The COVID-19 pandemic has changed pretty much everything for everyone in the U.S., and home buying is no exception.

To see how, the National Association of Realtors added a section to their “2020 Profile of Home Buyers and Sellers” that looks at how the data is shifting. NAR pulled out data on primary home buyers who closed from July, 2019, through March, 2020, compared with those who closed from April through June, 2020. That means the pandemic dataset is based on just 3 months – likely not long enough to call something a major trend but long enough to get an idea of where things are likely to go.

The big picture:

- Pandemic-era buyers are likely to make more money and pay more for homes. The biggest jump was in the $500,000+ price range.

- More people want to live with more people. They’re choosing properties suitable for multiple generations, and more unmarried couples as well as unrelated people are buying together.

- Buyers are spending less time searching before talking to an agent.

- Having trust in and personal connections with an agent are becoming more important for buyers when choosing someone to work with.

- 14% of buyers said COVID-19 created some kind of roadblock that impacted the transaction.

To dive a little deeper, here are some of the main takeaways based on the biggest swings in data.

Who’s buying what?

Demographics and household makeup are reshaping demand. Although married couples remain at around 60% of buyers, the next largest group – families with children under 18 – is up by 2 points, as are unmarried couples. Single women, previously the third largest group, have dropped 4 points.

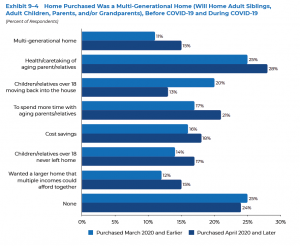

But the big story here is increasing demand for multi-generation homes. Buyers who say they wanted room for taking care of or just spending time with older parents and relatives are up a combined 7 points. (Hello, sandwich generation!)

Unmarried couples and roommates who want to share costs are also trending upwards.

FYI to young adults who plan to move back home: Your parents might not buy a house with room for you and your collection of soccer trophies. “Children/relatives over 18 moving back into the house” as a reason for buying dropped 7 points.

Unsurprisingly, people who make more money are buying more houses; people who make less are buying fewer houses – undoubtedly related to the pandemic’s economic impact. Household median income for pre-pandemic buyers was $94,400 compared to $110,800 from April on.

More people are taking the opportunity to move from rentals into buying a home – up a whopping 9 points.

People who identify as White/Caucasian and those born in the U.S. remain the vast majority of buyers; however, Asian/Pacific Islanders are up by 4 points and Hispanic/Latino people are up by 2.

Where are they buying?

Suburbs are hot. Urban areas are still in. Small towns are out.

Specifically, suburbs/subdivisions are up 7 points. Urban areas/central cities are up 2. Small towns are down 7, with a 2-point drop off for rural areas.

We’ve been reading for months now that pandemic-era buyers, especially those who can work remotely, are fleeing cities for suburbs and small, rural towns in the quest for more space, lower costs, and fewer people. NAR’s numbers bear that out for suburbs, but not for small towns and rural areas.

How much are they paying?

Median price is up significantly, going from $270,000 to $339,400. The pandemic doesn’t appear to have slowed sales, especially in hot markets with tight inventory. People are paying more to get what they want, but prices are rising as demand exceeds inventory.

Prices start to move up in the $350,000 to $399,999 range, with a 3 point jump. The $400,000 to $499,999 range is up by 4 points. It’s the $500,000+ homes that are really taking off, with a 9 point jump to 23% of buyers. High demand and tight inventory were already driving prices upward, but the pandemic is pushing them even higher, as the median price went from $270,000 to $339,400.

Homes from the $199,999 to less than $100,000 range all saw a downturn.

What’s the search like?

Buyers are spending less time in the home buying process searching before getting an agent – now 2 weeks instead of 3 – and typically seeing 8 rather than 9 homes. Most people are still seeing 5 to 10 homes.

What are buyers looking for in an agent?

Trust and personal connections are becoming more important to buyers. The category of “Agent is friend or family member” is up 5 points; “Agent is honest and trustworthy” climbed by 3.

Experience and reputation were rated as slightly less important for home buying.

What’s up with lending?

Fixed-rate mortgages continue to reign supreme, but more people are holding on to their cash. Buyers who had no mortgage dropped 5 points. The number of people going for conventional loans headed up by 4 points. There were slight upticks in fixed-adjustable or adjustable rates.

Median percentage financed stayed the same at 88% throughout the 12 months, with the largest group of 80% to 89% financed seeing a slight drop. Most movement was in the 70% to 79% range, which went up by 5. So buyers are putting down more cash, but fewer people are putting down all cash.

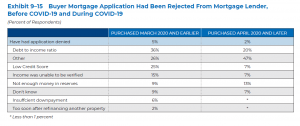

Getting a mortgage appears to be getting harder, but the numbers aren’t clear on why. Looking at reasons for denials, low credit scores dropped 18 points and unverifiable income dropped by 8 points. But the category of “other” climbed 21 points, leading to the question of whether some new, pandemic-related reasons have popped up.

It will be interesting to see whether these nascent trends continue into 2021, but it will always be important for real estate pros to keep on top of trends. Knowing where things are going can help agents refine marketing strategies, identify potential niches and, most importantly, make sure they’re giving clients the best possible service.

Lisa Wyatt Roe is an Austin writer and editor whose work has been featured on CNN.com/Travel, in Texas Parks & Wildlife Magazine and in the book “Seduced by Sound: Austin; 100 Musicians on Why They Make Music.” Travel and live music feed her soul. Volunteering with refugees feeds her sense of purpose. And making friends laugh feeds her deep (yet possibly sad) need to get all the laughing emojis on Facebook.