What does it say that I dedicated Monday’s post to discussing the whole 416 market, the GTA, different market segments, sales, inventory, and listings, and when it comes to condos, I’ve set aside an entire post on Wednesday?

I almost think that question is rhetorical.

Having already started my “End of 2020” blog-themed posts on the side, I don’t want to spoil the surprise here, but we will be dedicating a good section to exploring the 2020 condo market.

The 2020 real estate market began with condos seemingly increasing in price by 20-25% inside of four months while the freehold market lagged behind in terms of appreciation. I routinely heard stories about fifteen-offer melees on cookie-cutter one-bedroom condos back in January and February, and it wasn’t uncommon to see even the most unattractive condos in the downtown core attracting 2-3 offers.

It was as crazy a condo market I’ve ever worked in.

Then along came the pandemic, and everything changed.

During the height of the pandemic, I kept tabs on prices, sales volume, and inventory for all property types, as well as absorption rates. If you look back in the summer as well as the early fall, you’ll see blog posts to this effect, specifically relating to C01 and C08 condos.

Today, I want to pick up where we left off with the August TRREB stats and see how 2020 finished up with respect to condos.

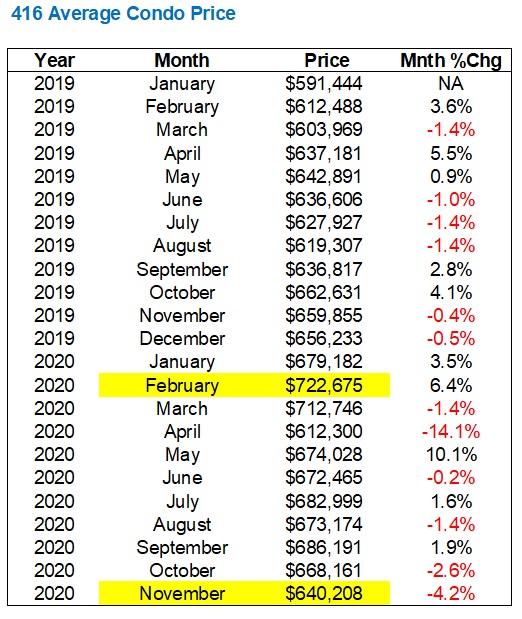

We’ll start with a refresher on the average 416 (Toronto) condo price, and just for context, we’ll go as far back as the start of 2019:

Note that the average condo sale price increased 10.1% from December 2019 to February 2020, but this is the whole of the 416. Specifically, in C01 and C08, I have said many times, anecdotally, that prices increased 20% in the smaller 1-bedroom segment.

I’ve highlighted the “peak” in February, pre-pandemic, as well as where we currently stand at $640,208 in November, which is off 4.2% since October, and 11.4% since February.

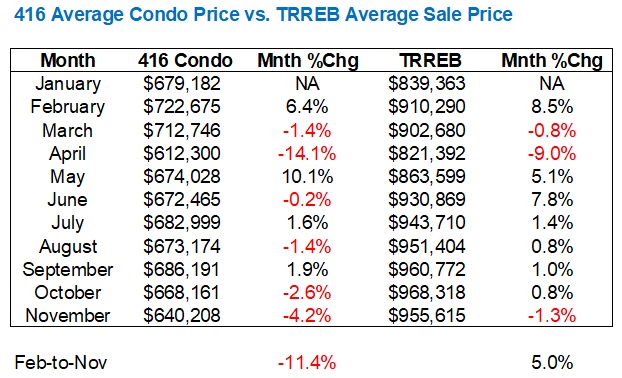

What I find most interesting about condo prices, however, is that they have no kept pace with the overall TRREB average home price.

All market segments were hammered by the pandemic. Every segment, and the overall TRREB average sale price, dropped substantially from March to April. And every segment made a huge comeback in May. However, whereas the overall TRREB average home price continued to climb, the 416-condo price did not

Check it out:

As you can see, the “bounce back” in May was far greater for condos than for the overall TRREB average: 10.1% compared to 5.1%.

But as the spring led to summer, and summer led to fall, condo prices dropped as the overall average continued to climb. Considering the overall average includes condos (as well as detached, semi-detached, and rowhouse), I think it’s fair to say that an average of freehold, excluding condo, would show an even larger increase than the 5.0% shown from February-to-November.

So what does all of this mean?

And what does the September, October, and November data tell us, different from the last time we had this discussion upon reviewing the August figures?

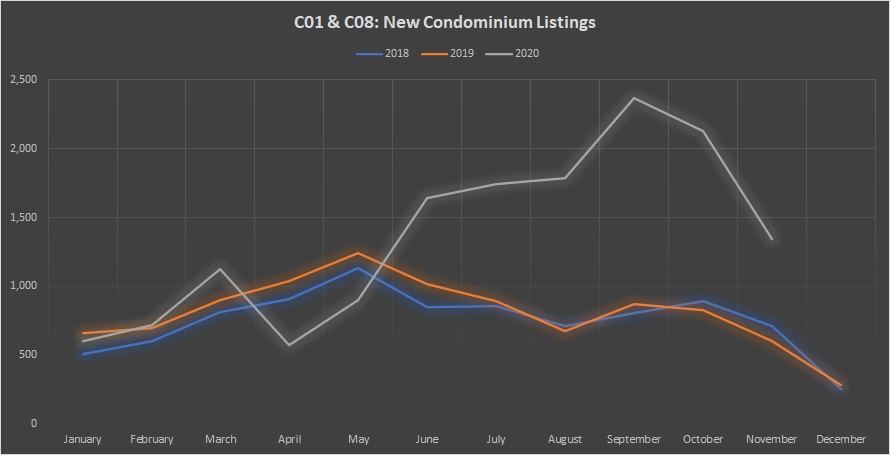

Let’s look first at new condo listings in the downtown core (C01 & C08):

September listings were through the roof.

As if the 1,600 and 1,700+ listings that we saw from June to August weren’t eye-popping enough, we saw almost 2,400 in September and over 2,000 in October.

Listings dropped dramatically into November, however, at a rate far larger than we’re accustomed to seeing; 36.7% in 2020 compared to 27.2% in 2019 and 20.2% in 2018.

If sales dropped at a corresponding level, then this means that “months of inventory” would decline, and the balance between supply and demand would be restored.

Let’s take a look at the sales figures:

Hmmm.

Not quite what we expected.

Only 522 sales in C01 and C08 in November, which is down dramatically from October.

In fact, that 30.0% decline from October to November significantly trails the respective declines in 2019 and 2018 of 17.4% and 8.9%.

With inventory declining at a faster rate than previous years and sales declining at a faster rate as well, it seems that perhaps the absorption rate won’t be catching up quite as much as we’d hoped.

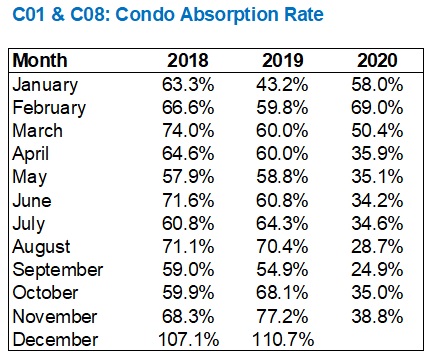

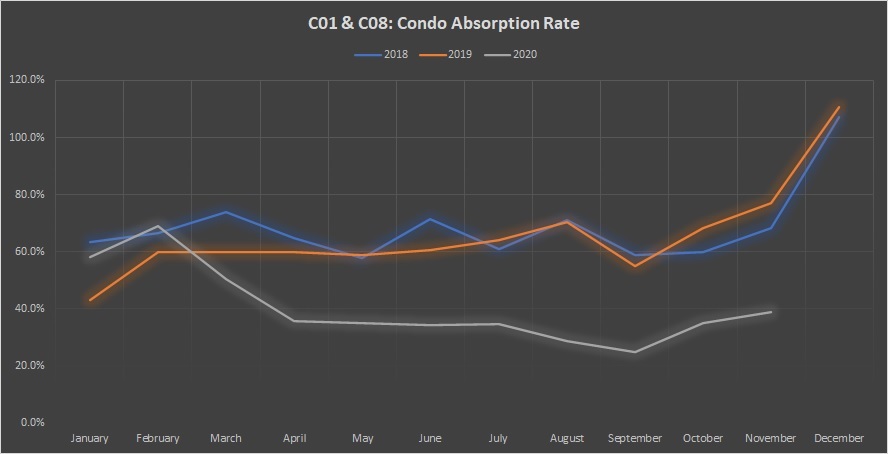

Here’s how the absorption rates look in these periods:

You can choose to look at this either as an optimist or a pessimist.

An optimist would note that the bottom figure of 24.9% in September leads to an uptick in absorption rate of 35.0% in October and 38.8% in November which is now higher than it’s been in any month since March.

A pessimist would note that 38.8% is a pittance compared to 68.3% in 2018 or 77.2% in 2019, and that the market has a long, long way to go.

So what could, in theory, help the condo market?

I have long suspected that the weak condo rental market has had a larger impact on the resale market than anything else. With interest rates as low as 1.5% for a 5-year fixed rate, this should be a bonanza to the condo market! But with investors on the sidelines because it’s near impossible to rent out downtown condos, and with other investors looking to sell, rather than carry condos vacant, we see a decline in demand along with an increase in supply, and that’s a recipe for a decline in prices!

Let’s look at activity in the downtown core (C01 & 08):

That’s new lease listings, which you can see absolutely skyrocketed in April when the pandemic hit.

This was caused by a number of factors, including job losses, working-from-home allowing people to give up living downtown, a lack of students, and vacancies caused by tenants looking for lower rents elsewhere.

Listings typically do decline in November, as you can see from the blue and orange lines representing 2018 and 2019, however, the decline in 2020 is far sharper!

The same can be noted for condos leased as well:

Condos leased skyrocketed from March to June, then tapered off as we moved through summer and into fall.

There are still more than twice as many condos being leased in Sept/Oct/Nov in 2020 than in 2019 and 2018, but in the end, the “balance” in the market all depends on the absorption rate, which looks as follows:

Do you see that point in November where the grey line passes the orange line?

That’s the very moment when the condo rental market turned around.

The market is still weak, yes. And this is only one month. But to see the absorption rate in November of 2020 surpass that of 2019, and almost pull even with 2018, tells me that the market is not only making a comeback but also showing upward momentum.

My colleague had a listing on Western Battery for which he received six offers to lease over the weekend. SIX!

“The pandemic’s over,” he told me, sarcastically.

But perhaps we should consider the possibility that the rental market is trending upwards?

If that’s the case, and we know that the weak rental market has had a massive impact on the resale market, then should this lead us to conclude that the resale market will follow suit?

It’s really tough to call the “market bottom,” in any market.

As I’ve said, I would love to meet the person who pulled their net worth out of the DOW Jones at 29,000, and then bought back in at 18,000.

So, far be it for me to suggest that market indicators do exist here demonstrating that there’s upward momentum on price in the condo market.

I’m not one for predictions, but I will predict that the average 416 condo price is up over $670,000 by February – that’s a 5% increase.

Agree, disagree, or agree to disagree?

Izzy Bedibida

at 9:09 am

Any stats on the mix of condo sizes involved? Is the higher proportion in the sub 500sq ft range vs the larger sized condo units? having this info would be quite useful.

Francesca

at 7:08 am

We just sold our four bedroom detached house in markham two weeks ago in two days in a crazy bidding war and have been actively looking at two bedroom plus den condos in north York in the Yonge and Shepard area and can say that prices are dropping weekly and condos are being suspended and relisted at a lower price. Many units we have seen recently have been on the market for months and we are talking about larger family units not in an area known for Airbnb’s. I think the overall condo market has been affected not just the small one bedroom downtown market. Some sellers are in denial and holding off for early 2020 prices. My realtor seems to think the condo market will depreciate even more after Christmas.

Professional Shanker

at 3:50 pm

So what is your plan, hold out and rent for a year or just secure a deal you are comfortable with.

Francesca

at 8:10 am

We are actively looking and will move in with my parents temporarily if we don’t find someone we like. We won’t rent, we will buy something if it’s the right unit or live with my parents for a while

Appraiser

at 8:11 am

“Active Listings dropping at a faster rate than sales means MOI has dropped for Freeholds and Condos in past week… Share of condos sold conditionally has turned up recently (which from past results, seems to be higher in stronger market times).” https://twitter.com/areacode416

“Condo investors are rushing back to the market. Investors are going to set the floor on condo prices.”

https://twitter.com/JohnPasalis?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Chris

at 10:30 am

Whoops, you missed a couple pertinent parts of their tweets:

“- 416 Freeholds following right along with 2019 line

– 416 Condos dropping rapidly (but have far to fall from). From Oct 20 have dropped 22%. Same period last year dropped 30%, though.”

– Scott Ingram

416 condo listings currently sitting at 5,158, compared to ~2,000 the previous two Decembers, per Ingram’s chart.

“Don’t get me wrong – investors are not going to rush and pay $50K over market value. They all want a deal.

But I do think they’ll be driving the new demand in 2021 far more than demand from end users – I could be wrong, but that’s my hunch.”

– John Pasalis

Remains to be seen where exactly that price floor is set.

Marty

at 10:41 am

I’m not one for predictions, but I will predict that the average 416 condo price is up over $670,000 by February – that’s a 5% increase.

AGREE. And maybe 10% by May.

Pragma

at 11:36 am

Let’s do some very simple math. I picked a random downtown condo, 1 esplanade. 2 bed. I looked at recently sold and recently leased:

$840k sale price

2700/rent

$3300 property tax

700/month maintenance

Do the math and that equates to a 2.4% yield. Which is at the very low end of acceptable for a condo. There are currently 31 units for lease so your condo is likely to stay empty for a few months or you’ll have to discount the rent even further. Would you buy this condo today? Would any investor? And investors are especially important in the condo market (~40%).

And what if we return to a more normal, but still very low, 4% yield? That condo would need to be $512k.

The math tells me there is still pain to come for Toronto condos.

Appraiser

at 12:18 pm

The “math” is weak, but the anecdote is way strong.

Chris

at 12:33 pm

Feel free to share your “strong” calculations, then, appraiser. Come on now, point out what what exactly of the above is “weak”.

Although realistically, nobody will be surprised if you just sheepishly slink away, as usual.

J

at 12:32 pm

Good analysis, I would just add that there are a few not so insignificant costs that you didn’t factor in:

– round trip closing costs amortized over the holding period

– maintenance within the unit

– vacancy

– realtor lease commissions

– the value of your time that goes into being a landlord

All these factors further suppress the yield. Once you assign realistic values to all the revenues and expenses and consider the risks involved, even investing in a crappy GIC might not look so bad in comparison.

Fearless Freep

at 10:30 am

You don’t even need a crappy GIC to get close to the minuscule return on a downtown condo. For example, EQ Bank’s current HISA rate is 1.5% which admittedly could drop at any time, but unlike a GIC, you’re not locked in.

Chris

at 10:47 am

Tangerine also currently has a promotional rate of 2.1%. Take advantage for a few months while it lasts, then once it’s over, move your money back to EQ Bank. Wait for Tangerine to offer another promotional offer, and transfer your money back to Tangerine. Repeat as necessary. Good way to maximize interest on cash savings, emergency fund, etc.

Potato

at 1:50 pm

Indeed — there’s some gearing so condo prices “should” magnify rent changes. So when rents were increasing faster than inflation the last few years, condo prices flew. Rents are down ~17% at the moment (and rent price is the one chart notably absent from the post). The rental market looks to be stabilizing (in terms of volumes/listings/absorption/vacancy), but is that stabilizing with rents down double digits, or recovering to where they were? If rents are stabilizing lower, prices on condos “should” be down much more than 20% before they stabilize too (though the lower rates would offset that a bit).

But “math” and “should” hasn’t been a framework that Toronto has seen in a very long time, so bears will not die of shock if David is right and it bounces right back.

Bal

at 2:40 pm

Right now rent is down everywhere….not only condo….i think even the basement apartments are taking forever to rent…

Dafacts

at 4:07 pm

Investors aren’t looking for rental cashflows, many are happy to take the capital appreciation / capital gains. It’s more tax advantaged than rental income & it’s a leveraged investment.

It’s unlikely that we’ll see the record price appreciation of the past 10 years repeat itself among condos, but investors are clearly making a bet that it will. It’s not just the rental income, but also the final sale price.

Appraiser

at 8:46 am

And there you have it.

The difference between Dabears and Dafacts.

Chris

at 6:52 pm

BNN with more coverage coverage today on Toronto’s struggling condo market:

“Toronto’s languishing condos put mom-and-pop investors in a bind”

https://www.bnnbloomberg.ca/toronto-s-languishing-condos-put-mom-and-pop-investors-in-a-bind-1.1533968

Appraiser

at 8:49 am

One thing shared in common by yourself and Rabidoux on real estate: always, consistently, unfailingly – behind the curve.

Chris

at 10:18 am

“Behind the curve!” shouts the guy touting employment stats from months ago, pre-second wave lockdowns. The guy who warned of a bull-trap just for stocks to shoot up by 30-60%. The guy who tries to paint other’s math as “weak” while providing none of his own.

Slink away, buddy.

Appraiser

at 8:22 am

Oops, looks like I hit a nerve.

Ouch!

Chris

at 8:44 am

Taking a page out of Kyle’s playbook, are you? When lacking a rebuttal of any kind, just accuse the other person of being mad!

Time to slink away, appraiser. Come back when you have something substantive to add. I won’t hold my breath.

Jimbo

at 6:56 am

I think investors will set a floor on the price and it may cause it to go up. 5% is not crazy by Toronto terms.

I still say the floor won’t be found until summer next year.

Appraiser

at 8:57 am

The condo floor is already in. The vaccine announcement reinforced it yesterday. Immigration and NPR door will be opening soon. You want to get ahead of this one.

Snooze, ‘ya lose.

J G

at 11:56 am

My offer from last month still valid – go buy an downtown investment condo yourself now and show me the purchase agreement. I’ll transfer you $200 right away.

Otherwise, don’t spew garbage as stocks are clearly the better investment.

Libertarian

at 10:38 pm

You have to remember JG, he has admitted that he doesn’t like buying investment condos. He owns only one and that’s because his wife wanted it.

So I agree with you, why he’s on here telling people to buy investment condos when he doesn’t even do it himself is bizarre.

Jimbo

at 4:14 pm

I think that is highly dependent on commercial space and what companies do in lieu of the vaccine.

Appraiser

at 9:38 am

Best summary yet of the U.S. election:

“Trump lost the election. He will lose all legal challenges that try to change that. Those are obvious and fundamental facts. The rest is, literally, commentary.”

Conservative American syndicated columnist Jonah Goldberg https://twitter.com/JonahDispatch

Alex

at 10:32 pm

I am betting on 658 K for 416 condo’s in February and actually hoping for steep prices drop so the government agencies stop tinkering with mortgages and waive the mortgage stress test in it’s current form. Just to remind the main purpose of the test was to prepare buyers for future interest increases – as it was claimed. We all know the reason was to slow the raise in housing prices by controlling the mortgage volumes. According to BoC no future interest hikes in 2 years and low housing prices make it redundant.