Century 21 Regency Realty agent Cheryl Piccinini has lived and traveled all over the world, but there is no place she would rather be than Alabama.

“No matter what you want, you can find it here,” the Enterprise, Alabama-based agent said. “You can find the city, the country. We’ve got beaches. It is just an amazing place.”

Clearly, Piccinini isn’t the only one who thinks so. Between July 1, 2022, and July 1, 2023, Alabama’s population grew by 34,000 people, according to estimates published by the U.S. Census Bureau. Of these 34,000 new residents, nearly 31,000 were “domestic migrants,” or people moving to the state from elsewhere in the country.

Additionally, the 2023 National Movers Study conducted by United Van Lines ranked Alabama No. 8 among all states for inbound moves. Survey participants reported family and employment opportunities as their primary reasons for moving to the state.

“We are very bullish on Alabama and its long-term prospects,” Jeremy Walker, CEO of the Alabama Realtors Association, said. “We have a booming automotive manufacturing section, which creates more opportunities for our builders to create more rooftops, which leads to more opportunities for our members to help experience homeownership.

“We were down by about 30% in (home) sales last year, but generally our members are very optimistic that there is going to be a significant rebound this year.”

Walker said the prospect of lower mortgage rates is prompting many agents to feel more positive about the 2024 housing market. Lower rates are likely to make homeownership accessible to more buyers and it should prompt some potential sellers who are locked in at a rate of 3% or less to list.

In Birmingham, ERA King Real Estate agent Anna-Maria Ellison said that even without lower mortgage rates, she is seeing buyers return to the market.

“It is not necessarily interest rates being high or low, it is just them staying put for a longer amount of time,” Ellison said. “Now, obviously, 7% or 8% interest (rates) are not going to attract a lot of people, so having them in the mid-6% range is good, but the fact that is just sitting still and not as volatile as it was in the third or fourth quarter of last year is helping buyers feel confident in going out and making a purchase.”

While Alabama agents might feel good about their state’s prospects as a migratory hotspot, they must also face the repercussions of a growing population — namely increased pressure on the state’s already constrained housing inventory.

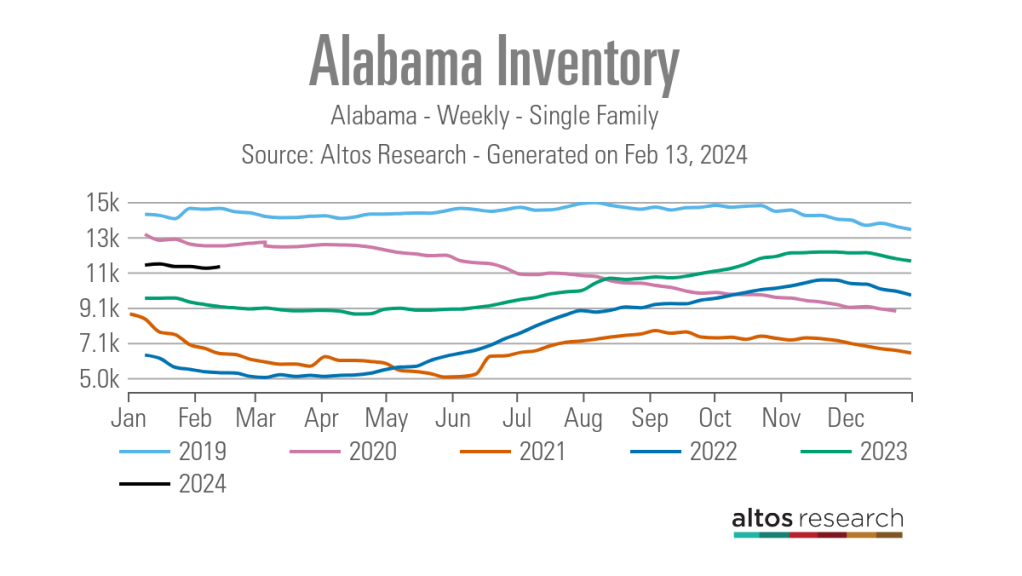

As of Feb. 9, 2024, Alabama had a 90-day rolling average of 11,894 active single-family listings, according to data from Altos Research. Although this is up from 9,962 active listings one year earlier, it is still below the 13,442 listings recorded in early February 2020, just prior to the onset of the COVID-19 pandemic.

“Inventory was the theme last year and it is shaping up to be the theme this year,” Ellison said. “We do not have enough houses on the market to satisfy demand, even with the higher interest rates.”

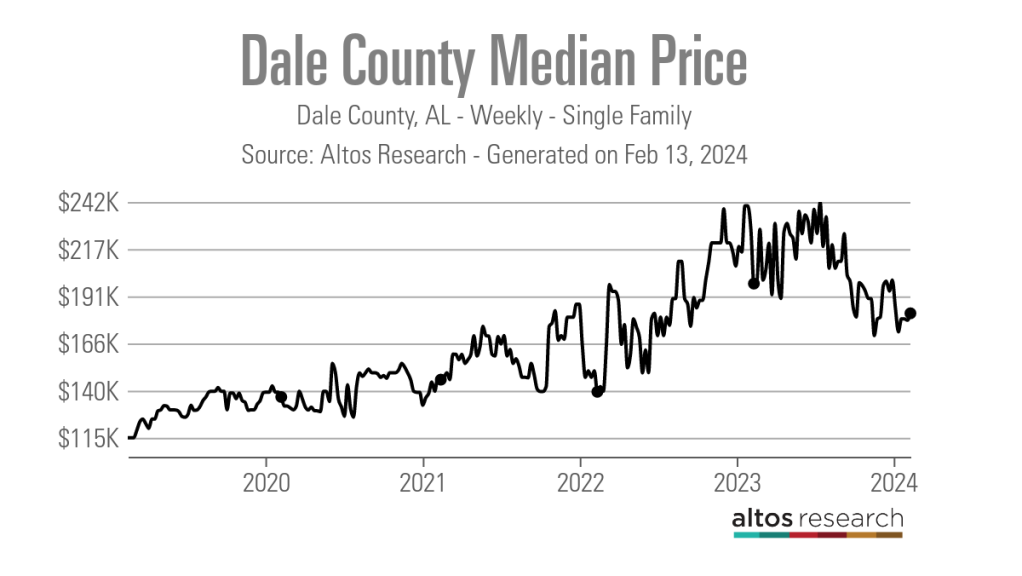

For Piccinini, the inventory constraints and high levels of demand have put upward pressure on list prices. According to data from Altos Research, as of Feb. 9, Dale County, where Piccinini works, had only 72 active single-family listings and a 90-day rolling average median list price of $179,900, up from $135,900 pre-pandemic.

“Our prices have gone up quite a bit, so far in that first-time homebuyers used to be able to walk into a decent three-bedroom home for $180,000 a couple of years ago, and now you can’t find something like that for under $300,000. And that has priced a lot of people out of the market,” Piccinini said.

Since they are paying more, Piccinini said that buyers have also become choosier and are less willing to look past the flaws a property may have.

While a lack of existing home inventory is certainly part of the problem, Ellison said that in Birmingham, agents and buyers are also facing a lack of new home inventory.

“New construction is backed up,” she said. “They are building it as fast as they can, but when you didn’t build for a number of years or you cut way back on production, you get behind.”

According to Ellison, new construction in the Birmingham area typically accounts for 15% to 20% of the houses on the market at any given time, but that has not been the case over the past four years.

Nationwide, since the start of the pandemic in March 2020, homebuilders have faced a myriad of difficulties, including supply chain issues and a shortage of skilled laborers. But in Alabama, Walker said that smaller builders are also dealing with challenges posed by local governments.

“Local builders are truly getting crushed by local governments,” Walker said. “As an example, in Baldwin County, near our coastline, we have a lot of smaller cities and each one is taking its own anti-growth attitude. There is a lot of NIMBYism, and it’s extremely unfriendly to local builders and developers, so it is extremely difficult to develop the housing that is needed for our workforce down there in that environment.”

But in other parts of the state, including Huntsville (near the Tennessee border), Walker said that municipal regulations are friendlier to builders, making it easier for them to address the growing need for housing. Despite these challenges, Walker retains an optimistic stance as he looks ahead.

“We are seeing people from across the county come to Huntsville with the NASA program and Redstone Arsenal,” Walker said. “The FBI is also relocating a number of their jobs from Washington to Huntsville, but our college downs are also booming, and we are seeing an increase in retirees moving to the state because of the cost of living here.”

In the short term, as the spring purchase season quickly approaches, local agents share some of Walker’s positivity.

“About two weeks ago at our brokerage, the amount of activity we were seeing on listing kind of went up quickly,” Ellison said. “We went from not a lot of people looking to five or six showings on a property.

“I think our inventory will increase depending on what the Federal Reserve does in March, and that will determine if the buyer traffic is more in line with normal increases throughout the spring.”