We all know the economy has taken some pretty rough hits over the last couple of years. Between the pandemic and the neighboring wars, we have been on a roller coaster nearing economic distress. That doesn’t mean however people have stopped wanting things. People still buy cars, take vacations, and move from place to place.

That also means despite everything, people are still buying homes, yet they are making risky movements to do it. According to NBC News, we are seeing similar interest rate hikes and risky buying tactics just prior to the 2008 economic collapse. This has many concerned that the state of the real estate market is a daunting warning of foreshadowing about what is to come.

The worry is not unwarranted either. The rate at which inflation has grown since the Ukrainian and Russian wars has been exponential. People who are interested in buying worry that if they don’t buy now, they may not be able to afford anything in the future. Because though the cost of literally everything has risen, the amount people get paid has not. If things continue to go south people could lose their jobs and not be able to refinance or even sell their homes.

This is putting homebuyers in a position to look for alternatives to a 30-year fixed mortgage.

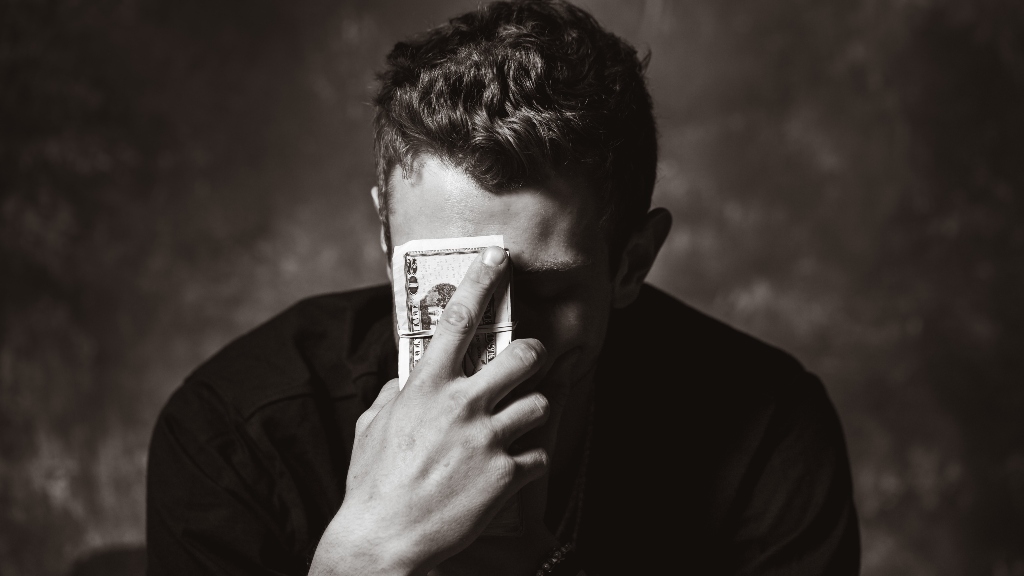

Some folks are opting for a 2-1 buydown which is extremely risky. You pay for the loan interest on a home only for several years and then you are swapped to paying the loan interest and your mortgage at the same time increasing your monthly payments by hundreds. This will end up putting the homebuyer in a predatory market. There is potential, just like in the 2008 crash, that these practices will lead to home losses and shutdowns of institutions that preyed on these people.

Overall, the big concerns are going to be the fact that interest rates continue to go up and there will continue to be a steady decline in home purchases due to that. I know we all need to make money in this stressful world, but don’t prey on people to do it.

The economy is making home buyers want to leap at risky decisions, but we should also make sure they are completely informed of those risks before buying. If they want to continue, then it is their own fully informed choice, but don’t omit the truth to make a sale.

A native New Englander who migrated to Austin on a whim, Stephanie Dominique is a freelance copywriter, novelist, and certificate enthusiast. When she's not getting howled at by two dachshunds or inhaling enough sugar to put a giant into shock, she is reading, cooking or writing about her passions.