The National Association of Realtors® (NAR) released its most recent Profile of Home Buyers and Sellers report. The annual survey conducted by NAR “allows industry professionals to gain insight into detailed buying and selling behavior.” This year’s survey contained 131 questions, and it surveyed home buyers and sellers who purchased between July 2019 to June 2020.

Here is a breakdown of some characteristics of home buyers.

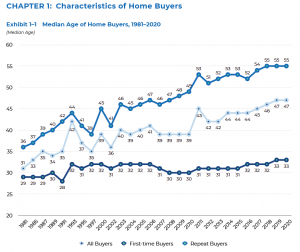

Median age of home buyers

A shift in a home buyer’s age hasn’t changed much when compared to last year. For first-time home buyers, the median age is still at 33 years. Repeat buyers have remained at 55 for three straight years. The median age of home buyers stayed at 47 in 2019 and 2020, which has been the oldest median range since NAR began collecting data in 1981.

Also, the 25 to 34 age group continues to be the largest share of home buyers. This year they accounted for 23% of all buyers, and the smallest share of home buyers came from the 18 to 24 (3%) and 75 and over age groups (5%).

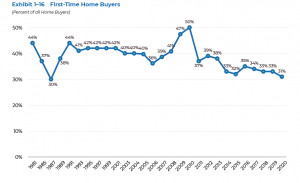

Decrease of first-time home buyers

First-time buyers’ market shares have remained below the historical norm of 40% since 2011, and this year we saw a new decline. In 2019, first-time buyers made up 33% of all home buyers. This year that figure dropped to 31%. This is the lowest it has been since 1987 when it was at 30%.

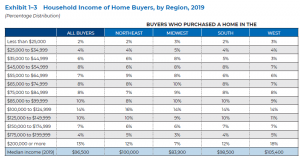

Increase in median household income

First-time buyers might have decreased, but median household income for 2019 increased. This year the median income is at $96,500 whereas last year’s median income was at $93,200.

Although income has increased for both first-time buyers and repeat buyers, there is a large gap between the two. Data shows first-time buyers’ median income is at $80,000, and repeat buyers’ median income is at $106,700. Also, married repeat buyers have the highest median income at $120,300.

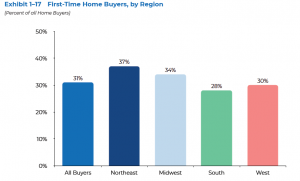

The report shows those with higher incomes come from the West region with the Northeast region following right behind. And, this could be the reason the Northeast has the highest share of first-time home buyers with 37%. And, why the South region has the lowest at 28%.

Who’s buying a house?

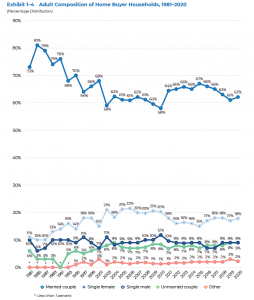

Married couples make up 62% of recent buyers, up 1% from the year before. Single female buyers make up 18%, and 9% are single male buyers. However, the shares of first-time buyers that were married decreased from 53% to 52%. For married repeat buyers, it remained at 67%. And, first-time buyers who are unmarried couples decreased to 16%.

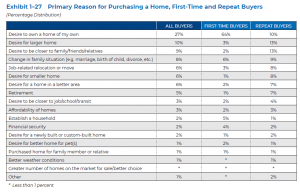

Why are people buying houses?

Not surprisingly, the main reason first-time home buyers want to purchase a home is that they want to have a house they can call their own. According to the report, 64% of first-time home buyers said this is why they purchased a house.

- On the other hand, repeat buyers purchased for these reasons:

- To purchase a larger home – 13%

- To move closer to family and friends – 13%

- Due to a life change (childbirth, marriage, or divorce) – 9%

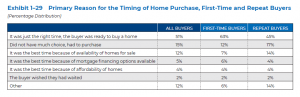

Home buyers are also purchasing homes because it happens to be just the right time. Of all buyers, 51% cited this as a reason. For first-time buyers, they were at 63% and repeat buyers at 45%. Also, 15% of buyers said they didn’t have another choice, and 12% bought a house because of the availability of homes for sale.

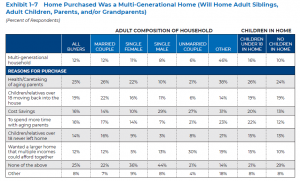

Also, 12% of all buyers are still purchasing multi-generational homes like they did last year. These homes have “adult siblings, adult children over the age of 18, parents, and/or grandparents” living in the household.

- The main reasons for purchasing this type of home are:

- Take care of aging parents – 25%

- Children over 18 moving back home – 19%

- To save money – 16%

- Spend more time with aging parents – 16%

NAR’s report shows the 25-34 age group still maintains itself as the largest age group of home buyers. The number of first-time buyers has decreased, but this can be expected as the pandemic has turned things upside for a lot of people. However, there has been an increase in overall median income, and the data shows people still have a desire to own their own home, including buying multi-generational homes.

Veronica Garcia has a Bachelor of Journalism and Bachelor of Science in Radio/TV/Film from The University of Texas at Austin. When she’s not writing, she’s in the kitchen trying to attempt every Nailed It! dessert, or on the hunt trying to find the latest Funko Pop! to add to her collection.