Am I really that predictable?

I mean, “Burning Questions” again? We did this after Labour Day, right? To start the fall market? And we did this to start off January 2021, not just as a stand-alone blog, or even a two-part series, but rather a three-part series that spanned the entire first week back!

Well, what can I say? I just like photos of burning logs.

Seriously, did you notice over Christmas that when your Smart TV boots up and shows you Netflix, Amazon, and Youtube, among others, there’s a special section for the “yule log?” Literally, a nine-hour video of a yule log burning in a fireplace. Who watches that?

I do.

And I love it. Put it on in the background, all day, all night. Just me, myself, and a burning yule log…

(sigh)

The break is over, folks!

But it was good, right? You were able to rest, relax, and recharge? I mean, with the city freaking out and shutting down again, and all of us supposed to be huddled indoors until we’re told it’s safe to go out again, I can’t imagine you all had anything but a relaxing holiday!

I did. Sort of. I think.

What was the most eventful moment of my winter break? Well, Christmas Eve, of course. It was magical! And by “magical,” I mean the human body’s magical ability to heal itself, since I just about cut off my left thumb before bed on Christmas Eve. No kidding around here, I actually was set for bed around 10pm, going to be a good husband and father and all that, going to bed early and waking up with energy. But first, I had a hankering for some cheese! I honestly don’t know how to explain how this happened but do you that feeling of reaching for a glass that you think is full, only to find it’s actually empty, and your hand jerks up in the air because the glass is lighter? It’s your mind and body not being in synch, right? On Christmas Eve, for some odd reason, my right hand pressed down on the cheese with a brand new Henkel knife, and for some odd reason, my left thumb was there too, but I still pressed the full might of my right hand down on the block of cheese…….and my thumb…

That is the most blood my body has ever produced. My poor wife, I swear, it’s Christmas Eve and she’s just gone to bed, and I’m shouting, “Ummm….hey, babe? Uh, some help?” She came downstairs to me saying, “I have to warn you, this isn’t good, and I’m really sorry…” to find this idiot of a husband standing with his arm extended and a literal pool of blood below.

She told me I had to go the hospital.

Really? On Christmas Eve? During COVID? Not a chance. Just hand me some super-glue and let me pretend it’s 1944 in Europe.

This damn thumb took two days to stop bleeding. And it was so sore, I couldn’t type until the New Year.

But the funny part was: on Christmas Day, I showed up at my Dad’s house, and my stepmom, Lynn, had a massive bandage on her left pinkie. She almost cut off her finger the night before too – chopping potatoes for the mash the next day.

Ah, the magic of Christmas!

And the magic of those mashed potatoes. I literally skipped turkey, stuffing, and whatever green vegetable there was. Just a mountain of potatoes with a hole in the centre for gravy. It was a potato volcano with gravy lava. And yes, I’m an adult. Apparently…

Let’s see, what else?

How about my wife sending me to Toys R Us at 2pm on December 24th? Yeah, it seems that Amazon didn’t deliver the police car that my daughter wanted, so I was dispatched into the wild to find a replacement. But again, the funny part about me in a toy store is that it may as well be my child in the toy store. I was sent to get one toy, but left with six. I mean, have you seen the “CAT Construction” trucks? My wife bought one for my son and I knew because I wrapped it. But that was an excavator. Here at Toys R Us, on Christmas Eve, I found the collector and OCD parts of me buying one dump truck, one bulldozer, one ready-mix truck (it’s not concrete, but rather ‘ready-mix,’ and I know this because my Dad drove these trucks in the 1960’s and has been telling me about it since birth…), one front-loader, and while they had the eighteen-wheeler flat-bed, I figured I’d save that for his birthday…

Oh, in addition to the police car that my daughter wanted, I also got her the SWAT van. We’ve been chasing this thing around the house for two weeks…

What else?

Seriously, what didn’t happen over the winter break!

Was it as eventful for you as it was for me? I feel like, with COVID upon us once again, we were indoors more, the time went slower, and we had more to experience, for better or for worse.

And now that we’re officially into 2022, now with the kids at home, now with a ridiculous 5th wave of COVID, it’s time to take Soul II Soul at their word, specifically, from their 1989 hit:

Back to life, back to reality

Back to life, back to reality

Back to life, back to reality

Back to the here and now, yeah

Man, that’s gold.

And the sentence, “How ever do you want me” appears twenty-four times in that song, as does “How ever do you need me.”

Now that’s music!

That’s also my undiagnosed A.D.D. showing, as I’ve clearly been away from blogging for far, far too long and I’m a bit rusty…

But we are, in fact, back to life, and back to reality.

What “reality” will look like in 2022, none of us really know.

And how that “reality” affects our real estate market, I also think few of us could accurately foresee.

Then again, if you had predicted what would happen to the Toronto real estate market in March of 2020, with a worldwide pandemic staring at us, I’m sure you wouldn’t have said, “I predict a 30% increase in the average home price.”

So even if our new “reality” in 2022 is closed schools, 20,000 daily COVID cases, bars/restaurants shut down again, is it going to have a negative impact on the market? Is asking this question done so in poor taste? Or is this a real estate blog, after all?

Over the break, I began formulating my thoughts for this very blog.

It’s the culmination of everything that happened in 2021 and the issues that will still linger as we turn to 2022.

At times, it can seem repetitive. It might seem like we talk about the same subjects over and over here on TRB, but it’s not for lack of alternative discussion points, but rather it’s born of necessity. And while the themes might remain the same, the analysis is ever-changing.

So let me use this as a forum for the thoughts that came to me over the break. These are questions that I asked myself a few times, as well as discussing with friends, family, and colleagues. They might not be the “most important” questions, but the ones that kept me up at night – with my bloody thumb raised above my head…

–

1) How much further can this market possibly push us?

Push us?

Yes, push us. How much further can this market go, run, increase, rise, and push, but also how much more can it push us to take on more debt, accept the rate of appreciation, and make personal and financial sacrifices to remain home-owning Torontonians?

Some people assume that because I’m a real estate broker, I automatically want to see the market go up, and nothing but.

Every time I meet somebody and they ask, “How’s the market?” I usually pause, sigh, take a breath, or do something inadvertently that speaks louder than words could. Then I might say, “It’s been busy,” or something non-committal, since I don’t love talking real estate outside of real estate. If the conversation continues, and I say, “The market is nuts,” or “Prices are out of control,” the response is always the same:

“Well that must be good for you, right?”

I really don’t like the feeling of an “out of control” market being “good” for me. As a by-product, I understand the thinking. But the raison d’être is not a market that’s spiraling into chaos.

I live and breathe real estate so often I get desensitized to what the average Torontonian thinks or feels. If I transaction one-hundred times or more in a given year, it becomes second-nature. But to a person or a family that buys/sells/moves once a decade, if that, the concepts associated with Toronto real estate are so incredibly difficult to grasp.

Last year, I heard from a woman to whom I’d rented a condo back in 2006. She had moved to the United States, found love, marriage, family, and was looking to come back to the GTA. During our initial conversation, she said, “I’m not a millionaire,” which eventually led to her describing her feelings on the association of one’s net worth with one’s affordability.

She had two major roadblocks ahead of her in the quest to buy a home: her lack of desire to take on a “large” mortgage, and her psychological barrier to a particular purchase price.

“I refuse to believe that I can’t get a great house for a million dollars,” she said.

A Million Dollars.

It sounds like a lot of money, right?

Well, what if you’re coming from, say, Nashville, Tennessee, where you can get a house for $550,000 that looks like this:

Not bad, right?

Want better?

How about living in Atlanta, Georgia, in an established, safe, historic neighbourhood, and getting a breathtaking house like this for $599K:

It’s hard to imagine, right?

Now, many of you wouldn’t want to live in Nashville or Atlanta. Many of us see Toronto as bigger, better, and, well, I won’t get into politics…

But imagine a person who doesn’t live in Toronto trying to make sense of our market.

Imagine a 2-bedroom, 1-bathroom, semi-detached house on Toronto’s east side selling mere weeks or days before Christmas for $1,200,000, amid a dozen offers from frantic bidders.

Imagine that market, and now compare it to other markets.

What’s special about Toronto?

Ask me, ask yourself, then ask a person relocating from Bakersfield, California, or Lethbridge, Alberta, or Osaka, Japan, and I think you’re going to get a variety of answers!

Why Toronto is expensive is easy to answer: supply and demand. We spent a lot of time on this in 2021 here on TRB.

But whether Toronto is “worth” these high home prices is up to the individual to decide.

My former client, relocating from the Southern USA, just couldn’t quite wrap her head around “one million dollars” for a house, which in this case, would see her moving to Oakville or Mississauga in search of a detached on a large lot for under $900K.

Her other qualm was the idea of a “half-million dollar mortgage,” which you and I might not think much of, but again, perhaps we’re all just so desensitized to this.

Once upon a time, we saw a mortgage as a large liability. “I owe that much money to the bank,” we might think.

Today, most of us, especially myself, see a mortgage as a payment plan.

If you bought a house for $900,000, with a $400,000 down payment, your monthly payments under a 5-year, fixed-rate mortgage at 2.59%, on a 30-year amortization, would be $1,596.56.

That is how I would choose to see that “half million-dollar mortgage” rather than being scared by the large number.

In this case, a person with $400,000 for a down payment should, or could, or would be looking closer to a $1,300,000 purchase price, which might make them freak out and think, “I owe nine-hundred thousand dollars to the bank,” but in reality, they’re simply paying the bank $3,591.82 per month, of which $1,679 is paying off their mortgage and $1,912 is staying with the bank in the form of interest.

This is a concept that most Torontonians have come to grasp, and yet so many people moving to Toronto from other places around the world still choose to look at the average home price and mortgage amount and get scared half to death.

If “age is just a number” then can’t the mortgage amount be as well?

Or am I just desensitized?

Are we all just desensitized?

How much longer are we going to see double-digit percent rates of yearly appreciation and think this is normal?

The December TRREB stats haven’t been released yet so we don’t yet know what the 2021 average home price in Toronto is.

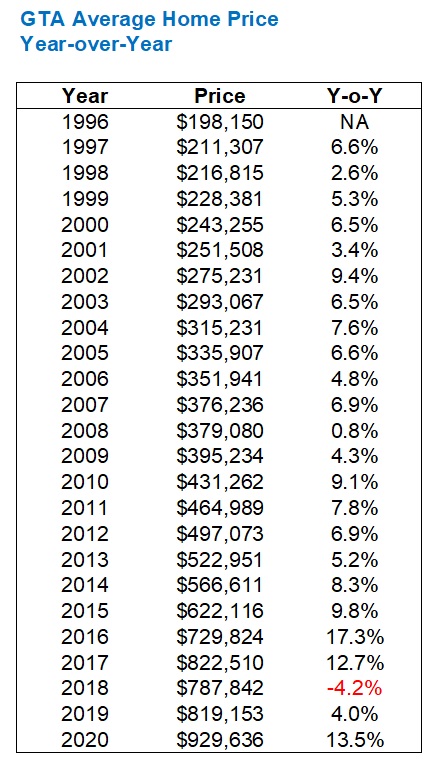

But let’s look at prices from 1996 through 2020, with 1996 being the last year that we did not see a year-over-year price increase:

Ah, yes, 2018!

The fallout from the market drop in April of 2017 had a lasting impact, and with those crazy prices in January, February, March and April of 2017, the year finished well ahead of 2018 when all was said and done.

But since then?

Oh, just a worldwide pandemic and real estate prices up 30% in 21 months…

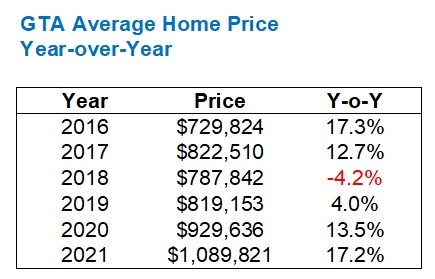

The average home price in Toronto in November of 2021 was $1,163,323.

If I were to average each month’s average, January through November, it would come out at $1,089,821.

So with that in mind, let’s just look at the last few years…

Again, many of us have grown desensitized to this.

We’re not talking about shares of Tesla here.

This isn’t Bitcoin.

This is the price of a home in our city. It’s how hard people have to work to find a place to live with their families.

It’s absolutely mind-blowing when you sit back and play the game, “How much is the market up since (insert year)”

Pick a time in your life, or a job you were working, or a trip you came back from. Recall a conversation about real estate with your boss, or your dad, or your best friend.

For those of you who are not in the market, this hurts.

For those of you who thought about getting into the market but didn’t, you’re going to feel a range of emotions. Many people feel anger, others feel resentment. Jealousy is a natural one. Disbelief is another. But don’t go down the rabbit hole of thinking that “The crash is going to be that much bigger,” instead, wrap your head around this concept called “acceptance,” and take stock of your life and where you’re headed, then figure out how the real estate market fits into your plans.

It’s crazy, folks. I have no other word.

But having said this, and you probably knew this was coming, I simply don’t see prices going down or even staying the same in 2022.

Here’s an article you might have read just after Christmas:

Read the comments on the article and you’ll see that every single one blames real estate agents, the government, and fake news for the increase in housing prices.

But can that blame extend back to 1996? Or is this just recent?

Canada-wide, the headlines remain the same:

To be fair, this media outlet isn’t making a prediction, but rather quoting one from another source: Royal LePage.

There’s an inherent bias there, of course, just as there would be if I were to tell you the market is set to rise in 2022, which I am.

But almost all the media coverage on the real estate market right now is simply quoting predictions from Royal LePage and Re/Max. And those predictions aren’t really based on anything. If they are, it’s not noted in the articles, nor did Re/Max or Royal LePage say anything of substance to back up their predictions.

So does anybody have any data to help predict the year ahead?

Oh wait, we can make numbers say anything we want.

Thus, if we’re predicting the market will decline, then we’ll look at the ratio of household debt to household income, or, the ratio of wage growth to real estate price growth.

And if we’re championing the market to go up, then we’ll simply rehash all the supply-and-demand data from 2021 that is surely not going to change.

So then, shall we now try to answer the question from the onset?

How much further can this market possibly push us?

Further, still.

Much, much further still.

Because even if the average home price in the GTA “only” rises from $1,163,323 in November of 2021 to $1,200,000 by November of 2022, it’s still exceptionally out-of-reach for a majority of Torontonians, and it’ll mark the 26th year out of the last 27 years that the average home price in Toronto has increased. Toronto residents simply can’t keep up with the market, but the market doesn’t seem to care.

If there are two virtual certainties in the 2022 Toronto real estate market, they are these:

1) Prices are going up

2) Affordability is going down

2) What will happen with interest rates?

Of course!

On the heels of “prices are going up and affordability is going down,” we have yet another gift from the Gods in our Trojan Horse of real estate joy.

Interest rates are going up in 2022, or so we’ve been told.

I honestly can’t think of another area of finance or economics where a particular piece of policy is made known a year in advance. Because by the time interest rates in Canada actually do increase, I’ll have grown more grey hair than I had to begin with.

In the fall of 2021, we started to hear the talking heads at CMHC, the Bank of Canada, and the PMO’s office begin talking about “rates increasing in late-2022.”

Blink, and we’ll be there. But first, we’ll see home prices rise.

When those announcements were first floated, I had the odd client ask, “Do you think that buyers will flock to the market this fall to buy, in anticipation of affordability being lowered in 2022?”

No. No I didn’t.

That would be giving people far, far too much credit! I don’t believe that more than a small percentage of the general public reads the newspaper (print or virtual) on a regular basis, nor do I think that even those fully-informed are going to change their 5-year-plan or 10-year-plan around a paltry 25-basis-points. Would somebody buy a home in November of 2021 instead of June of 2022 because of rumours of interest rates going up? Not a chance.

But here we are now, in early-2022, and the rise in interest rates doesn’t seem that far away.

During the Bank of Canada’s final announcement of 2021, it was noted that the Canadian economy had considerable momentum in the fourth quarter and that a 2% inflation target was projected to occur in the middle-quarters of 2022. Whether or not either of these points proves true, CREA itself recently predicted in a newsletter that there’s more than a 50% chance of the first rate-hike by March of 2022.

Some market analysts are predicting as many as five interest rate increases throughout 2022.

It’s important to remember, of course, that the overnight lending rate does not correlate directly with your typical 5-year, fixed-rate mortgage.

Here’s a chart showing the conventional 5-year rate, the discounted 5-year rate, and the overnight lending rate:

While your variable rate mortgage is directly affected by the bank rate, your fixed-rate mortgage moves according to the bond market.

So multiple increases in the bank rate will not lead to a corresponding increase in the typical five-year, fixed rate mortgage, and we’re not going to see a 3.99% mortgage rate any time soon.

Nevertheless, market enthusiasts can’t stop talking about mortgage rates!

The best article I read over the holidays was this one from Maclean’s:

“Five Charts That Will Define Canadian Real Estate And Housing In 2022”

By: Jason Markusoff

December 23rd, 2021

This is a recurring theme which the author calls “chartstravaganza,” and in each article, different economists offer up a chart that they feel speaks volumes about the topic at hand.

When it comes to the theme of housing the first economist chose to talk about, what else – interest rates.

Have a look at this chart:

The two Scotiabank economists offer the following take:

Canadian households and housing markets can weather the interest rate increases the Bank of Canada is widely expected to deliver next year. At present, fewer than half of Canadian households have mortgages or home-equity lines of credit (HELOCs). About 75 per cent of existing mortgages are locked in at fixed rates, while the much smaller stock of HELOC balances carries floating rates. Scotiabank Economics expects holders of the most popular five-year term mortgages that renew in 2022 to see their rates increase by an average of 36 basis points (bps), which translates into about $50 a month in additional payments on the current average outstanding loan balance of $241K. Renewals in 2023 are forecast to see rate increases of about 45 bps, or around $65, in additional monthly payments. While no one wants to pay more on their mortgage, Canadian borrowers are set to absorb higher rates: under federally mandated stress tests, they had to show that they could cope with rates around 180 bps higher when they contracted mortgages nearly five years ago on larger principals.

New mortgages taken out during 2021 have been stress-tested against an even tougher standard: borrowers have had to show they could handle a 5.25 per cent interest rate, about 250 bps over five-year fixed rates and some 380 bps over variable rates on offer in December 2021. Although the share of variable-rate mortgages in new originations soared in 2021, they still account for only about one-quarter of all mortgage balances outstanding. Under most variable-rate terms, rising rates don’t trigger immediate increases in monthly payments; instead, amortizations are lengthened. Where higher interest rates do mean larger current debt-servicing costs, mortgages can generally be converted into fixed-rate loans.

Canadians are ready for a return to normal interest rates.

The key takeaway for me was this: “borrowers have had to show they could handle a 5.25 per cent interest rate, about 250 bps over five-yvear fixed rates and some 380 bps over variable rates…”

So we are still qualifying buyers at up to 380 basis points beyond their ACTUAL mortgage rates.

Is it safe to say we’ve sufficiently disaster-planned?

May the lessons learned from the 2008 financial crisis please stand up?

I see you. Right there. Stress test, and all.

Okay, folks, that was a mouthful!

First blog back after the break, so as your best bud, circa 2001 used to say: let’s give’r

As unbelievable, or sad as it might be to think that I lay awake on the Christmas break, thinking about interest rates, I can tell you that during a quaint skate with some family and friends, I had a forty-minute conversation with a guy about mortgage rates.

Wait……maybe that explains why my son fell face-first on the ice.

Back here on Monday with the second part of our “Burning Questions.”

hoob

at 8:55 am

I was naughty and traveled over the holiday period. All things aside, the border crossings into the US and back into Canada, were as smooth and flawless as I’ve ever experienced. Rote review of immunization and testing records, a few polite questions, and a comment of how driving to Kansas City was long journey, but otherwise no issues.

Happy (?) 2022 everyone!

Andrew

at 9:31 am

David: many pundits are predicting up to six interest rate hikes this year. What’s your feeling?

David Fleming

at 11:51 am

@ Andrew

Two rate hikes of 25 basis points.

That’s it. Not a chance we see more.

Chris

at 2:09 pm

Seems a bit low.

“In a series of communications last month, the Bank of Canada signaled it is poised to begin raising interest rates early this year, and indicated it’s still assessing whether the omicron wave could be inflationary. The central bank has kept its key policy interest rate at a historic low of 0.25 per cent since March 2020. That rate is now seen rising to at least 1.5 per cent by the end of this year, according to money markets.”

https://www.bnnbloomberg.ca/traders-stick-with-canadian-rate-hike-bets-despite-fresh-lockdowns-1.1703055

Condodweller

at 3:21 pm

Well, based on that article someone posted in the previous post about our politicians interfering with the Bank of Canada and not allowing them to raise rates only time will tell. We know BOC wants to raise rates but the finance dept. doesn’t. Hmmm, who will win the tug of war?

Chris

at 3:27 pm

Who will win? Probably the US Federal Reserve.

https://www.bloomberg.com/news/articles/2022-01-05/fed-minutes-flag-chance-of-earlier-hikes-balance-sheet-rundown

Hard to see the Bank of Canada holding steady for long if they begin to raise rates south of the border.

Condodweller

at 5:12 pm

In the past BOC has raised rates ahead of the fed. If the finance minister wants rates to stay low here I’m sure they considered the fed going first. The fact is there is a significant disconnect between rates and actual inflation. In the article you linked they put US inflation at almost 7%. We are around 5% with rates at almost 0. The BOC has conceded rates may not be as transitory as they thought. Something will have to give.

We are going to have problems if the BOC keeps rates artificially low while inflation goes up and all of a sudden something happens that forces their hand at which point the increase might be sudden and large.

Chris

at 6:16 pm

A few big bank economists have raised that as a serious concern, urging the Bank of Canada to begin raising rates earlier, to avoid having to play catch-up with uncomfortably high inflation later and thus spurring more rapid and potentially damaging rate increases.

On a related note, I think it was Scotiabank that pointed out that, if Canadian CPI included used vehicles, as it does in the USA, we would be at about 6% year-over-year inflation.

Anyways, odds look to be pointing to both the BoC and US Fed raising rates in March.

c

at 12:49 pm

It’s nice to know economists agree with me :-). I find it funny when people rationalize interest rates by saying you can handle an extra $50 payment if rates were to go up by .25%. They should plug in an interest rate of 7-10% for kicks and see if they can handle the extra payment then on their $800k mortgage.

The BOC is using every trick in the book to not have to raise rates. Even now when they want to, they can’t. They expanded the range to 1-3% which is now exceeded (I’m pretty sure it used to be 1.5-2.5%). They play statistical games to bring CPI into the range, and even “adjust” CPI itself. It’s interesting to read about how they arrive at the CPI number. I have linked the BOC graph before..

https://www.bankofcanada.ca/rates/indicators/capacity-and-inflation-pressures/inflation/

I have been asking how high prices can go for years. It’s interesting to see perma-bulls like David start questioning it now.

Condodweller

at 12:51 pm

That last comment was mine, obviously. Autofill didn’t work this time.

Chris

at 1:35 pm

The inflation target was maintained at 2%, with a control range of 1-3% for the Bank of Canada’s 2022 mandate renewal. The only substantive change was to include some consideration around employment, however if we’re being realistic, even before this was explicitly spelled out in the mandate, it was clearly playing a role in monetary policy.

CPI isn’t calculated by the Bank of Canada, but rather by Statistics Canada.

Today’s employment reports out of both Canada and the USA should pretty well solidify rate rises within the next couple months.

The real question is, how high are they going to go, and how fast. Markets are currently pointing to 5 rises for Canada, and 4 for the USA in 2022.

Condodweller

at 4:33 pm

I’m aware statscan. Target has been 2% as far back as I can remember (which is not a short time) but the range has been updated to 1-3% along the way as well as the addition of the various other numbers CPI-trim etc.

Will find out soon enough and how much finance will let them raise. Something tells me even the pres himself doesn’t know yet.

Pragma

at 11:05 am

Your tone has very much changed over the last year or two. It has gone from endless cheerleader to … pragmatist! I am glad to see you are starting to see the societal costs of such a tremendous disconnect between house prices and fundamentals(economy, wages,…).

The argument for Toronto is that yes, it is not Nashville or Alabama, so you can’t compare the two. But can you compare Toronto to other similarly sized cities that are also agglomerates of high paying jobs? I think it would provide tremendous insight. Is Toronto in-line with other cities? Let’s look at NY, Chicago, SF, Berlin, Madrid. Or we could look at other smaller cities that tend to have even higher incomes. Seattle, Boston? My gut tells me that Toronto has disconnected from all comparable cities. But that would be great analysis if you could do it David.

In regards to interest rates: Central banks want inflation and will want to maintain negative real rates. It is the only way out of the fiscal debt situation we find ourselves in. The central bank controls the overnight rate, not the rest of the curve. For now the market is still pricing in this idea that although inflation might not be transitory, it is not something of long term concern. I think the market continues to underprice the risk of sustained inflation and I think we have shifted to a new cycle. If inflation is running at 4-5%, then central banks can still raise quite a bit from here and maintain negative real rates. And once the market realizes that inflation is more sticky than we thought, what does that do to the 5yr rate? The world moves in big cycles, the era we are moving into is not unprecedented.

Appraiser

at 12:39 pm

Au contraire mon frère.

The most fundamental of all of the fundamentals is on full display.

Supply and demand.

Average Joe

at 7:23 pm

No. Supply and demand sets a transaction price. Fundamentals are the utility, translated into a rational pricing recommendation. Supply and demand also applies to NFT pricing. You’d be the first to describe crypto markets as fundamentally sound.

So if willingness to pay was the foundational fundamental, you’d be out of work. No appraisals required.

Appraiser

at 4:24 am

Who said the real estate market was fundamentally sound?

When supply is chronically overwhelmed by demand, it is clear that fundamentally we need more housing.

Your last sentence is incoherent.

Average Joe

at 7:09 am

I agree that R1 zoning should be banned and we need more housing stock. But we can do more than one thing at a time.

First scenario. Lets say you have two bidders on a resale house. One is trying to exit the rental market, one is an investor. Both will pay at or above the acceptable price to seller. If the renter wins, there’s now two owners and one open rental. If the investor wins, there’s one owner and two renters. So one incremental unit of rental demand is generated by the investor blocking the exit of the renter.

Second scenario. Two bidders on a move up property. One has more equity than the other due to time in market (they were born first and purchased first). They can afford to keep their old place and rent it out. So now the potential investor who has more access to capital due to being alive longer wins and generates a rental unit. The non-investor would generate a property for sale at a market price – maybe this is the unit we looked at in scenario one.

There’s a popular game based on this dynamic that always ends the same way – there’s no more land to buy. So maybe we should push all those investment dollars away from monopolizing existing housing stock and into generating new units.

Toronto has laughable density compared to any other global city. Put those investment dollars into building net new housing people actually want near existing infrastructure. We need housing that is over 300 sqft and not in the middle of farmer’s fields.

Appraiser

at 11:31 am

Just a friendly reminder that the overnight rate just before the pandemic struck was 1.75% and the real estate market was scorching.

Jon

at 11:52 am

Another year and another new tax on real estate being floated:

https://financialpost.com/real-estate/mortgages/cmhc-funded-group-proposes-surtax-on-homes-over-1-million-to-address-housing-inequality

Appraiser

at 1:09 pm

The idea of the tax is not terrible (especially if you enjoy punishing the “overly affluent”) but the proposal is laughable. Setting the limit of a housing luxury tax at $1million nation wide is ludicrous. Townhouses in Brampton sell for more.

Far better to base any conceivable tax on the square footage of the house (ie. homes over 3,000 sq. ft. & condos over 1,000 sq. ft.). MPAC has all the square footage data in Ontario.

P.S. Any such luxury housing tax may well provide increased government revenue but it will most likely not solve the housing shortage. Much like doubling the land transfer tax in Toronto all those years ago solved nothing. Similar to most tax initiatives the money usually becomes part of general government revenues and is rarely targeted effectively toward the issue du jour.

Chris

at 2:11 pm

The article mentions that “such a surtax would hit nine per cent of homes across the country”. Have to imagine that percentage is going to be substantially higher in the GTA and Vancouver areas.

But this does seem a bit convoluted as a policy. I’d rather not see this tax, end land transfer taxes, and increase property taxes, as a simpler alternative.

Steve

at 11:42 am

Well the article itself concedes that it would actually be 13% for Ontario, and 21% for BC even before you zoom in on the hottest markets in those provinces. The focus on 9% across the entire country is pretty clearly to water down the reality for the hottest markets in the country, probably means it’s less than 9% in Saskatchewan – good for them!

Either way it seems likely to actually makes things worse as it adds a disincentive to owners selling in the long term and/or a cost that will be passed on in terms of the price owners will sell for. I guess that’s the rub though, the stated intent isn’t for it to actually do anything at all to help housing affordability in and of itself, it’s just a mechanism to raise cash to “do something” or as they put it “go toward other housing projects”.

Condodweller

at 12:31 pm

Let’s face it, affordability is an issue in the hottest markets i.e. GTA/GVA etc. Any luxury tax cut-off by definition needs to be above the average price for any market. Setting a luxury tax cut-off below what can buy you a house in a market is insane. IF it were to be contemplated it wouldn’t make sense to set it anywhere below two to three million.

If you want to catch joe potato farmer in PEI and make him pay a luxury tax on his $800,000 mansion you’d have to tie it to regional HPI or something like that.

This is clearly thought up by someone who can’t afford a home and doesn’t care how it affects anyone else. Including themselves once they manage to buy a home. But why would we want anyone to think more than one step ahead?

Murasaki

at 12:07 pm

“You would need a combination of factors [for Toronto’s housing market to crash], one being demographics — you would have to see immigration collapse, for example, at the same time as you would have soaring interest rates, at the same time as you would have a huge building boom that created surplus housing. It would take that sort of combination.”

— Robert Hogue, Senior Economist at RBC Economics

Appraiser

at 1:13 pm

There are still bears out there that believe it’s possible. They are just very quiet of late.

Chris

at 2:12 pm

We’re still here. Waiting to see how things shake out as the pandemic abates and interest rates normalize. Much like the stock market bears, I would imagine.

David Fleming

at 3:46 pm

@ Chris

Would you actually define yourself as a real estate bear?

As in, you think the market is going to decline?

I understand thinking the market is “overvalued,” since that has no actual effect on pricing. But surely you don’t think that prices are going to drop, say, 30% from current levels? That’s what I think of when I hear “real estate market bear.”

Chris

at 3:53 pm

That’s a really good question, David.

I’ve typically just accepted the bear label applied to me by others.

But you’re right, I more-so have a belief that a diversified equity portfolio will be a superior investment option to Toronto real estate (not considering one’s principal residence).

Do I think real estate will drop 30% from current levels? I guess it’s possible, and realistically, where does that take us back to; mid-2020 pricing?

Equally, I wouldn’t be entirely surprised to see equity values suffer a 30% decline. That happens relatively often.

But I suppose your assertion is fair, that the crux of my position is less so bearishness on real estate, as much as comparative bullishness on equity markets.

Condodweller

at 3:16 pm

Stop the press! Or is that Stop the presses?

“Under most variable-rate terms, rising rates don’t trigger immediate increases in monthly payments; instead, amortizations are lengthened. ”

Is this real? Just when I consider selling my bank shares at new record highs (thank you Santa) I see this? Are you telling me my friendly neighbourhood bank is slowly leeching an increasing amount of money from people by letting them think hey no problem, you can afford your half a million mortgage…err..payment plan (is mortgage going to become one of those politically incorrect words?), with increasing interest rates as it won’t increase your payments?

Bal

at 4:52 pm

for some reason I don’t think housing market will ever drop 30%..even if interest rates move higher.. no doubt that interest rates will impact housing market but not 30% … lots of immigrants are coming….I am from India and for Indians house is very important…we don’t believe in renting…. I met many people who recently moved from India with huge sum of money….They are selling their properties in India and bringing all the money here…so yes rising interest rates will impact housing market but immigration will be saving grace.

Kramer

at 1:07 am

I have much to say and will hopefully post more like in the good old 20teens, but I start with a question. How do we factor in the amount of money that has been poured into massive renovations turning, for example, $1M bungalows into $2.5M giants? When a city builds relatively LESS new homes, and relatively MORE wealth is ploughed in to making the existing homes more valuable, how do we account for this in our GTA price growth? Surely this has to add up and be a factor over 10 years. Kind of an “artificial” component of the growth if you will. On my small street of roughly 20 houses, at least $2M will have been ploughed into footprint-changing renos from 2018-2022, for example. Maybe it’s bot something to carve out and is just what it is. I don’t know.

Next, rates are going nowhere fast. The range in which interest rates can exist without destroying the financial system has shrunk once again thanks to this pandemic. Rates will go up… but very very slowly. If you want real insight on this listen to veteran titan global asset managers who are unbiased. The good ones are unbiased because they manage their global portfolio of assets regardless of what rates do and have no need for rates to be either low or high. They forecast reality with no motive to scare nor comfort their audience.

Lastly, as i ranted about a few months ago on an outdated blog post that probably no one saw, median income means nothing and people staying away from the market the last decade have been fooled by that metric and i feel bad for them. What does matter is the number of people in GTA who can afford homes at $X price, and how many homes there are at $X price. As we constantly increase our population, the number of people in Toronto who can afford homes at all price levels will always be increasing. If we don’t increase supply to match, prices will go up, all else equal.

Money has been printed and circulated, small scale and massive scale, globally. Covid-19 has been an asset inflationary event. The damage done is that the rich have gotten richer and the poor have gotten poorer… in the GTA of course one manifestation of this is continued increase in “unaffordability” of real estate… BUT… we avoided a depression and soup lines. The desire to continue to avoid a depression and soup lines is why rates will not go up big or fast. It will take a decade or more of things going swimmingly in the world to drastically change the interest rate picture.

I’m not making a housing market forecast, but I am not surprised at where the market is and won’t be surprised if it continues to go up.

Alex

at 10:19 am

David, you should know better than to think that 900k will get you a detach in Mississauga or Oakville. Oakville on average is more expensive than the 416.

Under 900k won’t even get you a detach in Binbrook right now.

Marty

at 10:56 am

I’m old enough to remember the original SWAT TV show (1975). Those guys basically drove around in a converted bread delivery truck.

I’m sure the new one is better.

Appraiser

at 4:37 pm

Well another head-turning jobs report for Canada. Not only did the headline number of 55,000 double economists expectations, the economy actually added a whopping 123,000 full-time positions!

” Full-time employment has trended up since June, and was 248,000 (+1.6%) higher than its pre-pandemic February 2020 level in December.”

Also from the report:

“In the 12 months ending in December 2021, nearly all provinces posted employment growth, led by Ontario (+413,000; +5.7%)…” https://www150.statcan.gc.ca/n1/daily-quotidien/220107/dq220107a-eng.htm?HPA=1

That’s right, over 400,000 new jobs added in Ontario in the past year. What affect do you think that has on housing demand in the province?