Happy new year! As we kick off 2022, I wanted to dig into one of the hottest real estate segments, multifamily in high-growth markets in the Southeast.

At least once a week I hear about a new fund targeting value-add multifamily deals across the Southeast, an operator opening a Miami office, or an Opportunity Zone fund targeting sites in the Sunbelt.

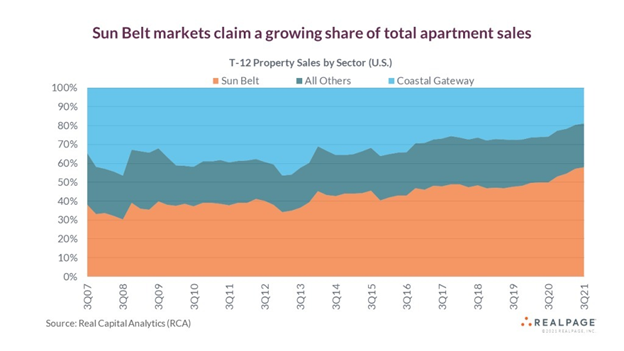

This isn’t just anecdotal, the Sunbelt has been gaining share of the total apartment sales consistently since 2007, growing from ~35% of total sales volume to nearly ~60% today (3Q2021 – RealPage). That growth has come primarily at the expense of the coastal gateway markets and has accelerated post-COVID.

Institutional owners have historically focused on gateway markets. Over time, as yields in gateway markets compressed, institutional owners shifted into high-growth markets like Atlanta, Dallas, Charlotte, Nashville, Tampa, and the like.

Take Atlanta for example. Multifamily sale volumes boomed there in 2021 to $14B, smashing the previous record of $8.5B set in 2019 (Costar). The surge in investment activity is being driven by “National” buyers, primary institutions entering the market for the first time and making a splash.

The entry of institutional buyers into the market is driving up pricing. They’re generally able to pay more due to their low cost of capital and long-term approach. Additionally, their sophisticated operational approach enables them to bring rents to market more effectively. Most of these owners use revenue management systems, optimize assets for revenue growth, and make strategic long-term capital improvements.

The historic levels of multifamily rent growth across the Southeast right now is no secret. 8 of the top 10 rent growth markets in the country as of Q321 are located in the Southeast, with year-over-year rent growth exceeding 20% (Costar).

The confluence of supply/demand factors combined with the growth of institutional owners is leading to historic levels of rent growth.

The question on everyone’s mind is, can the Southeast markets support this level of rent and is the room for further rent growth?

I think so. While many people point to rent growth versus wage growth as a sign of increasing affordability issues, my belief is that the Southeast has been under rented due to the lack of institutional ownership historically and the fact that rents haven’t kept up with the rapid population and job growth. The rent increases today is the market playing catch-up and I believe there is significant room for rents to continue to grow as these markets are still relatively affordable compared to coastal markets.

That’s why we’re continuing to hold assets and buy additional assets in select markets across the Southeast.

That said, there are a number of questions I’m pondering:

- Are rents outpacing wages in these markets to such an extent that there aren’t enough high-paying jobs to support them?

- What happens to demand when these markets are no longer affordable relative to other dynamic markets? Will growth slow?

- Will supply catch up, eventually outpacing demand and leading to slowing rent growth and increasing vacancy?

- Will supply-constraints such as construction costs keep markets in the Southeast from seeing excess new supply?

What do you think? Hit me up on Twitter with your thoughts.