The National Association of REALTORS® has produced the Profile of Home Buyers and Sellers since 1981. The report provides an overview of who purchased and sold a home in the last year. While the report is 142 pages long, and of the many statistics included, some will appeal more than others, these findings are particularly interesting.

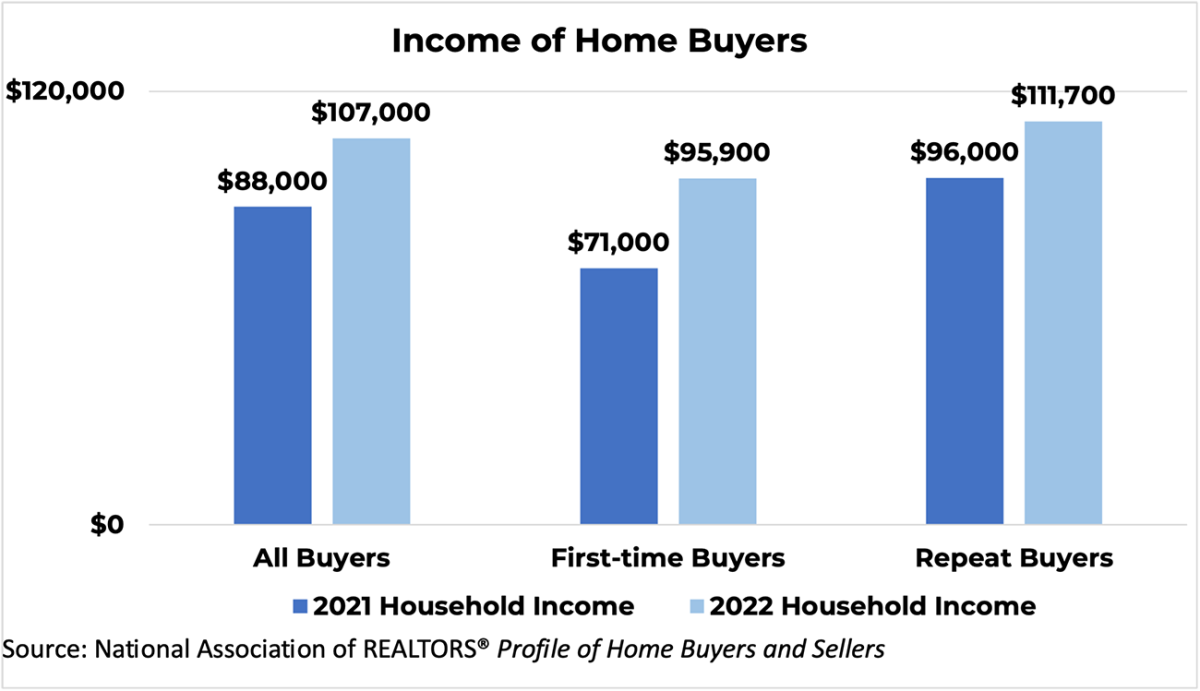

1. Household income jumped among successful home buyers

Home buyers who could purchase a home in the last year, even with the rise in home prices and interest rates, had to have higher incomes. For first-time buyers, household incomes rose nearly $25,000 from the previous year.

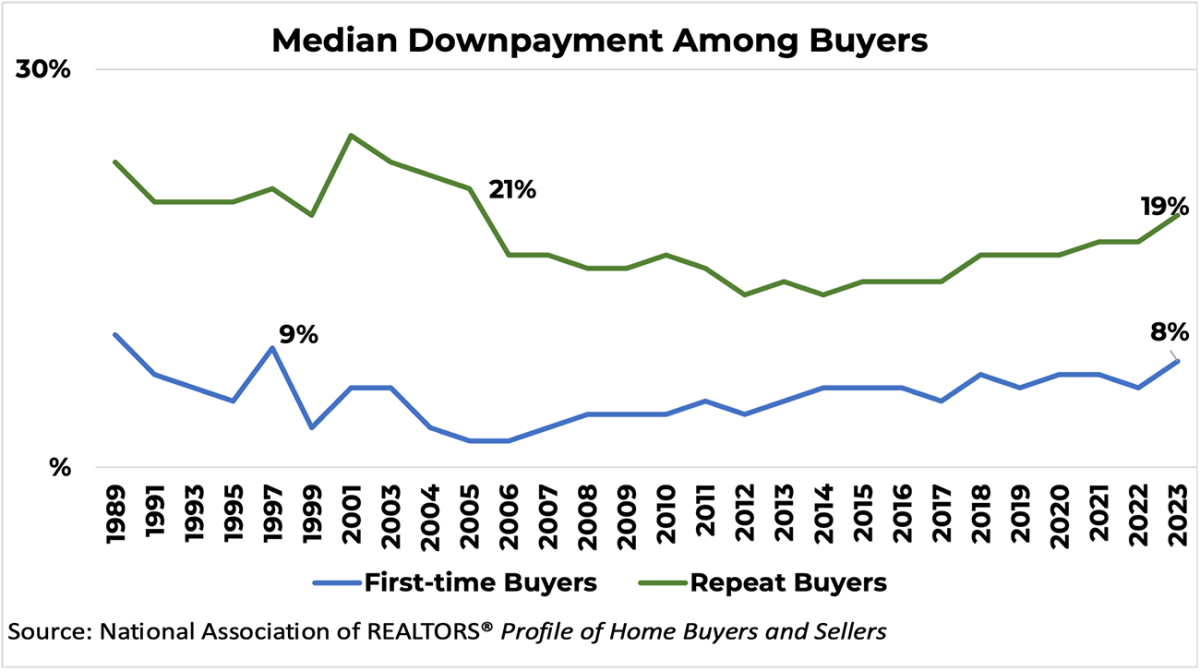

2. The downpayment for successful home buyers is the highest in two decades

Successful home buyers are wealthier and can put down higher downpayments, especially to have an offer accepted in a housing market with limited inventory and multiple offers. For repeat buyers, they have housing equity, which has grown with the rise in home prices and has allowed them to put down more money on their next property.

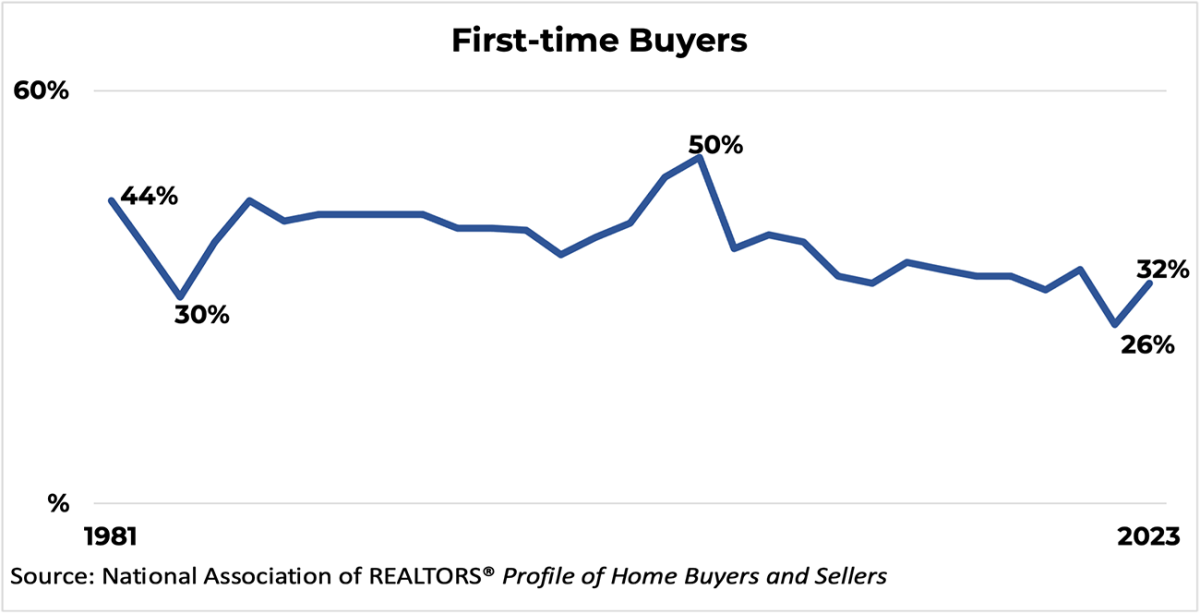

3. The number of first-time home buyers rose this year

Despite a multitude of headwinds for first-time buyers: limited inventory, erosion of housing affordability, and difficulty saving for a downpayment (with high rent, student debt, car loans, and childcare costs), the share increased. The 2022 Profile of Home Buyers and Sellers recorded the lowest share of first-time buyers since 1981 at 26%, while the historic average is 38%. The drop was likely due to all the reasons noted but also extreme competition in the market as interest rates were rising. With a slightly less competitive housing market, first-time buyers could tip-toe back.

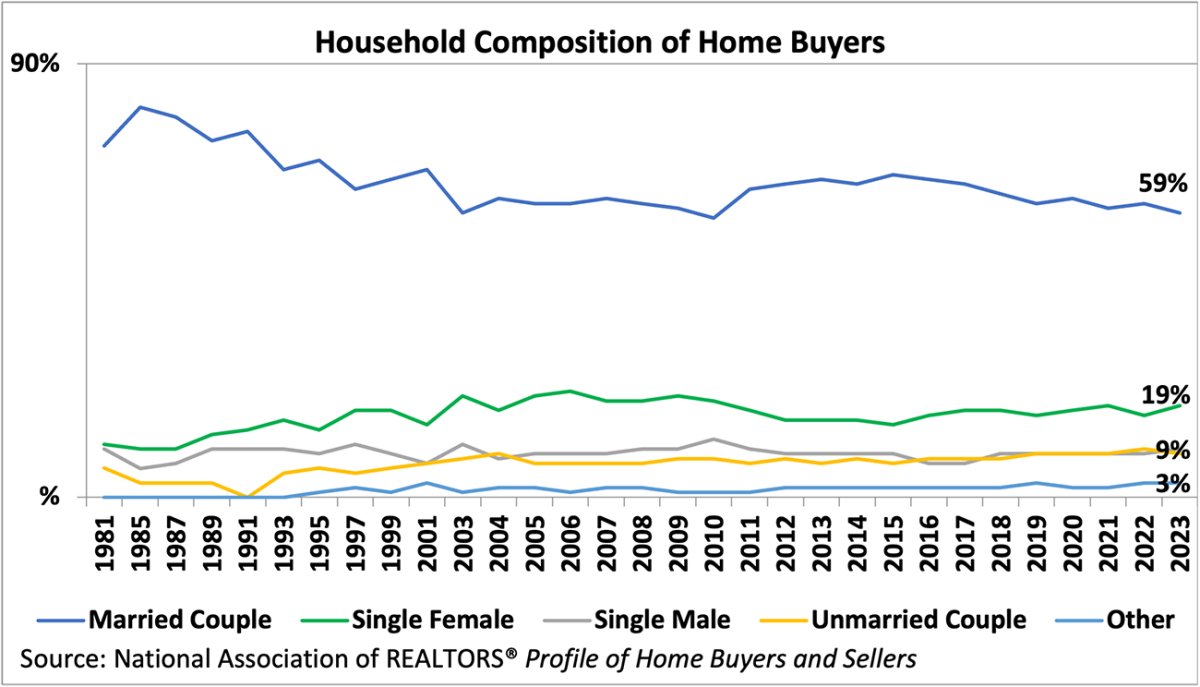

4. The share of married couples in the housing market continues to ease while singles, especially single women, rise

Overall, marriage rates have lowered from previous decades, and that demographic shift is reflected in today’s housing market. The share of singles is 29% percent of the overall market, while married couples have declined to 59% from a high of 81% in the 1980s. There are notable differences in what single buyers purchase regarding home size and neighborhood amenities.

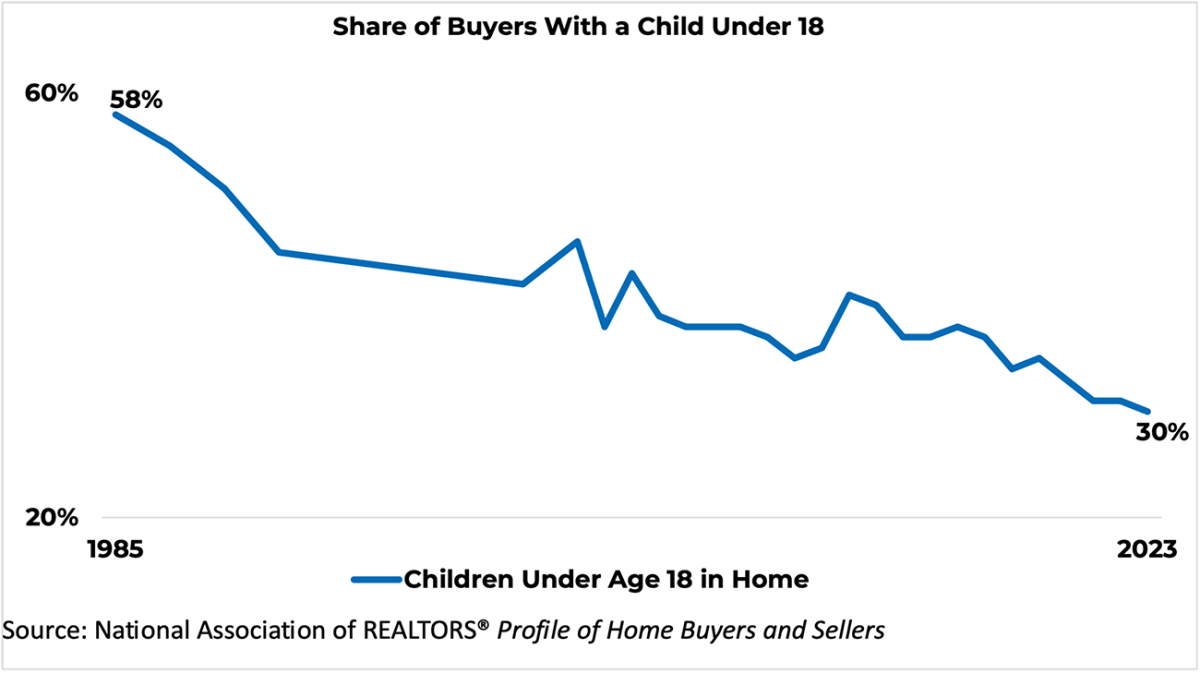

5. Another notable demographic change is the share of buyers who have children under 18 in the home

The share dropped to a historic low of 30% of buyers from a high of 58% in 1985. This shift is likely due to a higher share of older repeat buyers (58 as a median age this year), an overall drop in birth rates, and people having children later in life. This change means a difference in neighborhood amenities and could change how often a buyer moves, e.g., if they would move with a growing family or as an empty nester.

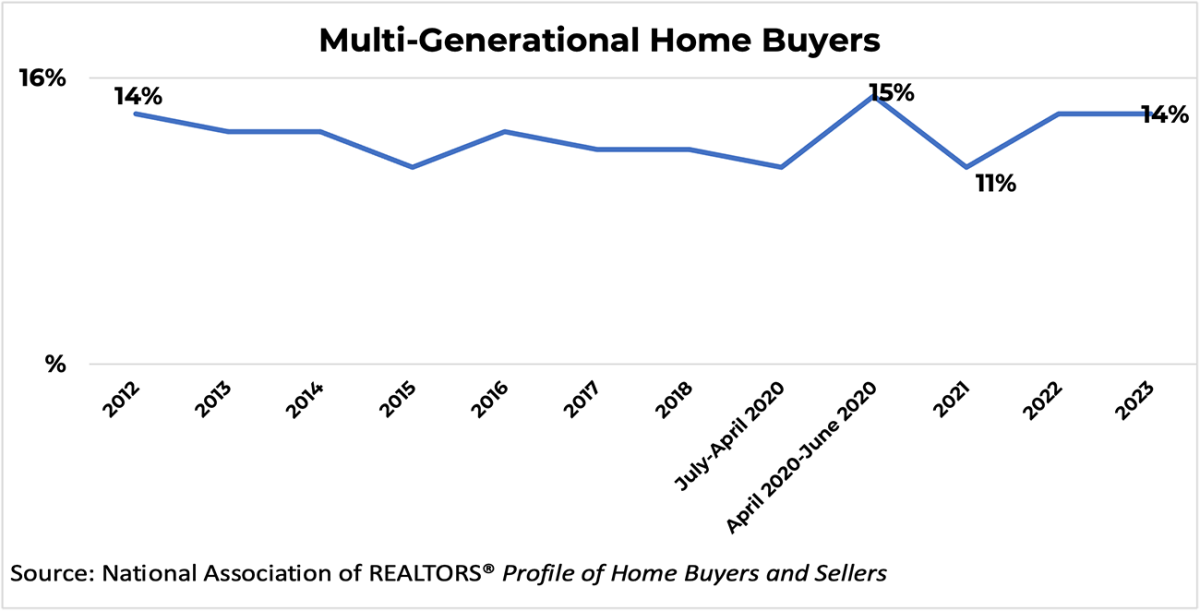

6. Multi-generational buying seems to be a sticky trend

Fourteen percent of all home buyers are purchasing a multi-generational home. This could house an elderly relative, adult children over 18, or families of other makeups for cost savings and to buy a larger home. One thing is clear about post-COVID-19: families want to support each other. The top reason to sell is to move closer to friends and family; for some, they find living with one another the best way to achieve this.

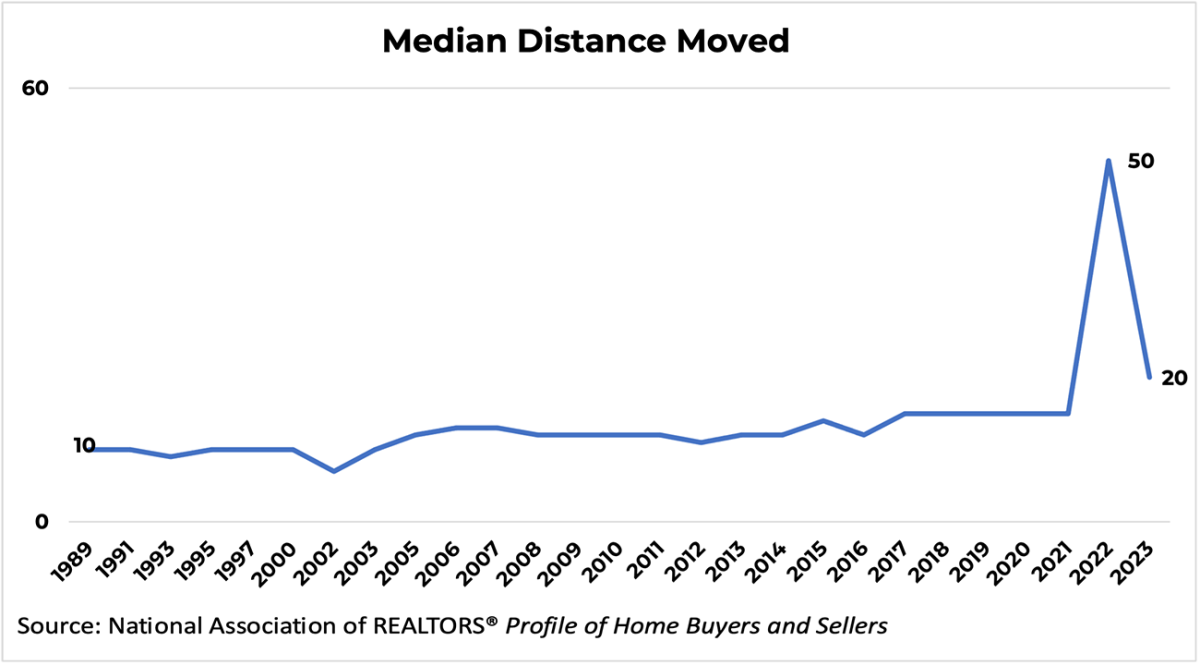

7. Distance moved and location seem to be boomeranging back to pre-COVID-19 trends

Historically, buyers moved just 10 to 15 miles from 1989 to 2021. In 2022, that jumped to a high of 50 miles. The trend seems to be reverting and is now at a still-elevated 20 miles. Last year, buyers were also more apt to seek small towns and rural areas. While the trend is still elevated this year, there is a move back to suburban areas. This is likely due to several factors, such as CEOs wanting more in-person office time, home buyers who wanted to lock in a low rate last year willing to move further out, and the higher income of buyers this year able to purchase closer to city centers.

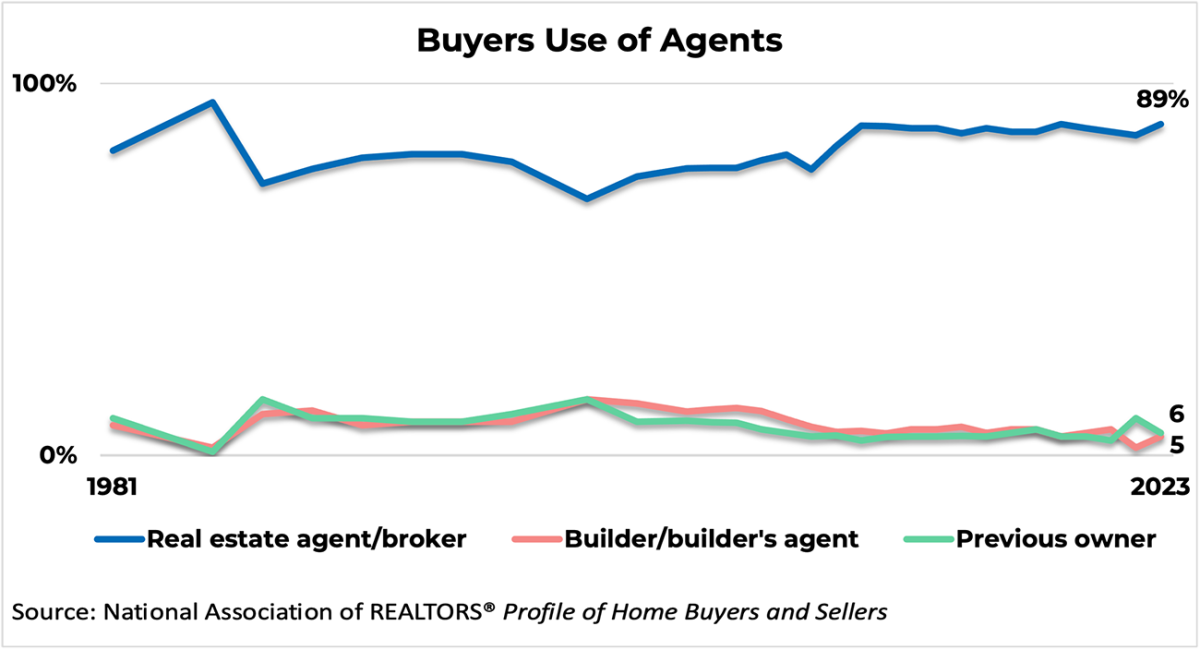

8. Eighty-nine percent of home buyers used a real estate agent or broker to purchase their home

Buyers want a real estate agent or broker who is not only able to help them find the right home but is also going to help them negotiate, explain, and understand the real estate market. This is the biggest financial purchase of one’s life, and real estate agents are helping buyers achieve the American Dream.

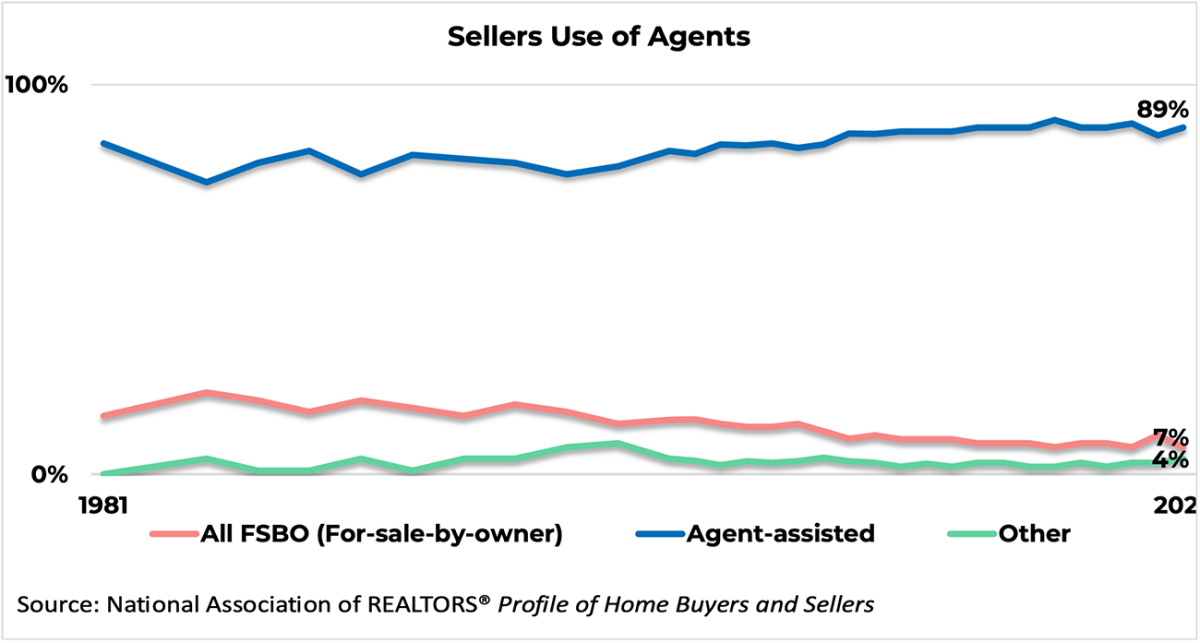

9. Eighty-nine percent of home sellers used a real estate agent or broker to sell their home

Similarly, home sellers want an agent to help them price their homes competitively, market them for sale, find a qualified buyer, and do so within a specific timeframe. Buyers and sellers who are happy with their agent would recommend or use their agent again when buying and selling a home.