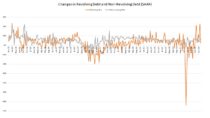

The Federal Reserve’s latest G.19 Consumer Credit Report states that consumer credit increased 5.9 percent in 2021, with revolving and nonrevolving credit increasing 6.6 percent and 5.7 percent, respectively. During the fourth quarter, consumer credit increased at a seasonally adjusted annual rate of 6.6 percent, while the December monthly increase was 5.1 percent. The year of 2021 ended with $4.4 trillion total outstanding consumer credit, $1 trillion in revolving1 and $3.4 in non-revolving2.

November saw revolving credit jump at a record annualized rate of 23.4 percent, the largest in its category in two decades. The gain in October was 7.8 percent. A slightly lesser surge occurred in June at 21.2 percent.

The November jump may have reflected households using credit more freely due to improved confidence, compared to the months before when they paid down the debt due to economic uncertainty at that time. With the Federal Reserve’s commitment to hike rates in 2022, credit cards’ prime rates are expected to increase and, in turn, increase the amount of interest owed on revolving credit balances.

As with each completed quarter’s worth of data, this month’s G.19 report featured entries for outstanding Student and Motor Vehicle Loan debt (both non-seasonally adjusted). As of the end of the fourth quarter, these two categories totaled $1.7 trillion and $1.3 trillion, respectively. Student debt decreased from the previous quarter by $2 billion and Motor Vehicle Loan debt increased by $11 billion. Both 2021 and the prior year finished with student debt being paid down, unprecedented in the entire series, which began in the first quarter of 2006.

Notes:

- Revolving credit plans are largely composed of credit card debt but also include home equity lines of credit (HELOCs). These may be unsecured or secured by collateral and allow a consumer to borrow up to a prearranged limit and repay the debt in one or more installments. The G.19 Consumer Credit report excludes HELOCS and home equity loans, as they are secured by real estate.

- Nonrevolving credit is closed-ended credit extended to consumers that is repaid on a prearranged repayment schedule and may be secured or unsecured. Like revolving credit in this report, non-revolving excludes real estate-related credit.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.