Brooklyn Home Prices Soar to Record Highs in Second Quarter, But Feverish Market Could Chill

Buyers in Brooklyn are still paying top dollar, particularly for townhouses, despite news of a slowing market.

Brooklyn Heights, 2020. Photo by Susan De Vries

Buyers in Brooklyn are still paying top dollar, despite news of a slowing market nationally.

Over the past three months, listing inventory in Brooklyn has fallen for the first time in a year and a half, while the median sales price has hit a new record for the eighth time in more than two years, according to the latest closings report by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate.

“Low listing inventory continued to provide a firm underpinning to sustain record price trends,” Jonathan Miller, president of Miller Samuel, said of the second-quarter report.

The number of sales increased in Brooklyn year over year and so too did median sales prices. During the second quarter, 3,726 sales closed in the borough, up 8.7 percent vs. the same period last year, when 3,427 closings were recorded.

The second quarter saw the median sales price hit $985,000, up 8.2 percent compared to the same period the prior year, when the median was $910,000. One- to three-family homes experienced a massive 19.1 percent increase in median sales price vs. the second quarter of 2021, with the median this year coming in at $1.19 million compared to last year’s $999,000. The average price per square foot of a one- to three-family home was $702 this quarter, up 10.7 percent vs. 2021’s second quarter price of $634.

Condos in Brooklyn also increased in median sales price, climbing to $990,000, an increase of up 4.2 percent over the same period a year earlier. The price per square foot averaged $1,124, up 14.2 percent on the same period last year.

Meanwhile, the median price of co-ops in the borough sat at $557,500, down 4.7 percent from second quarter figures in 2021.

Across the borough, east Brooklyn saw the smallest increase in median sales prices year over year, rising 1.1 percent from $875,000 to $885,000, the report said.

However, the figures reflect sales that closed earlier in the year, possibly weeks or months after contracts were signed, meaning the deals were struck likely prior to interest rate hikes that kicked off on March 16 and occurred again in June and other market uncertainties that have affected sales nationwide.

More recent data shows the market in Brooklyn may be less frenzied but still strong, bucking national trends of a cooling housing market.

In his Housing Notes newsletter sent out Friday, Miller said overall new signed contracts in Brooklyn have been falling annually for the past two months compared to the previous year’s “unusually elevated activity.”

“However, month over month, newly signed contracts have also fallen for the second straight month as the recent spike in mortgage rates has slowed demand and expanded new listings. New signed contracts, and new listings for June were well above the same period pre-pandemic,” he wrote.

Miller told Brownstoner that even with sales slowing compared to the pandemic-era surge and the uncertainty around what could happen next in regards to a recession, Brooklyn is still seeing sales far above pre-pandemic levels, and he doesn’t expect to see a drop in housing prices any time soon.

“There’s an assumption that prices correct, they don’t. At the national level it takes a little over a year because sellers don’t sell unless they have to sell, and inventory in Brooklyn is much lower, it has fallen significantly like the rest of the country.”

However, he did say if we see a recession due to the Federal Reserve going too far, “all bets are off.”

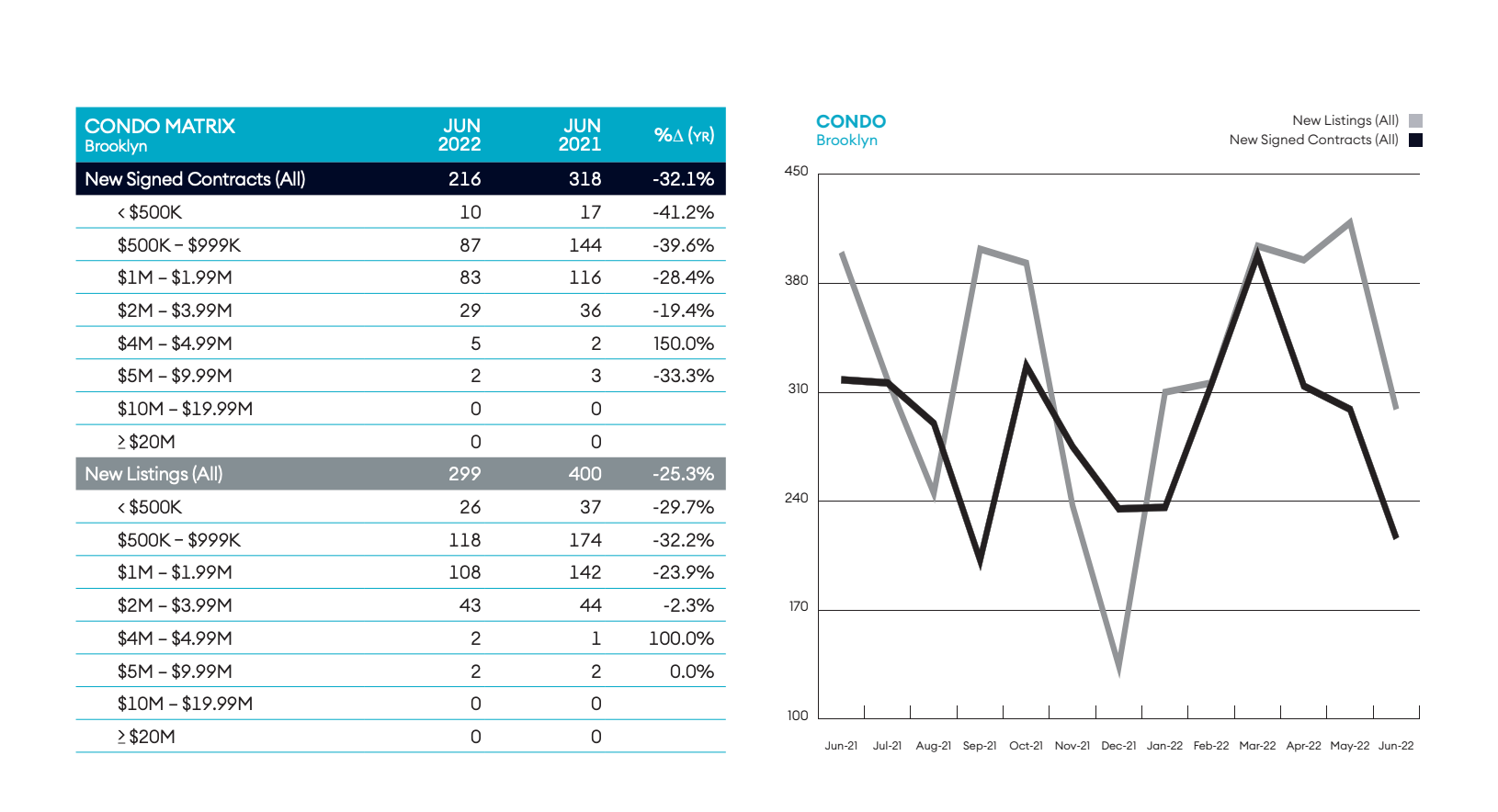

The report shows in June the biggest reduction in new contracts signed between June 2021 and June 2022 was for condos, which fell 32.1 percent. Of the new contracts signed (216 this June, compared to 318 last June) the majority at 87 were for list prices between $500,000 and $1 million. Ten were for condos under $500,000 and two were between the highest bracket of $5 and $10 million.

This June, there were 142 new contracts signed for co-ops, compared to 186 in June 2021. For one- to three-family homes, buyers signed 192 new contracts, compared to 203 in June 2021.

Miller told Bloomberg the drop in new contracts elsewhere is in part due to “the spike in interest rates, inflation, economic uncertainty, the war in Ukraine,” but said there is a “whole smorgasbord of things the consumer has been grappling with,” that could affect sales.

Related Stories

- Brooklyn ‘Starter’ Homes Scarce as Real Estate Prices Hit New High in Borough

- Brooklyn Townhouse Sale Prices Jump Almost 30 Percent in the Third Quarter

- More Renters Signing Leases in Brooklyn, While Rents Edge Closer to Pre-COVID Levels

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment