The total number of mortgaged residential properties in the U.S. with negative home equity decreased 6% in the second quarter from the prior quarter, according to CoreLogic Homeowner Equity Insights quarterly report. Conditions have improved in the Northeast, but homeowners in the West are still struggling.

Negative equity applies to borrowers who owe more on their mortgages than their homes are worth.

Overall, just 2% of homeowners with a mortgage (1.1 million homes) had negative equity as of the second quarter. On a year-over-year basis, negative equity rose by 4% to 1.1 million homes, or 1.9% of all mortgaged properties.

Since the market’s peak in the second quarter of 2022, homeowners’ equity declined by a total of $287.6 billion, a loss of 1.7% year over year.

“While U.S. home equity is now lower than its peak in the second quarter of 2022, owners are in a better position than they were six months ago, when prices bottomed out,” said Selma Hepp, chief economist for CoreLogic.

“The 5% overall increase in home prices since February means that the average U.S. homeowner has gained almost $14,000 compared with the previous quarter, a significant improvement for borrowers who bought when prices peaked in the spring of 2022.”

Hepp also pointed to factors such as down payments and natural disasters, which can also have a negative impact on home equity.

National homeowner equity

In the second quarter of 2023, the average U.S. homeowner lost approximately $8,300 in equity during the past year, the report showed.

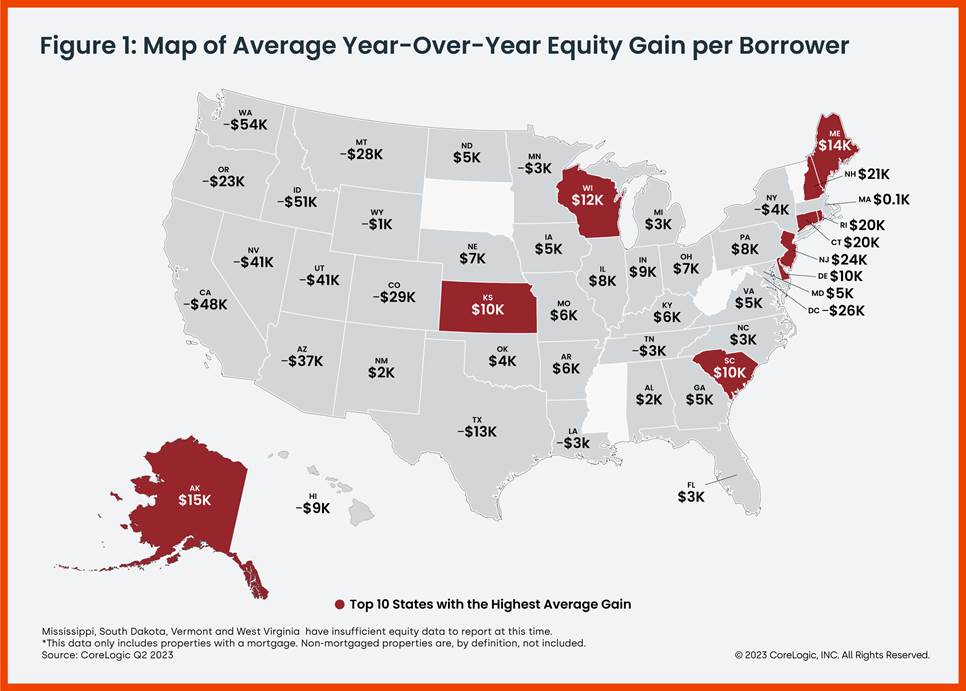

New Jersey, New Hampshire, Connecticut and Rhode Island experienced the largest year-over-year average equity gains, all at $20,000 or more. Meanwhile, 16 states and one district posted annual equity losses: Arizona, California, Colorado, Hawaii, Idaho, Louisiana, Minnesota, Montana, Nevada, New York, Oregon, Tennessee, Texas, Utah, Washington, Wyoming and Washington, D.C.

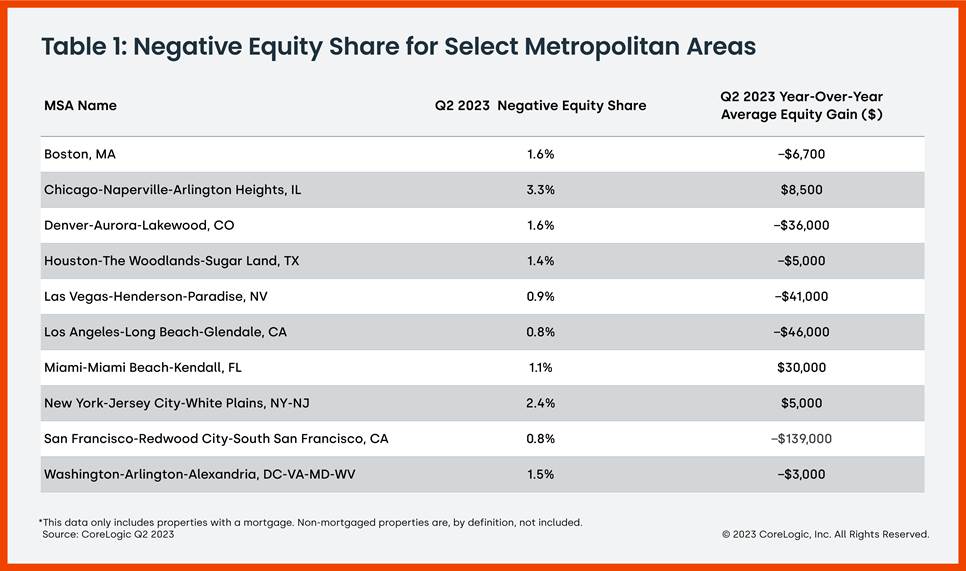

CoreLogic also provides homeowner equity data at the metropolitan level. The data provider noted that 0.8% of properties with a mortgage in the San Francisco and Los Angeles metro areas had negative equity in the second quarter. In San Francisco, the average equity loss year-over-year was $139,000. It was negative $46,000 in Los Angeles.

Quarter over quarter, U.S. homeowners with mortgages gained on average $13,900, a collective increase of $806 billion (5.2% gain) in home equity.

Borrowers in the West continued to post the largest year-over-year equity losses. However, the report found that homeowners in states like Hawaii, California and Washington “still have the most accumulated equity due to the pace of appreciation over the past decade.”