Even before the COVID-19 pandemic, half of renters in the US were spending 30% of what they earned to pay their rent. For the poorest 20%, on average, more than half of their income went towards paying for housing. Now with much of the service economy and low-income workers hit hard, the pandemic-prompted economic crisis could also become a housing crisis.

According to Apartment List, 24% of Americans did not make a full, on-time housing payment in April. In May, that number rose to 30% and reached 32% in July. Eviction moratoriums across the country, one-time stimulus checks, and expanded unemployment have helped people to stay in their homes for the time being. As those moratoriums expire, expanded unemployment runs out, and court houses reopen; more than 20 million renters could be at risk of eviction by September. Without monthly rent income, landlords can’t make mortgage payments. Mass evictions would be devastating for individuals, families, communities and ultimately economic recovery.

Low-income women, particularly low-income women of color, face higher eviction rates. Women from Black neighborhoods account for 30% of evictions, while only comprising 9.6% of the population. Risk factors for eviction, according to a Policy Research Brief by the MacArthur Foundation, include: having children, lower wages, and domestic violence. Approximately 16 million American children live in households headed by a single mother.

Though it may seem like a repeat of The Great Recession of 2008, it’s not. The previous housing and financial crisis was created by problematic mortgage underwriting that resulted in a housing bubble that burst resulting in soaring foreclosures, falling housing prices and homes left empty. Renters moved into the urban cities. What is happening right now is very different. Renters are moving out of cities, sales for newly built homes have skyrocketed, and there is an undersupply of houses on the market.

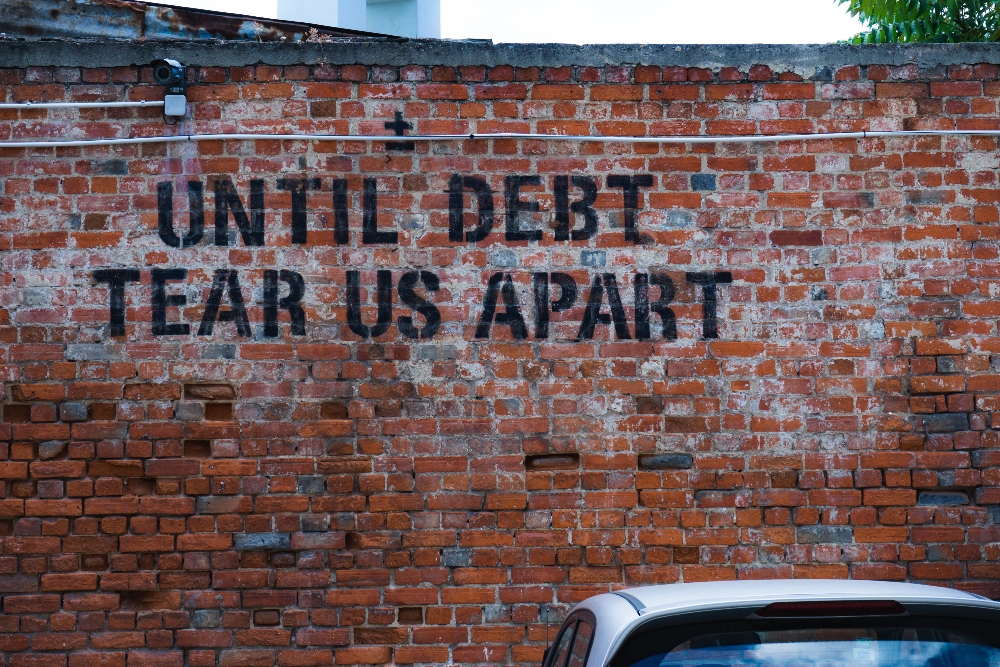

What is the same in 2008 and today? An urgent need for policymakers to step in. According to economist Bill McBride, “There are two things we need to do right now.” McBride says “First, we need to keep doing CARES Acts until this is over. If we run the debt up $10 trillion, it will be money saved. Second, we’ve got to get a grip on the pandemic, and that probably means shutting every indoor business down for a few months again and moving as much outdoors as we can.”

Yasmin Diallo Turk is a long-time Austinite, non-profit professional in the field of sexual and domestic violence, and graduate of both Huston-Tillotson University and the LBJ School of Public Affairs at the University of Texas. When not writing for AG she should be writing her dissertation but is probably just watching Netflix with her husband and 3 kids or running volunteer projects for HOPE for Senegal.