I have had to think about Redfin after Q3 of 2022. Redfin has been my favorite brokerage for years now for a few reasons. I have thought their commitment to the consumer was unshakable, and the desire to save consumers money and to improve things for buyers is written into the DNA of the company. I thought their blend of technology and a W2 employee workforce that makes investment in technology worthwhile was brilliant and bold, if fraught with risk. I thought Glenn Kelman to be one of the smartest visionary CEOs in the industry, and thought his achievement in guiding Redfin from the depths of the GFC and Real Estate Bubble to the heights of the post-COVID madness was amazing.

Over the years, Redfin has pivoted and juked and jived to deal with the challenges of the market, the industry, consumer changes, and competition from all sides. I thought on the whole they did so admirably. In a way, the story of Redfin is the story of proptech innovation in the residential real estate space.

Redfin started out as a brash upstart, breathing fire, challenging the industry and its settled practices, going to Congress to complain about anticompetitive behavior from other brokerages, from the MLS, and from NAR. Then they matured a bit, stopped the war against the industry (something that say REX would need to learn one day), became REALTORS, joined various MLSs, tried to fit in and work out a modus vivendi with other brokers and agents, all while pursuing its quirky W2-based model. Over time, Redfin became one of the strongest defenders of brokerages against non-brokerage proptech, such as Zillow and Opendoor. Sure, some of that was motivated by self-interest, but it was odd to see the onetime bete noire of the industry defending the rights of brokerages. Then once Kelman realized the potential of iBuying, Redfin spun up RedfinNow long before Zillow did. Then COVID hit, things went to hell for a while, only to come roaring back in the hottest craziest housing market in our lifetimes. Redfin invested in mortgage with Bay Equity, in rentals with RentPath, and things were looking rather rosy.

Then the Jerome Powell housing market hit with a vengeance. 2022 has been one of the weirdest housing markets in memory, with transactions going poof as buyers got priced out, but prices continuing to climb… unless you’re an investor or an iBuyer and you can’t simply just hold inventory on your balance sheet.

So we get the Q3 of 2022 Redfin. It is going back to its core business. Redfin is jettisoning iBuying completely, laying off almost a fifth of the workforce to do so, and refocusing on its core strength: a powerful website and a W2 workforce that is the most productive of all major brokerages in the country. All of their moves make sense given the market conditions and competitive landscape. But they refocus on the core business, with different assets and different capabilities. I think Redfin is going back to the future, and some of what we learned from the Q3 earnings call suggests a vision of the future of real estate.

I think most of the smaller brokers and larger agent team leaders in the industry should be watching Redfin closely over the next few quarters. Not as a threat or as a competitor, but as a pathfinder for what housing services might look like in an entirely new landscape.

Let’s get into it.

The Numbers

As always, let’s touch on the numbers. You already know them, but it sets the basis for further discussions.

- Revenue of $600.5 million, up 11% YOY

- Gross profit of $58.1 million, down 54% YOY

- Core real estate services gross profit of $54.9 million, down 43% YOY

- Core real estate services gross margin down 26%, vs. 37% in Q3 of 2021

- Net loss of $90.2 million, down 377% YOY

- Adjusted EBITDA went from a positive $11.8 million last year to a loss of $51 million

All in all, a horrible quarter. Glenn Kelman wasn’t all that shy about laying it all out, and stated that the “entirety of the earnings shortfall came from RedfinNow.” Accordingly, the iBuying business is now shuttered and 13% of employees have been laid off. Since April of this year, 27% of Redfin employees have been shown the door.

The result is a refocusing at Redfin. As Kelman himself said during the call: “We can sell more homes over time by focusing on our core business, building our online audience, and giving customers the best brokerage, mortgage, title, and rental service.”

So what does that look like?

Redfin of 2023: Back to Basics

Basically, the Redfin of 2023 looks a whole lot like Redfin of 2013.

It will be, for all intents and purposes, a giant agent team with a high-traffic website instead of a top producing agent as the primary lead generator. That is what Redfin has always been.

Redfin will focus on things like traffic to the website, Google search rankings, and striking the balance between sending leads to its in-house employee agents vs. sending leads to its network of Partner Agents.

Redfin won’t get rid of its W2 workforce anytime soon, because of two key advantages that the W2 workforce gives them: productivity and ancillary services attachment. As Kelman noted, the employee agents close transactions at a higher rate than partner agents. So sending a $1 million home sale to an employee and sending $250K home buyers to partners makes more sense. The trick is knowing what to send outside the company and when to send it. Redfin wants to keep its employee agents busy all the time, but not so busy that they can’t close deals at a very high rate and to keep Redfin consumers coming back to Redfin. From the earnings call:

Compared to partners, our employees close sales at a higher rate, build customer relationships that lead to repeat and referral sales for our benefit and drive higher mortgage and title attach rates. This gap between employee and partner performance is only widening. The judicious allocation of opportunities to our own agents is how we make the most profit per home buyer. And it’s why our growth is more durable than if we were purely dependent on increasing online traffic or recruiting agents. [Emphasis added]

Speaking of attach rates, Redfin’s mortgage attach rates in Q3 were between 23% and 25% vs. 8% in Q3 of 2021. That’s quite an improvement. Title attach rates were 40%; not shabby. And Kelman spoke about that:

Bay Equity is a great lender. It delivers fantastic service, but we also employ our real estate agents. And when you employ the agents, you can ask them to sell more than themselves. You can ask them to sell every product the company has got.

So we think that we can continue to drive attach rates higher. We’re not getting much credit for it, and we shouldn’t until Bay Equity generates a profit, but no lenders are generating a profit right now. So I just want to be clear that we can make more money for homebuyer because we can sell them more products, and we can sell every single one of those products at a profit. [Emphasis added]

The W2 employee thing is both a blessing and a curse; Kelman acknowledged that their losses were bigger in 2022 because having employees with all of the overhead hurts more when the market tanks. But there are real advantages here as well, as noted.

2023 Ain’t 2013

The more interesting thing for me is the fact that Redfin of 2023 has assets that the Redfin of 2013 lacked. Specifically, its businesses in mortgage, title, and rentals were not things that Redfin of 2013 had. Plus, the new Redfin has finally come to embrace something that they had known for quite some time: buyers don’t care about rebates. The mix of those factors could be interesting both for Redfin, and for segments of the industry as a whole that could learn from Redfin.

We already touched on mortgage and title, and how Redfin’s employee workforce gives them an advantage in terms of attach rates. Let’s touch on the other two things: eliminating buyer rebates and rentals.

Buyers vs. Sellers

One of the more interesting sections for me came when an analyst asked what kind of testing Redfin had done on pricing its services. Kelman says:

Now we may take further steps to raise prices even more, but we have determined through extensive testing that buyers are not price sensitive, and sellers are price sensitive. And if you look at all of the portals trying to generate sell-side demand, they have failed. And we have succeeded because it turns out that people who come to a website respond to either a cash offer or to a 1% fee. And so if we want to take share in a durable way, we still think that offering customers a better deal on the sell side will drive share. [Emphasis added]

This is something that the industry as a whole has suspected (or known) for a while now. Redfin’s buyer rebates were a curiosity; Redfin’s 1% listing fee was a threat to competitors.

By getting rid of buyer rebates, Redfin is acknowledging that buyers just don’t care that much about what they’re paying for brokerage services. Today. Under the current system.

What we don’t know, what Redfin doesn’t know, and what nobody knows is what happens when Buyers have to pay their agents out of pocket. The lawsuits in Missouri and Illinois that will hit next year, as well as who-knows-what from the DOJ and FTC, will change the landscape completely. Northwest MLS in Seattle area is already experimenting with the elimination of mandatory cooperation and compensation (where the seller pays the buyer agent via listing agents sharing it), but the evidence of major change is scarce.

I think buyers are not price sensitive today because buyers have been trained for decades that they don’t pay a commission. That’s the psychology, despite the economic reality that the buyer is in fact the person bringing money to the deal, which means the agent commissions that are baked into the price of the home are being paid by the buyer. I believe it’s fair to say that historical evidence has shown that most American consumers are not economically literate.

When economic illiteracy meets economic reality, however, buyers will react. We don’t know what will happen when Redfin has the buyer sign some representation agreement and the buyer has to come up with $30K at closing. We don’t know what will happen when the media finally notices and starts telling buyers to “ask your agent about how much you will be paying” and some such on morning show programs.

I do think, however, if the landscape changes overnight thanks to legal and/or regulatory changes, Redfin will be more able to deal with it than most brokerages in the United States. For example, if buyer commissions go from a percentage of the sale price paid by the seller to a flat fee paid by the buyer, or an hourly rate paid by the buyer, Redfin already knows how to manage a W2 workforce, knows how to compute what to charge in order to generate a profit from agents to whom Redfin is paying a salary, etc. Most brokerages dependent on a 1099 independent contractor workforce will need to learn new skills and quickly.

Rentals

The other major asset that Redfin has is Rent, formerly known as RentPath. Redfin spent $608 million on RentPath back in 2021, and relaunched in June of this year under John Ziglar’s leadership. Admittedly, they have a long way to go to compete against the two giants of Zillow and CoStar (Apartments.com). And Kelman is optimistic about Rent’s contributions to Redfin’s revenues and profits in the future, as it is growing fast.

However, today Rent is just a rental portal more or less identical to Zillow Rentals or Apartments.com — a place for renters to find a place, and for property managers and landlords to advertise properties for rent. Redfin.com sends traffic to Rent.com, and Rent.com sends rental listings to Redfin.com. A nice cycle.

If Rent is limited to that, then the story is merely a meh tale of real estate portals competing for eyeballs and listings and trying to get paid by somebody (usually the property manager/landlord). But I think there’s something more here because of Redfin’s core business.

Having W2 employees benefits transaction closing rates, mortgage and title attach rates, and possibly the need to pivot after the compensation apocalypse. But the other advantage of having W2 employees is that Redfin can get much more involved in the rental space than can Zillow or Apartments.com.

For a few years now, I’ve been suggesting that America is becoming #RenterNation for a variety of reasons. The main one is something whose signs were obvious for years, but that no one can ignore in 2022: home prices are climbing way, way past incomes. It isn’t as if working families and young people have had an easy time of buying a house in the past ten years, but the money printing from COVID has made things very, very obvious.

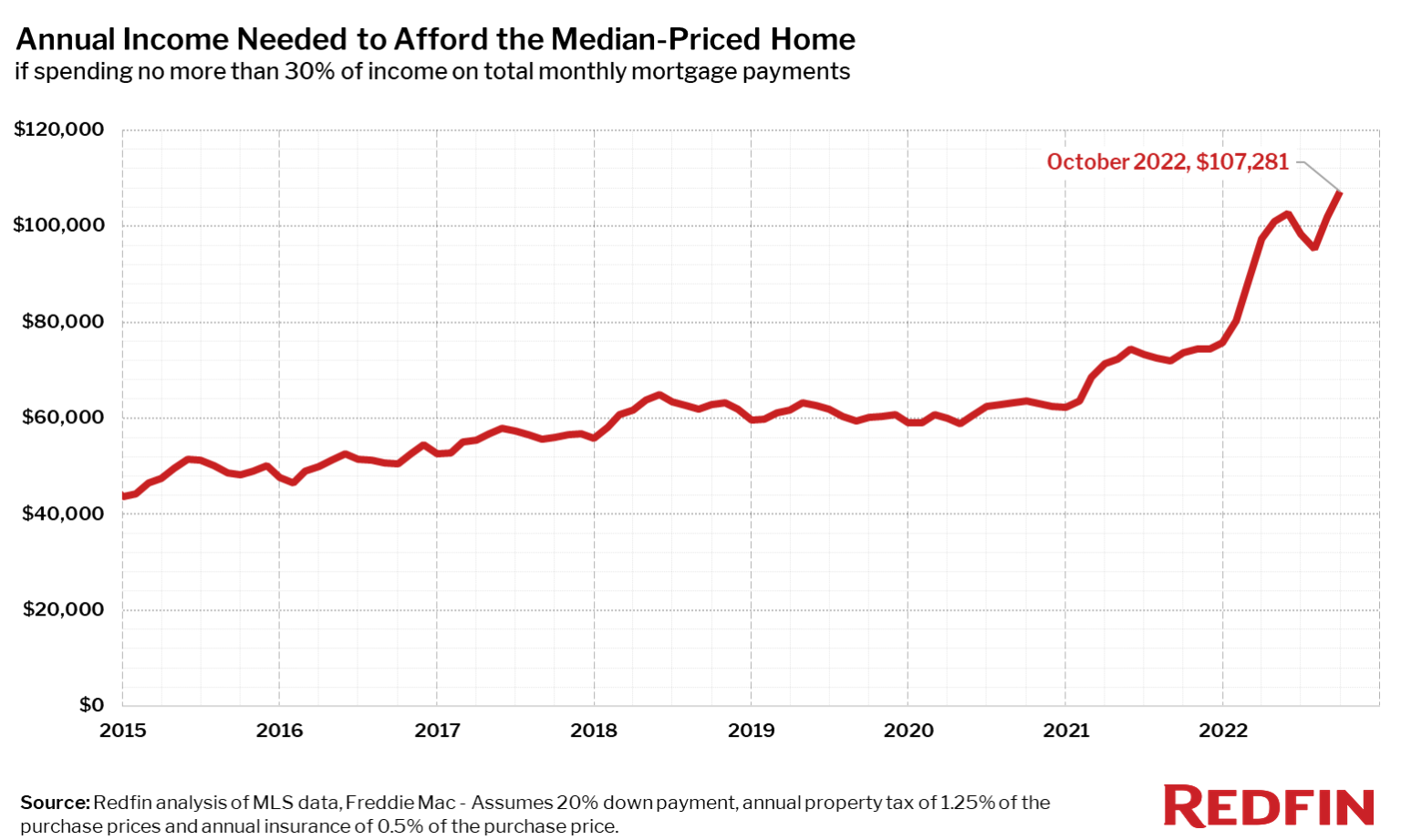

Redfin has been one of the leaders in pointing out how unaffordable buying a home has been recently. In this post from November 15th, Redfin pointed out that a buyer must have a six figure income to afford a typical home in the U.S.:

A homebuyer must earn $107,281 to afford the $2,682 monthly mortgage payment on the typical U.S. home, up 45.6% from $73,668 a year ago. That’s due to mortgage rates that have more than doubled over the last 12 months, combined with persistently high home prices.

From February 2020 (just before the pandemic started) to October 2022, the monthly payment for an American family buying the median-priced home increased by roughly 70%. Affordability challenges are a major reason why home sales have slowed so dramatically over the last few months.

Yet all the doomsayers predicting a collapse of the housing market are missing one thing, which may be the case of semantics affecting substance. The housing market can’t collapse, because housing is a necessary good. Homebuying and homeselling markets could collapse, but people need a roof over their heads, so the housing market cannot actually collapse without civilization itself collapsing. Yes, that’s just semantics to a certain degree but like I said, I think semantics may be affecting logic.

If you cannot buy a home, then you must rent one. Homelessness is not an option for most.

Leasing and property management, however, are areas where traditional brokerages and agents have avoided. For one thing, they don’t pay as well. The saying is that real estate sales is a dollars business, while property management is a nickels business. Brokers would rather (and do) tell their agents to spend more time calling their sphere for a listing or a buyer than spending time on a renter or a landlord.

But Redfin has a W2 workforce that they have to pay no matter what. If buying and selling activity slows down enough, it makes sense for Redfin to have those agents do some leasing or even property management to generate some revenues from their time. This is something I’ve been advising brokers and agent teams to look into for almost all of 2021 and 2022.

It isn’t easy, and there are real risks, but no other brokerage company in the U.S. has invested $600 million (and more) into a national rental portal. Once Redfin figures out how to incorporate leasing and property management into its real estate services in a way that makes sense, then Redfin can actually become a full-spectrum housing services provider.

That would be a major victory for the rabid squirrel born in the dark.

The Full Housing Lifecycle Company

The vision for Redfin is remarkably close to the vision for Zillow with its housing super app: the full housing lifecycle company.

Redfin can work with new college students to find them campus rental housing, then their first real apartment with roommates after they graduate. Then Redfin can help them find their own 1BR rental, then a 2BR after they get married, and then a starter home at some point. Redfin can help that couple sell that starter home and find a move up home with enough space for their growing family, or help them manage that starter home as a rental property. All along the way, Redfin can sell them mortgages, title, escrow, insurance, home improvement, etc. etc. etc.

Like Kelman said, “You can ask [employee agents] to sell every product the company has got.”

Zillow can try to do the same with the housing super app, but it has far less control over its network of Premier Agents than has Redfin over its W2 workforce. CoStar with Apartments.com has no control, and I see zero signs that CoStar has “full housing lifecycle” as a goal. CoStar just wants to be a great advertising platform for listing agents, sellers, property managers and landlords.

There is a scenario here where Redfin cuts out everything that isn’t core housing services, refocuses and manages to get through this downturn, and emerges on the other side as a unified full housing lifecycle company.

The reason why the rest of us should care is that that is a template for the future of real estate “brokerage”. I put that in quotes because Redfin isn’t a brokerage as we understand the term; it’s an agent team. And the power in the industry has been shifting to the agent team for years and years now anyhow.

As many of today’s mega teams — who grew up during the past decade of ever-higher, ever-more — need to retrench to deal with new realities, I think they would benefit significantly by looking at how Redfin navigates what’s going on. Sure, they won’t have Redfin.com or a major national rental portal, but most of those teams are local anyhow with real strengths with boots on the ground and deep relationships in local communities.

Small and midsize brokerages would also benefit, but they would need to undergo far more significant restructuring to become more like Redfin. Not so most successful agent teams.

Either way, Redfin’s back to the future move should be watched carefully by those leaders in the industry who are not national scale mega brokerages (Compass, Anywhere, HomeServices of America, Howard Hanna, eXp, etc.), because how Redfin deal with the new environment will be far more useful to them than how Zillow or Opendoor or Anywhere deals with the new environment.

-rsh