenant, and all the while, we’ve debated the protections that tenants enjoy in this province in 2023, and whether or not they’re unfair to landlords.

Both landlords and tenants can abuse the system and do.

But I feel as though in the past year, the sentiments, especially from those who comment here on TRB, have turned very much in favour of protecting landlords as we move forward.

I have a story in the queue, which I can’t discuss right now because it’s going to the LTB (probably six months…), which is going to underscore just how insane it is to let sitting tenants dictate whether or not a landlord/owner is able to sell the condo.

Now, consider how tenants can affect buyers of condos, or potential buyers, via the rights those tenants have with respect to the unit, and over their respective landlords.

Consider the following situation…

John the Tenant has been renting a condo from Peter the Landlord for almost two years.

The property is a 1-bed, 1-bath condo on Queen’s Quay for which John pays $2,160.40, after the rent was raised by the legal amount after the conclusion of the first full year.

Peter tells John, “I wanted to let you know that I am going to list the condo for sale.”

Peter then explains to John his rights, and how the process might unfold.

“I cannot evict you from this condo in order to sell it,” Peter says. “In fact, I can’t evict you unless I’m moving back into the condo for a period of twelve months or more, or somebody in my immediate family is doing so,” says Peter, outlining the process by which a tenant may be evicted in Ontario.

“But the buyer of the condo can evict you using the same method,” Peter explains. “If the buyer wants to move into the condo, he’ll provide you with an N12.”

John tells Peter that he understands, and agrees to cooperate with showings on the condo. Those showings will be with at least 24 hours’ notice, when it’s convenient for John.

The property is listed for sale and ends up selling after about three weeks. Bob the Buyer is a young man who is purchasing his first home, and is excited to move into the condo in the fall.

The sale date of the property is August 10th, and on August 11th, Peter the Landlord provides John the Tenant with an N12 stating that the buyer of the condo is moving into the unit.

Peter provides more than 60 days’ notice, from the first of the month, as is required by law.

The end of the tenancy is to be October 31st, 2023, for which legal notice was to be given by September 1st, 2023, but it’s August 11th, so John, Peter, and Bob are all well ahead.

John the Tenant responds to Peter’s email with the N12 and says, “Received.”

Peter the Landlord prepares for closing at the end of October, and Bob the Buyer obtains his mortgage approval, provides notice to leave his rental property, begins to purchase furniture for the new condo, books a moving truck, and tackles a half-dozen other tasks that are required in order to close on the purchase, and move into the condo.

A week before closing, Bob the Buyer books the moving elevator in the building and provides a security deposit. He fills out all the forms associated with the “Welcome Package” for the building, provides a post-dated cheque so the property manager can withdraw monthly maintenance fees, and even books the party room in the building two months out for his girlfriend’s birthday.

On October 28th, three days before closing, John the Tenant emails Peter the Landlord:

Hi John,

Pursuant to Page 2, Paragraph 3 of the Notice To End Tenancy Form N12, I will be exercising my right not to vacate the property as I disagree with the notice provided to me on August 11th, 2023.

Kindly advise on the date and time of my hearing with the Landlord & Tenant Board.

I will continue to pay lawful rent.

Peter.

Oh – he might add the bullshit term “without prejudice,” which has no logical meaning or impact, but which paralegals and other conniving tenants advise each other to do in Facebook groups, but I digress..

Yeah.

What a mess, eh?

But this is a situation that has happened thousands of times – probably tens of thousands of times, across the GTA.

It’s happening with increasing frequency and I’m not kidding when I talk about these Facebook groups. You would be shocked if you saw what goes on in there!

So what can Peter the Landlord do?

Nothing.

And what does Bob the Buyer do?

Ah! That’s where this gets interesting!

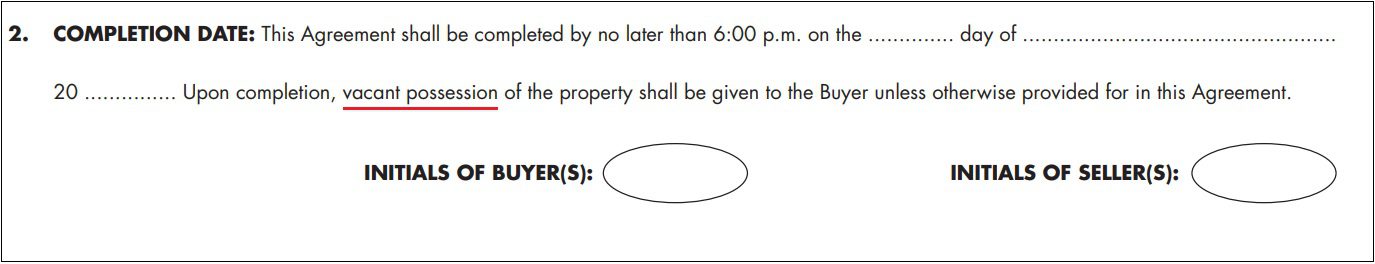

Because regardless of whether or not there is or isn’t a clause in the Agreement of Purchase & Sale to deal with a situation where a tenant doesn’t vacate before closing, there is verbiage in the boiler-plate section of the APS that spells out how possession must be delivered to the buyer:

Vacant.

The APS specifically notes that the property must be vacant.

Now, that’s all well and good, but the APS doesn’t specify what happens if the property isn’t vacant, and that’s where you get into a grey area.

I’ve been writing about this for some time now, and it looks like the mainstream media has finally picked up on it.

Shane Dingman has handled a lot of important topics over the last few years, and I’m pleased to see his name on this one:

“Reluctant Landlords: Condo Buyers Find They Are Unable To Evict Tenants”

The Globe & Mail

November 8th, 2023

The problem in this story is that unscrupulous developers/agents inserted a clause into the Agreement of Purchase & Sale that noted in the event the tenant failed to vacate, that the buyer would assume the tenant.

Shame on the buyer for not reading this, but in the story, many of them are new Canadians and have limited knowledge of real estate and/or English.

Shame on the seller/agent/developer for their pre-mediated acts which allowed them to wipe their hands of any issues before, at, or after closing with respect to the tenant.

From the article:

…the agreement of purchase and sale (APS) that he signed is not a standard document. It has language that shows the sellers understood the import of Sec. 51 and disclosed its potential application to the Parkview towns. “The buyer acknowledges and agrees to: (i) understanding section 51 (1) of the Residential Tenancies Act … and (iii) assume the tenant on closing,” the purchase agreement reads.

The same thing happened to at least two other buyers who bought townhouses on the same block at the same time and who also signed an APS without fully understanding the import of Sec. 51. Those buyers accept that they signed, but still feel misled by their real estate agent and by the seller, Muse Properties Limited Partnership.

The key here is the term “assume the tenant on closing.”

Any buyer who sees that in an APS should run. Fast!

Over the last couple of years, I’ve seen these issues ramp up significantly. As a result, my team and I are taking extra steps to ensure our buyer clients are not closing on tenanted properties, but also that they can opt out of any APS without issue. Not only that, we have a new condition in our offers that we’re working with to try and guarantee a vacant closing, which I’ll explain in a bit.

First, let me walk you through the hierarchy of clauses that go from “awful” to “great” when it comes to vacant closing.

I will bold the important parts, but read the clauses!

Don’t skim!

Here’s an old clause that’s been used for years, but which presents a problem:

The Buyer hereby authorizes and directs the Seller, and the Seller agrees, when this Agreement becomes unconditional, to give the tenant(s) the requisite notices under the existing Residential Tenancies Act (RTA), requiring vacant possession of the property effective January 31st, 2024. The Seller further agrees to provide to the Buyer copies of the requisite notices sent to, received by, and acknowledged by the tenant in this regard.

This clause was used consistently for many years, usually without issue.

But when tenants started to say, “I’m not leaving,” then buyers, sellers, and agents had to figure out the “what if.”

Because the clause above doesn’t provide any explanation of what happens if the tenant doesn’t leave.

Does the deal fall through?

Does the buyer have to take on the tenant?

There’s zero recourse here and it creates a giant grey area.

While the pre-printed or “boiler-plate” section of the APS refers to “vacant possession” as indicated above, it doesn’t provide for automatic termination of the APS, nor does it give the buyer the right to terminate the APS without penalty.

Ask any lawyer and they’ll tell you that grey areas lead to litigation.

So that clause needs to be cleaned up a bit.

Here is the clause that, as a buyer, you do not want in your APS:

The Buyer hereby authorizes and directs the Seller, and the Seller agrees, when this Agreement becomes unconditional, to give the tenant(s) the requisite notices under the existing Residential Tenancies Act (RTA), requiring vacant possession of the property effective January 31st, 2024. The Seller further agrees to provide to the Buyer copies of the requisite notices sent to, received by, and acknowledged by the tenant in this regard. The buyer and seller hereby agree in the event that the tenant fails to vacate the property prior to the completion of the transaction, the buyer agrees to assume the existing tenant upon completion of this transaction.

Notice how this is simply the clause above with one sentence added?

That bolded section is the problem.

Why the buyer would ever agree to assume a tenant, after seeking vacant possession and including a clause in the APS to provide notice for eviction, remains incomprehensible to me.

Unless this is a situation where a buyer is purchasing a multi-plex or in some one-off case where whether the tenant does or doesn’t leave makes no difference, then a buyer should never leave the vacant possession to chance.

If the buyer is in a hyper-competitive market where there are fourteen offers on a condo listing and the buyer needs to include this clause in order to “win” in multiples, then the buyer has to weigh the risks. But if I’m representing a buyer who intends to move into the condo, I would never advise accepting this clause.

Here is the clause that we are using in our offers on behalf of buyers:

The Buyer hereby authorizes and directs the Seller, and the Seller agrees, when this Agreement becomes unconditional, to give the tenant(s) the requisite notices under the existing Residential Tenancies Act (RTA), requiring vacant possession of the property effective January 31st, 2024. The Seller further agrees to provide to the Buyer copies of the requisite notices sent to, received by, and acknowledged by the tenant in this regard. In the event that the Tenant fails to vacate the property on or before January 31st, 2024, the Buyer shall have the option, in the Buyer’s sole and absolute discretion, to extend the Closing Date set herein up to five (5) business days in order to obtain vacant possession set out in this agreement, failing which, the Buyer shall have the option, in the Buyer’s sole and absolute discretion, to terminate the transaction, and the deposit shall be returned to the Buyer in full forthwith, without deduction, along with any accrued interest.

Note that there are two provisions to help our buyers:

1) The buyer has the right to move the closing date five days to attempt to secure vacant possession.

2) The buyer has the option to terminate the agreement and the deposit shall be returned in full without deduction.

Also to protect our buyer clients, we are ensuring that the closing date in our offers is at least five days after the expected vacancy date.

If the tenant is expected to vacate on January 31st, 2024, then we will NOT schedule closing of the condo For January 31st 2024, as many buyers and agents have done in the past. We need to gain access to the condo after the scheduled vacancy date in order to ensure that the condo is, in fact, vacant.

We would therefore schedule the closing date on February 5th, 2023 and schedule an inspection for February 2nd.

If the tenant has not vacated, and is indicating that they intend to stay and “await a hearing at the LTB,” then our buyer will terminate the transaction and receive their deposit back.

Here’s the rub, however:

Not every seller will agree to include this clause in the APS.

There are some sellers who will see this clause as an “out” and therefore strike the clause in any counter-offer, or simply reject the offer outright.

To each, their own, in this regard.

You might argue, “If the seller isn’t concerned at all, then he or she has no reason not to accept this clause.”

But in Ontario, with the rights that tenants enjoy, no seller/landlord is safe.

I also have to wonder how the banks would view this clause.

Let’s say that a person purchases a $1,500,000 house and, in order to obtain the financing, sells their $500,000 tenanted condominium. The bank uses the equity from the condominium to qualify the buyer for the purchase of the house. But what if hte tenant in the condo refuses to leave, the buyer of the condo walks away, and the purchaser of the house no longer obtains bridge financing to close on the purchase of the house?

Tenants’ rights avocates would probably argue:

Womp, Womp, Womp.

But sooner or later, we have to address the elephant in the room. Tenants refusing to leave when legally evicted via N12 for a buyer’s personal use are simply clogging the system and causing a lot of dominoes in the market to fall.

Now, if you want to get really agressive, include this clause:

The Buyer hereby authorizes and directs the Seller, and Seller hereby agrees, when this Agreement becomes unconditional, to give the tenant(s) the requisite notices under current residential tenancies legislation requiring vacant possession of the property for use by the Buyer or the Buyer’s immediate family, effective as of January 31st, 2024. The Seller agrees to provide the Buyer with copies of all notices immediately after service of the notices upon the tenant(s). In the event that the tenant fails to vacate the property on or before the date specified above, the Buyer shall have the option, in Buyer’s sole discretion, to extend the closing date by thirty (30) days, during which time the Seller will reimburse the Buyer for any associated financing costs in the event that the Buyer has obtained a bridge-loan. In the event that the tenant fails to vacate the property on or before the new closing date specified above, the Buyer shall have the option, in Buyer’s sole discretion, to terminate the existing Agreement. If the Buyer chooses to terminate the Agreement, the deposit will be returned to the Buyer in full forthwith, along with any accrued interest.

This clause is just like the last one, except the buyer is saying, “If you can’t get the tenant out, you’re paying my financing costs.”

Last, but not least, let me show you what my team and I have done lately.

We’ve included this condition in our offers when our buyer-clients are purchasing a tenanted property:

This Agreement is conditional for five (5) Business Days on the Seller providing to the Buyer, a copy of an Agreement to Terminate a Tenancy, Form N11, signed by the Tenant, failing which this offer shall be null and void, and the deposit returned to the Buyer in full without deduction.

Notice that this says “N11” and not “N12.”

We’re saying to the seller/landlord, “You have five days to reach an agreement with the tenant and both of you will sign the N11.”

Sending an N12 isn’t enough.

We want the tenant to put his or her name on a document and sign it!

Now, before you ask, “Can’t the tenant still refuse to leave?” the answer is YES!

But that’s why we also include this clause as noted above…

The Buyer hereby authorizes and directs the Seller, and the Seller agrees, when this Agreement becomes unconditional, to give the tenant(s) the requisite notices under the existing Residential Tenancies Act (RTA), requiring vacant possession of the property effective January 31st, 2024. The Seller further agrees to provide to the Buyer copies of the requisite notices sent to, received by, and acknowledged by the tenant in this regard. In the event that the Tenant fails to vacate the property on or before January 31st, 2024, the Buyer shall have the option, in the Buyer’s sole and absolute discretion, to extend the Closing Date set herein up to five (5) business days in order to obtain vacant possession set out in this agreement, failing which, the Buyer shall have the option, in the Buyer’s sole and absolute discretion, to terminate the transaction, and the deposit shall be returned to the Buyer in full forthwith, without deduction, along with any accrued interest.

Now, and only now, are our buyers fully protected.

Our offer is conditional on the seller/landlord meeting with and coming to an agreement with the tenant, to end the tenancy, and this is documented in an N11.

And if, for some reason, the tenant still fails to vacate, then our buyer can terminate the agreement unilaterally.

I’m sure this blog post will be very Google-friendly and some of you might be reading this in the year 2026 after having a painful experience with a tenant.

My inner Marty McFly doesn’t want to know just how bad this is going to get in the future…

Francesca Wiitasalo

at 8:15 am

I feel like this situation may become more common as rents continue to soar in the city. A tenant will risk waiting for a hearing rather than attempting to secure a more expensive lease elsewhere. If this becomes more prevalent of a phenomenon, less investors will be willing to buy to lease and this in turn will impact lease prices directly as it will create more demand and competition for the listings left, especially the quality ones. Ford needs to reverse the rule that any condo built after 2018 is exempt from the max yearly rent increase so that those buildings don’t become de facto luxury rentals only a very few can afford. The overall situation makes it very risky and stressful for a buyer buying a tenanted unit and makes you think twice about renting out a place. Once a tenant is in a home it seems like the law only protects them. In our building I’m noticing more people are choosing to rent out their units rather than sell them cause it’s faster and more lucrative to lease out right now than to sell. I wonder how happy these owners will be when suddenly they need to sell the units to take the equity to buy something else and their tenants decide not to leave. Many people are not educated enough to know there are risks becoming a landlord and just look at it like an easy short term solution.

David

at 8:36 am

No, the Provincial Government must revise the LTB and enforce the laws when tenants do not leave and stay for months if not a year awaiting a hearing. In many cases they even stop paying rent. I can tell you that many people, simple people not high end investors, would love to put some of their nest egg into the rental market as opposed to RRSP’s etc, but do not because of the horror with the LTB. This would increase supply and take it out of the control of the big investors and rents would not have pressure

Steph

at 10:05 pm

Agreed. I’m a “simple person” with a few rentals properties, and I’ve always had great tenants, but the fear of the rogue system-abuser and a lack of support from the LTB is changing my mindset. I don’t think it’s worth it. Not to mention the fact that you get taxed twice – once through income tax and again in cap gains. I don’t see the point when you add the risk.

I like having a mix of owners and renters in low-rise neighbourhoods, and I always preferred renting in houses when I was a tenant, but if this fear keeps up, we will only have large-scale institutional rental operators who can take on those risks, and the only places to rent will be towers.

Eddie

at 6:55 am

You also get taxed twice when you own stocks – you pay income tax on the dividends (both within the corporation as the profits are taxed, and as an individual when you receive the dividends), and on the cap gains when you sell the stock. It seems fair to me that investment real estate should be taxed in a similar manner.

DD

at 12:44 pm

Thank you, thank you, thank you, for your clauses.

Appraiser

at 1:22 pm

“Average rent price hits new high for sixth consecutive month: report”

“A new report says the average asking price for a rental unit in Canada reached $2,178 last month, a 9.9 per cent year-over-year increase and continuing a trend that has seen asking rents hit new highs for six months in a row.” https://www.bnnbloomberg.ca/average-rent-price-hits-new-high-for-sixth-consecutive-month-report-1.1997910

Andrew

at 4:09 pm

I still have difficulty wrapping my head around a tenant having all the power in the real estate transaction between the buyer and seller.

John

at 3:45 pm

Under the RTA tenancy runs with the Land.

Essentially it stops a Landlord from doing exactly what y’all are discussing which is to displace a tenant quickly and without recourse in order to sell the property for a hugely inflated price to someone who will then set the rent as high as possible in order to cover the inflated cost. Meanwhile the realtors are collecting big commissions while pricing the average buyer out of the market and driving rents sky high.

Get legal advice not realtor advice.

Sirgruper

at 8:55 am

The Landlord also has a few other options:

1. Pay the ransom; or

2. Get aggressive and sue the tenant (not in small claims court) for huge damages and let the tenant sweat. Only fair

Ace Goodheart

at 11:55 am

The landlord tenant system is broken and is getting more broken each day. It used to take a month to get a tribunal hearing. Now it takes over a year (and bad tenants know this, they know they can live rent free for a year, then disappear and find another landlord to do it to again).

Add to this the vacant home tax. If you cannot find a buyer for your home, and you have purchased and moved into another home, then you are forced to tenant your home pending finding a buyer. That means, you have to put a tenant in your “for sale” home, knowing that you are selling it anyway and the tenant would have to leave if the new owner wants to move in. You get a six month grace period to try to sell your home, but if you look on Housesigma right now you find many properties that have been for sale for more than six months (de listed and re listed over and over again). Those sellers are going to have to pay vacant home tax unless they put a tenant in a house that they are trying to sell.

Broken system. Simply does not work for anyone other than bad actor tenants.

Bryan

at 12:45 pm

Honestly I think you hit the nail on the head with that first sentence. Even if I am not a repeat scam artist, If I am a tenant paying less than market rent and I am trying to save for a down payment, it is absolutely worth it to defer my eviction by 12+ months. Back when the LTB date came up in 2-4 weeks it was not.

James

at 3:27 pm

Get proper legal advice. This realtor is not a legal professional and is not licensed to practice law in Ontario. This type of behaviour and the commoditization of residential rentals by realtors specifically (as they are the only ones who always benefit from real estate transactions) are driving the housing crisis.

Get real and proper legal advice rather than these shake and bake work arounds from a realtor.

Tony Sbrocchi

at 10:14 am

Terminating the APS by the buyer when the seller is in breach is the wrong advice. Never accept a mutual release from the party that breached.

Roseanne Fitzlaff

at 7:57 pm

How does a person get a tenant to leave if you want to sell? I am a senior and no longer want to deal with a tenanted property.