Do you gamble?

I don’t. I used to. But you reach a point where you say, “This is as much as I’m willing to lose,” and then you simply stop. (we hope…)

A friend of mine recently took up sports gambling as a hobby. He knows very little about football but loves “the action.” He called me a few weeks ago to ask what I thought of the point spread on Monday Night Football and I said, “I have no clue.” That was as honest as I could be. I further added, “I have about a 48% chance of being right, no matter which line I choose.”

The math doesn’t add up on that one. If you pick the Packers, you have a 48% chance. If you pick the Lions, you have a 48% chance. What about the other 4%?

I was being cynical, to some degree. But my point was that, “The house always wins.” It doesn’t matter whether you choose A or B. In the long run, the house always wins.

One week, he asked me for some prop bets. So I gave him the over/under on Christian McCaffrey’s receptions, only to see CMac tear his hamstring and leave the game. We made a play on the rookie quarterback Davis Mills, only to see him lay an egg. I think we hit on D.J. Moore’s over 5.5 receptions, but in the end, we went 1-for-5.

He said to me, “Imagine if we had taken the opposite of all five bets.”

It’s funny because it’s true.

If gambling were truly a 50/50 proposition, you wouldn’t make five bets and win one.

But it happens, over and over, to the point where that old saying comes into play: “It’s almost like you’re trying to be wrong!”

It’s beyond coincidence.

You can’t continue to make five picks and be correct on only one or two before you wonder, “Why don’t I just choose the complete opposite?”

If you’re so good at being wrong, then simply flip the switch, and you’ll be right.

A client emailed me on Friday and asked:

hey david. wondering how you guys are looking at this rating of toronto as the second biggest bubble risk globally?

It was the first email I answered on Friday morning.

And I was able to answer it quickly too!

You know I’m a collector, right?

I mean, what kind of nut-job does this to his wine cellar?

Don’t ask.

Also, don’t ask what I just put up on the wall in my son’s room either…

My point is, that a collector collects! And if you combine a collector with a real estate agent and a cynic, you might have a folder on your hard drive that looks like this:

That’s right! I have a unique spot on my computer dedicated to the wonder of UBS and their “Bubble Indexes.”

I collect them. I can’t help it.

They’re a fascinating beast!

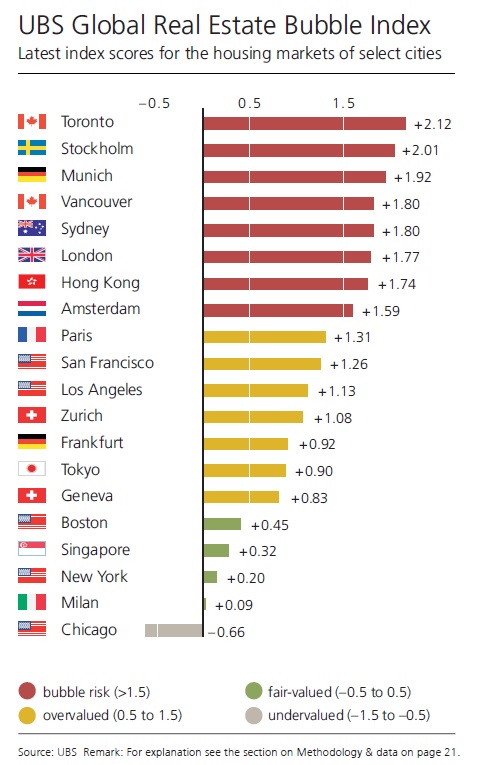

And it’s one thing to read them and say, “This is going to be soooo wrong,” but it’s another thing entirely to look back at a report from 2017, when Toronto was ranked #2 on their list, only to see house prices increase by 46% since then.

It’s magic.

It’s almost as though they were trying to be wrong, because it seems like they’re just so damn good at it!

I emailed my client and told her that despite the recent report (I merely assumed that she meant UBS, although there is an IMF report as well), I remain bullish on Toronto real estate in the medium and long-term. Don’t ask me where prices will be in November or January, but if you’re asking about next year, it’s all good.

I then gave her a couple of links to past blog posts I had written on the UBS Bubble Index, and lastly, “for your reading pleasure,” I attached the UBS Bubble Index from 2014 to 2021. That’s as far back as my “collection” goes, but if any of you have the report in a PDF for previous years, please email it to me and I’ll give you a 1982 G.I. Joe “Stalker” figure. Cool?

UBS published their 2021 “Global Real Estate Bubble Index 2021” on October 5th. Clearly, it took the media a week or more to digest this. The headlines I’m seeing out there are more to do with the IMF:

“World At Risk Of Sudden, Steep Selloffs In Stocks, Housing Market, IMF Warns”

Financial Post

October 12th, 2021

But if the media loves negativity, and we know they do, I think we’re going to see some headlines next week (or this past weekend…) about the UBS Bubble Index.

So let’s get a head-start, shall we?

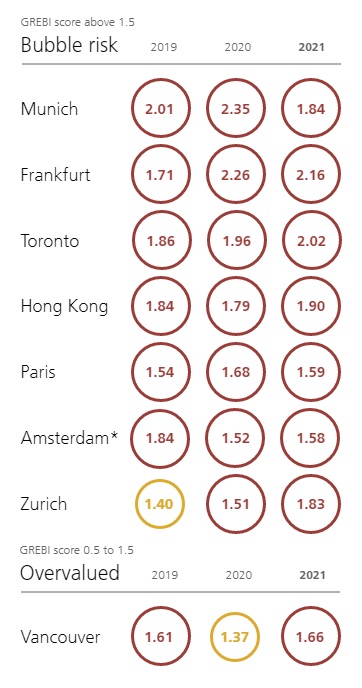

Here’s the 2021 “Bubble Risk” chart, which for some odd reason doesn’t seem to be in order…

If we rearrange that list above, we’ll see that Toronto checks in at #2.

We’ll also see that with a “Bubble Risk” above 1.5, Vancouver’s rate of 1.66 actually places it in “Bubble Risk” and not “overvalued,” which makes this chart even harder to explain. But maybe the people at UBS were too busy losing money on NFL wagers to draw up a proper chart?

#2

It’s a true fait accompli.

And as a result, many people reading headlines will hold off on their real estate purchases and wait for “the crash.”

But what happens if we look backwards and use this incredible thing called “hindsight” to predict the accuracy of the 2021 rankings?

Like, for example, what did UBS think about the Toronto market in 2020?

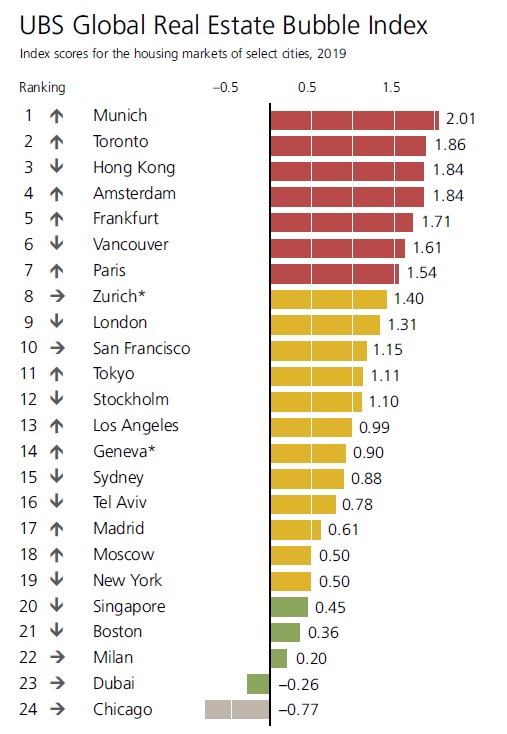

Here’s the 2020 rankings:

In October of 2020, when the 2020 UBS Global Real Estate Bubble Index was published, the average price for a Toronto home was $968,318. This past September, the average home price was $1,136,280. So since UBS told us we were in a bubble, house prices have climbed 17.3%.

But any prognosticator can have a bad day, right?

In 2019, Toronto ranked #2 overall! Even better than in 2020!

Here’s the 2019 rankings:

So just to review:

2021: #2

2020: #3

2019: #2

Sounds like we’re in a bubble, right?

Except that, as was illustrated before, house prices are up – way up, since the UBS Bubble Report was published in October of 2019.

Up how much?

Just 33.3%.

Do you want to keep playing?

How many times must you be wrong before it’s almost ironic?

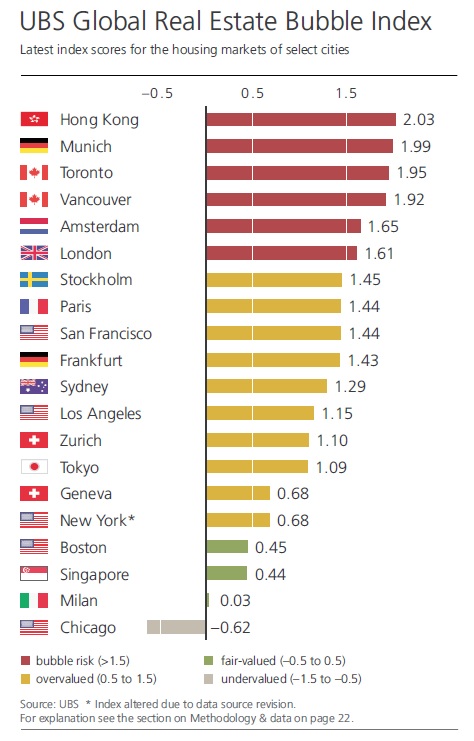

Here’s the UBS Bubble Index for 2018:

Toronto is #3 this time around.

Always a bride’s made, even once, a maid-of-honour, but never a bride.

2021: #2

2020: #3

2019: #2

2018: #3

(sigh)

Oh, and the average Toronto home price is up 40.7% since UBS published this bubble report in 2018.

Here’s the UBS Bubble Index in 2017:

Finally

It happ-pened to me

Right in front of my face

And I just cann-not hide it…

Great song by CeCe Peniston from 1992, and it also describes how , working backwards, we must feel about reaching #1 on the UBS Bubble Report after a 3rd, 2nd, 3rd, and 2nd.

Finally!

Yes, in October of 2017, Swiss Bank UBS felt that there was no larger real estate bubble on the planet than our near, dear, Toronto.

Ranking us #1 overall, the headlines in Toronto newspapers were calling for Armageddon!

In October of 2017, the average home price here in Toronto was $780,104.

Man, if only UBS had invested in the average Toronto home! That bank would be up 45.7% today!

I think we get the point, right?

The saying, “Even a broken clock is right twice a day” might fit perfectly right about now.

Whether it’s Garth Turner, Hilliard MacBeth, UBS, or the IMF, we’ve seen nothing but bubble talk about Toronto for the last decade, and then some! And I’m not denying that house prices are high, or that they’ve become unaffordable for people. But the idea that we’re in a “bubble” is played out.

I know I mentioned this already in a post at some point in the past two years, but I’m going to do so again.

February 19th, 2008, I wrote: “Is The Market In Trouble?”

Here’s the teaser for the blog:

I even used a photo of a bubble.

The only thing that’s changed since 2008 has nothing to do with real estate, but rather is the fact that my photo selection is better and higher quality.

Back in 2008, nobody had a blog. Nobody openly opined on real estate either.

I remember taking such a shit-kicking for this blog post at the time, and now the average home price in Toronto is up 197.4%.

All this talk of a bubble. It was ludicrous.

Can you imagine people complaining about an average home price of $382,048? For Toronto? For a world-class city, nucleus of the country, expanding by the day? It was ludicrous.

Today, our average home price is $1,136,280, and there’s still talk of a bubble.

By the time you read this, the newspapers will be littered with articles about Toronto being the #2 bubble in the world.

But what does that matter? What does it mean?

How can it be relied upon when UBS has ranked Toronto anywhere from #1 to #3 for the last five years, and prices have gone up every year?

How can we put any stake into this bubble-talk when it’s been happening since I wrote blogs about it in 2008, or even as I wrote real estate exams in 2003?

We can’t. But maybe that’s not a fair question since it was borderline rhetorical.

The amazing thing is: we’re in period of high inflation and there are still people out there who believe that the real estate market is going to decline. I mean, it’s one thing to have 4% annual inflation, but it’s another thing altogether for the Prime Minister to announce, during an election, that he really doesn’t care about inflation. Personally, I think that’s because he doesn’t know what it is…

Inflation doesn’t account for real estate prices rising year after year, but it sure doesn’t help!

UBS and the IMF can point to traditional indicators all they want, but they’re like the guy at the St. Lawrence market who frowns upon credit cards because he says “cash is the way of the future.” True story. He wears his mask around his neck too which I don’t like, but I digress…

From Page 6 of the Bubble Report:

“Overall, a long, lean spell for cities’ housing markets looks more and more probable, even if interest rates remain low.”

Really?

How?

Low interest rates, inflation, record demand, low supply. Sure sounds like a recipe for “lean spell” to me!

From Page 8 of the Bubble Report:

“…an expected tightening of monetary policy by the Bank of Canada will challenge price levels in the coming quarters.”

Really?

What tightening?

Didn’t the Liberal government suggest increasing the CMHC insurance ceiling from $1,000,000 to $1,250,000? Haven’t we heard about a new First Time Buyers Savings Account? Aren’t we being told that the government is going to “increase affordability,” by doing a lot of things that will actually make prices rise further? (More on that topic on Wednesday…)

Yawn.

I could pick apart this report and even show you how they’ve said the same things in previous years, but a broken clock is right twice a day, and UBS can’t even match that.

Looking forward to the 2022 report!

Post Scriptum for my running friends:

I did my first ever 16KM run on Sunday. I took a readers’ reccomendation on Endurance Tap and ate it (drank it?) around the 9KM mark, but then I had a hankering for pancakes for the rest of the run. 🙂

The run wasn’t bad and I feel like I can do more, but it’s not physical; it’s mental. There’s something about hitting the 6KM mark and then thinking, “I’m just starting a 10K” that makes it really difficult. What do you do to occupy your mind during long runs?

Chris

at 6:38 am

“What tightening?

Didn’t the Liberal government suggest increasing the CMHC insurance ceiling from $1,000,000 to $1,250,000? Haven’t we heard about a new First Time Buyers Savings Account? Aren’t we being told that the government is going to “increase affordability,” by doing a lot of things that will actually make prices rise further?”

David, you’re confusing fiscal policy and the actions of the government with monetary policy, which is determined by the Bank of Canada.

The ‘tightening’ UBS is forecasting is our central bank reducing/ending asset purchases and raising interest rates.

https://www.bnnbloomberg.ca/fidelity-s-wolf-sees-bank-of-canada-forced-into-early-rate-hike-1.1659267

Appraiser

at 9:16 am

To be perfectly pedantic, the BoC is a mere sub-agency of the Department of Finance, under the responsibility of Minister and Deputy Prime Minister Hon. Chrystia Freeland; under the tutelage and apprenticeship of JT himself.

Chris

at 10:12 am

Yes, the BoC is a Crown corporation under the auspices of the Department of Finance. But, monetary policy and the central bank are still separate from fiscal policy and the various levels of government. To be pedantic.

David Fleming

at 9:41 am

@ Chris

Fair point. And correct too.

I suppose I’ve always looked at “Fiscal & Monetary Policy” as one. And not just because Mr. Georgiadis, my grade-12 economics teacher, used to say, “Fisclnmonetarypolcy” so that the kids at the back of the room thought it was a single word. But I don’t believe the two are mutually exclusive.

I see fiscal and monetary policy as a quick-setting epoxy. There are two elements: a resin and a hardener, and they don’t work alone. They must be mixed together.

The idea that the government can use monetary policy to increase interest rates while using fiscal policy to “make housing more affordable” is ridiculous. We’re going to see the Bank of Canada increase the overnight rate by, what, twenty-five basis points? Fifty? Then fiscal policy, because of election promises, will be used to bring more buyers into the real estate market, and/or increase buying power?

My understanding of fiscal and monetary policy (and yes, this goes back to university economics) is that it mainly applies to stimulating or reigning in the economy. If we need to stimulate the economy, then cut interest rates, give people less reason to save money, allow for larger borrowing power, and put more money into the economy. When we need to reign in the economy, raise interest rates and give people a reason to save, and make it more costly to borrow.

But in recent years, in Canada, fiscal and monetary policy has been applied overwhelmingly to the real estate market. I understand that the real estate market is the economic engine of the country, but we can’t look at increasing/decreasing interest rates solely in terms of how it will affect the real estate market.

We’re coming out of a pandemic where businesses have been brutalized. In theory, we should be stimulating the economy or risk losing entire industries. Low interest rates and incentives toward putting money into the economy. Restaurants, gyms, movie theatres, retail, or how about a massage therapist? How many massages were people getting in April of 2020?

Canada’s GDP per capita peaked in 2012 and has been stagnant from 2017 through 2020. Pre-pandemic, this should have been a concern. Post-pandemic, I don’t know that this is the time to be shrinking the economy. But I think I’m off topic here…

My point is simply that fiscal and monetary policy are tools to regulate the economy, and too often, they are viewed solely as tools to regulate real estate. And yes, I wonder if the government has a long-term plan to address inflation and purchasing power while also recognizing the need to bring the Canadian economy out of pandemic-conditions.

Chris

at 10:20 am

Absolutely, fiscal and monetary policy work together. And your understanding of them is more or less correct.

The Bank of Canada, and many other central banks, are facing a very difficult decision, in my opinion. You’re correct that they probably want to continue to stimulate the economy, coming out of the pandemic; however, on the other side of the equation, we’re seeing high inflation, labour shortages, and supply chain constraints.

There are a lot of smart people on either side of this debate, but I would place myself in the camp expecting inflation to prove less transitory than initially though, resulting in a faster than anticipated tightening of monetary policy.

We’re already seeing it in Korea, England, New Zealand, and Norway. USA CPI remains high. We’ll see what Canada’s CPI is on Wednesday.

Condodweller

at 2:35 pm

“My point is simply that fiscal and monetary policy are tools to regulate the economy, and too often, they are viewed solely as tools to regulate real estate.”

David, I think you give RE too much credit here. Rates are low because our economy has been going down the toilet for years. RE prices increasing has been an unintended consequence. A consequence that was acceptable to the government up to recently when increasing number of people, read voters, started complaining about affordability. Now they’re facing a situation where RE makes up an increasing portion of our economy which put’s them between a rock and a hard place.

Every indication is that rates are going to be going up it’s just the question of when and how quickly. The government has done a great job with hiding real inflation, but even so, it’s doubled in a year or so.

Also, you can’t look at rates and policies in a vacuum. The smart people in charge also have to worry about how we’re doing relative to our biggest trading partner.

Appraiser

at 8:37 am

U.nbelievable B.ull S.hit

Appraiser

at 9:18 am

Since the introduction of the stress test, whereby the vast majority of homebuyers have had to qualify for a mortgage at an imaginary 5%+ interest rate, approximately one-‘kagillion’ people have purchased properties in Canada.

Question for all of the “analysts” and “experts” out there:

With listing inventories at generational lows across Canada combined with seemingly insatiable demand, does a 25 or even a 125 bp increase in borrowing rates make a difference to the effective aggregate demand pool?

Chris

at 10:10 am

Not exactly a response to your question, but related:

“CIBC Deputy Chief Economist Benjamin Tal said many Canadians aren’t prepared for a shock to their mortgage rates as a result of volatility in the bond market.

In an interview Monday, Tal warned that upward pressure on rates could catch Canadian mortgage-holders flat-footed, even though underlying rates remain near historic lows.

“It’s all about the speed at which rates are rising. And, if we see another 30-, 40-, 50-basis-point increase in rates, that will be translated directly into mortgage rates in Canada. I would be very concerned,” he said, “because this market is not ready for a brief 100-basis-point increase in mortgage rates, by any stretch of the imagination. So, we have to be really careful when it comes to the housing market.”

https://www.bnnbloomberg.ca/mortgage-market-not-ready-for-swift-100-bp-increase-cibc-s-tal-1.1570570

Kyle

at 9:23 am

UBS must have a scheduled macro that changes the date, shuffles a few of the rankings and automatically publishes this report out to the media every Fall, because i can’t imagine any self-respecting Analyst ever wanting their name associated with this perennial garbage.

Pragma

at 12:38 pm

Everyone is a genius in a bull market. In 2008 you could have bought any asset on the planet and it would have performed relatively similar. That’s what happens when interest rates are in a firm downtrend. I’m not bearish RE by any stretch but I think interest rates will provide a bigger headwind to further growth than you think.

Chris

at 12:48 pm

Great point, Pragma.

David states “the average home price in Toronto is up 197.4%” from February 2008 to today.

By comparison, the S&P500 is up 242.03%, the DJI is up 188.36%, the NASDAQ is up 569.53%, and the TSX is up 56.96%.

Many ETFs don’t go back quite that far, but VTI, Vanguard’s Total Stock Market ETF does, and is up 253.04%.

Higher interest rates, if/when they arrive, will probably be a substantial headwind to equity markets as well.

Condodweller

at 3:26 pm

Call me unique but I would treat the UBS report as risk analysis. Call me crazy but could it be why they refer to it as bubble risk on the graf and not a crash indicator? Without knowing exactly how they rank the cities, I would imagine they have their own process, but I do know that it’s meant as a comparison between various cities in the world. As far as I can tell it passes the litmus test as well. I mean we were at the top of the list in a year when prices declined, followed by a two place demotion the next year. As prices started to recover we went up a notch only to fall back one the next.

I don’t know anything about RE in those cities at the top other than Toronto and Vancouver but I’m guessing that Frankfurt had a banner here to end up ahead of us despite the price increases here. Or perhaps they agree with you that despite the prices increases we’re not at a higher risk of being in a bubble.

I don’t know who the target audience is of this report but I would use it if I had a few hundred million $$ to deploy in RE and wanted to geographically diversify my portfolio. All though, someone who is about to take out a million $$ mortgage for a house they’re considering with a down payment from mom and dad and a questionable salaried income may want to take a pause to consider it. But hey, I’m just a bear clawing away at the linoleum floor of my basement apartment in my parent’s house, right?

P.S. There are many podcasts out there that are 2+ hrs to distract your mind from thinking about the next 10k. There is a great TED talk about ultra-long distance runners and ironically the advice is to think short term. Worry about your next 10 strides. You could also try counting lamp posts or perhaps for sale signs on lawns or value the houses as you run by.

Sirgruper

at 3:54 pm

David. Congrats on the 16k. Ten miles under the belt. Well done.

A few suggestions, there are lots of running groups and it really passes the time. Once you get in the 20k’s and 30k’s (no doubt you will) it helps to have a group.

Picking the right route helps too. Vary your route and take the bike paths and trails throughout Toronto. Nature makes it easier. Finally and weirdly, as you do it more, by kilometre 7 or so you get the feeling that you can run without effort for as long as you want and you start thinking of other things that interest you. Its strange but true. And if not, you can write your next blog in your head or run neighbourhoods and check-out the real estate. In any case enjoy.